Shutterfly 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

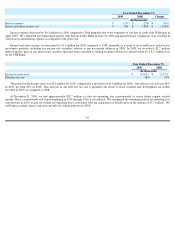

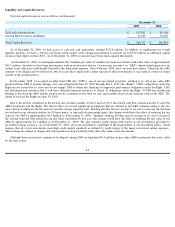

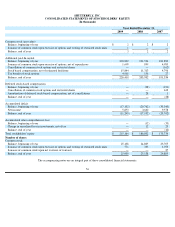

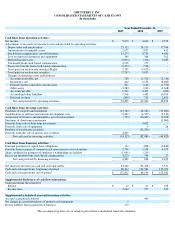

Investing Activities.

For 2009, net cash used in investing activities was $14.1 million, which included $13.8 million for capital

expenditures for computer and network hardware for our website infrastructure and information technology systems, capital expenditures for

production equipment for our manufacturing and production operations, and $3.9 million of capitalized software and website development. We

also paid $0.8 million in cash to acquire TinyPictures, Inc. The use of cash was offset by cash provided from the liquidation of $4.3 million (at

par value) of our ARS investments that were called by various issuers at par.

For 2008, net cash used in investing activities was $82.1 million, which included $18.2 million for capital expenditures for computer and

network hardware for our website infrastructure and information technology systems, capital expenditures for production equipment for our

manufacturing and production operations at our California and North Carolina facilities, and $4.5 million of capitalized software and website

development. An additional $52.3 million was used to purchase auction rate securities, offset by $3.0 million in proceeds from the sale of the

short term investments. We also paid $10.1 million in cash consideration to acquire Nexo.

For 2007, net cash used in investing activities included $31.9 million for capital expenditures for computer and network hardware for our

website infrastructure and information technology systems, capital expenditures for production equipment for our manufacturing and production

operations at our California and North Carolina facilities, and $3.1 million of capitalized website development costs. Additional cash of $3.0

million was used for purchases of short-term investments and $2.9 million was used for the acquisition of “Make-it-About-Me,”

and a customer

list.

Financing Activities.

For 2009, net cash provided by financing activities was $4.9 million, primarily from $3.3 million excess tax benefit

from stock-

options and $2.7 million of proceeds from issuance of common stock from exercise of stock options, offset by $91,000 principal

payments of capital lease obligations and $1.0 million in cash used to pay employee withholding tax liabilities for restricted shares vested during

2009.

Our financing activities for 2008 provided cash of $0.6 million, primarily from $1.2 million of proceeds from issuance of common stock

from exercise of stock options and $0.5 million excess tax benefit from stock options, offset by $0.8 million principal payments of capital lease

obligations and shares withheld to pay for employee’s withholding tax liability for restricted awards vested of $0.3 million.

Our financing activities for 2007 provided cash of $2.2 million, primarily from $5.0 million of proceeds from issuance of common stock,

offset by $2.8 million of capitalized lease obligations.

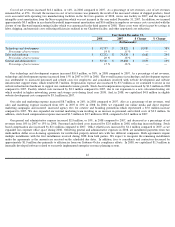

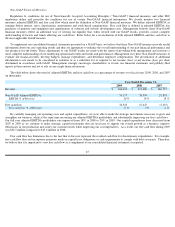

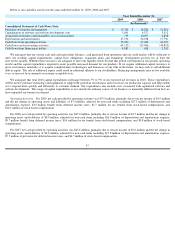

Contractual Obligations

We lease office space in Redwood City, California and a production facility in Charlotte, North Carolina under non-

cancelable operating

leases that expire in 2010 and 2014, respectively. In 2008, we terminated the lease at our Hayward, California facility effective June 2009,

which was originally scheduled to expire in September 2009. In 2008, we entered into a non-

cancelable operating lease for our new Phoenix,

Arizona facility that commenced in February 2009 and will expire in 2016. We lease information

technology equipment under various capital

leases that expire through 2011. We also have co-location agreements with third-

party hosting facilities that expire in 2013. As a result of our

growth strategies, we believe that our liquidity and capital resources requirements will grow in absolute dollars but will be generally consistent

with historical periods on an annual basis as a percentage of net revenues. We anticipate leasing additional office space, production facilities and

hosting facilities in future periods as the need arises, consistent with our historical business model.

48