Shutterfly 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

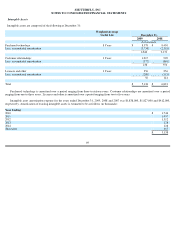

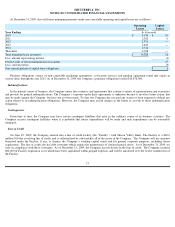

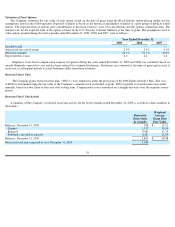

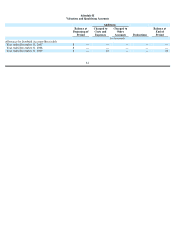

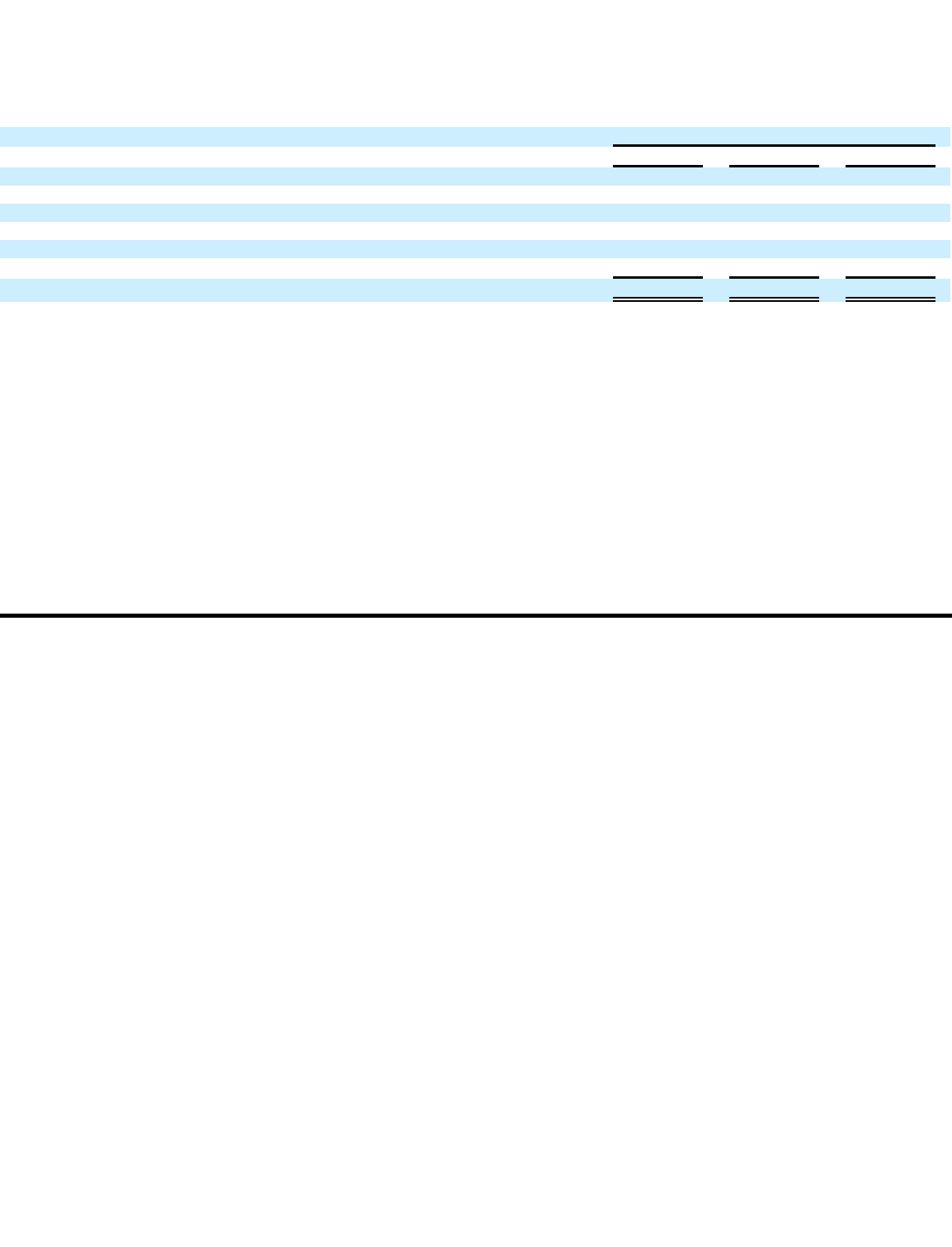

The Company’s actual tax expense (benefit) differed from the statutory federal income tax rate of 34.0%, as follows:

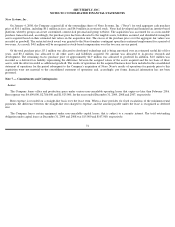

At December 31, 2009, the Company had approximately $32.7 million of state net operating loss carryforwards to reduce future regular

taxable income. These carryforwards will expire beginning in the year 2014 through 2016 for state purposes, if not utilized. The Company

recognized the remaining federal net operating loss carryforward in 2009, except for federal net operating losses associated with the Company's

acquisition of TinyPictures in the amount of $1.7 million. The Company will begin accruing current cash taxes payable for federal purposes in

2010.

The Tax Reform Act of 1986 limits the use of net operating loss and tax credit carryforwards in the case of an “ownership change”

of a

corporation or separate return loss year limitations. Any ownership changes, as defined, may restrict utilization of carryforwards.

The Company also had federal and state research and development credit carryforwards of approximately $1.8 million and $1.8 million for

federal and state income tax purposes, respectively, at December 31, 2009. The research and development credits may be carried forward over a

period of 20 years for federal tax purposes, indefinitely for California tax purposes, and 15 years for Arizona purposes. The research and

development tax credit will expire starting in 2018 for federal and 2023 for Arizona.

December 31,

2009

2008

2007

Income tax expense at statutory rate

34.0

%

34.0

%

34.0

%

State income taxes

3.5

%

(3.7)

%

4.6

%

Stock

-

based compensation

6.2

%

16.7

%

2.6

%

R&D tax credit

(6.3)

%

(17.4)

%

(1.7)

%

Other

0.1

%

0.4

%

(0.5)

%

37.5

%

30.0

%

39.0

%

78