Shutterfly 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

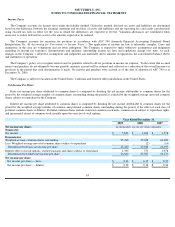

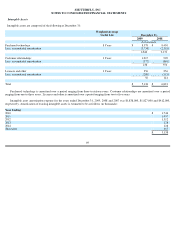

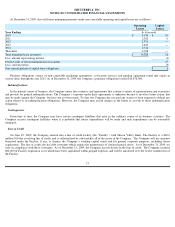

Intangible Assets

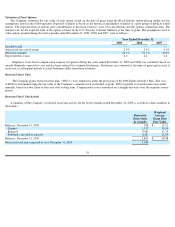

Intangible assets are composed of the following at December 31:

Purchased technology is amortized over a period ranging from three to sixteen years. Customer relationships are amortized over a period

ranging from one to three years. Licenses and other is amortized over a period ranging from two to five years.

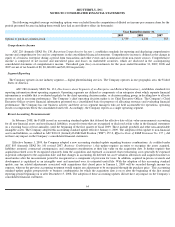

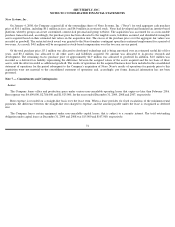

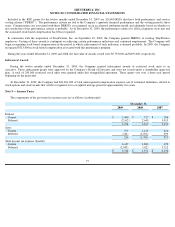

Intangible asset amortization expense for the years ended December 31, 2009, 2008 and 2007 was $1,838,000, $1,827,000 and $412,000,

respectively. Amortization of existing intangible assets is estimated to be as follows (in thousands):

Weighted Average

Useful Life

December 31,

2009

2008

In thousands

Purchased technology

8 Years

$

8,578

$

8,450

Less: accumulated amortization

(3,734

)

(2,318

)

4,844

6,132

Customer relationships

3 Years

1,015

990

Less: accumulated amortization

(777

)

(440

)

238

550

Licenses and other

3 Years

256

256

Less: accumulated amortization

(200

)

(115

)

56

141

Total

$

5,138

$

6,823

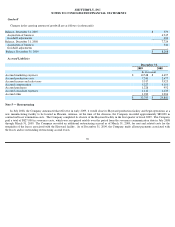

Year Ending:

2010

$

1,746

2011

1,457

2012

1,312

2013

128

2014

128

Thereafter

367

$

5,138

69