Shutterfly 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

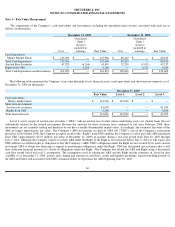

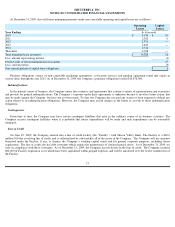

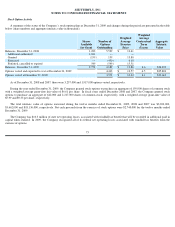

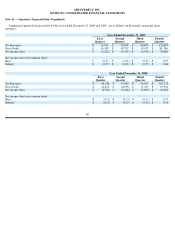

Stock Option Activity

A summary of the status of the Company’

s stock option plans at December 31, 2009 and changes during the period are presented in the table

below (share numbers and aggregate intrinsic value in thousands):

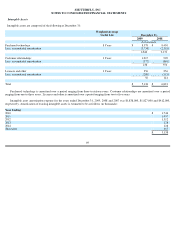

As of December 31, 2008 and 2007, there were 3,237,000 and 1,917,000 options vested, respectively.

During the year ended December 31, 2009, the Company granted stock options to purchase an aggregate of 159,000 shares of common stock

with a weighted average grant-

date fair value of $6.61 per share. In fiscal years ended December 2008 and 2007, the Company granted stock

options to purchase an aggregate of 642,000 and 2,217,000 shares of common stock, respectively, with a weighted average grant-

date value of

$5.99 and $9.33 per share, respectively.

The total intrinsic value of options exercised during the twelve months ended December 31, 2009, 2008 and 2007 was $3,963,000,

$3,662,000 and $18,136,000, respectively. Net cash proceeds from the exercise of stock options were $2,740,000 for the twelve months ended

December 31, 2009.

The Company has $10.3 million of state net operating losses, associated with windfall tax benefit that will be recorded in additional paid in

capital when realized. In 2009, the Company recognized all of its federal net operating losses associated with windfall tax benefits from the

exercise of options.

Shares

Available

for Grant

Number of

Options

Outstanding

Weighted

Average

Exercise

Price

Weighted

Average

Contractual

Term

(Years)

Aggregate

Intrinsic

Value

Balances, December 31, 2008

1,223

5,529

$

13.41

Additional authorized

1,161

—

—

Granted

(159

)

159

13.80

Exercised

—

(

450

)

6.10

Forfeited, cancelled or expired

549

(549

)

15.51

Balances, December 31, 2009

2,774

4,689

$

13.88

6.6

$26,490

Options vested and expected to vest at December 31, 2009

4,413

$

13.57

6.5

$25,801

Options vested at December 31, 2009

3,572

$

12.42

6.1

$23,662

75