Shutterfly 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

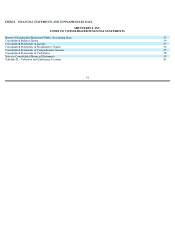

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

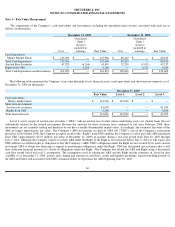

The Company classifies its auction rate securities as trading securities, currently recorded as short term investments at December 31, 2009.

Investments that the Company designates as trading assets are reported at fair value, with gains or losses resulting from changes in fair value

recognized in earnings.

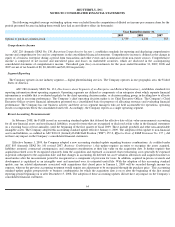

Fair Value

The Company records its financial assets and liabilities at fair value. The accounting standard for fair value provides a framework for

measuring fair value, clarifies the definition of fair value and expands disclosures regarding fair value measurements. Fair value is defined as

the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants

at the reporting date. The accounting standard establishes a three-

tier hierarchy, which prioritizes the inputs used in the valuation methodologies

in measuring fair value:

Level 1 – Quoted prices in active markets for identical assets or liabilities

Level 2 –

Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities;

quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for

substantially the full term of the assets or liabilities.

Level 3 –

Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or

liabilities.

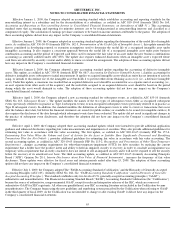

The Company utilized a discounted cash flow approach to determine the Level 3 valuation for its auction rate securities. The assumptions

used in preparing the discounted cash flow model include estimates for interest rates, timing and amount of cash flows, credit and liquidity

premiums, and expected holding periods of the ARS. These assumptions are volatile and subject to change as the underlying sources of these

assumptions and market conditions change. They represent the Company's estimates given available data as of December 31, 2009. The

Company also measures the Rights at fair value, in order to match the changes in the fair value of the auction rate securities.

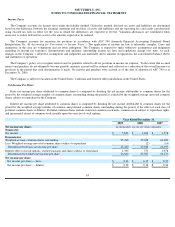

Concentration of Credit Risk

Financial instruments that potentially subject the Company to credit risk consist principally of cash, cash equivalents, short term investments,

and accounts receivable. As of December 31, 2009, the Company's cash and cash equivalents were maintained by financial institutions in the

United States and its deposits may be in excess of insured limits. The Company believes that the financial institutions that hold its investments

are financially sound and, accordingly, minimal credit risk exists with respect to these investments.

The Company’

s accounts receivable are derived primarily from sales to customers located in the United States who make payments through

credit cards, sales of the Company's products in retail stores, sales of commercial print sources, and revenue generated from online

advertisements posted on the Company's website. Credit card receivables settle relatively quickly and the Company maintains allowances for

potential credit losses based on historical experience. To date, such losses have not been material and have been within management’

s

expectations. Excluding amounts due from credit cards, as of December 31, 2009, two customers accounted for 38% and 14%

of the

Company’s net accounts receivable. And as of December 31, 2008, the same two customers accounted for 38% and 13% of the Company’

s net

accounts receivable.

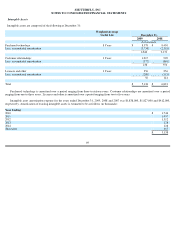

Inventories

Inventories are stated at the lower of cost on a first-in, first-

out basis or net realizable value. The value of inventories is reduced by estimates

for excess and obsolete inventories. The estimate for excess and obsolete inventories is based upon management’

s review of utilization of

inventories in light of projected sales, current market conditions and market trends. Inventories are primarily raw materials and consist

principally of paper, photo book covers and packaging supplies.

60