Shutterfly 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

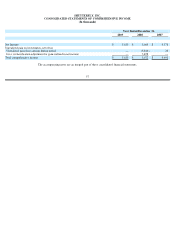

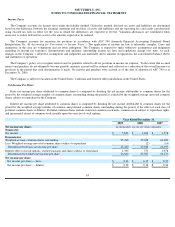

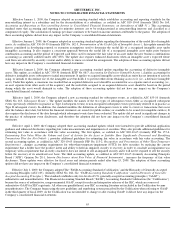

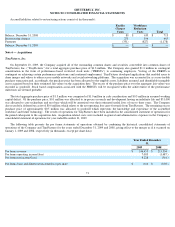

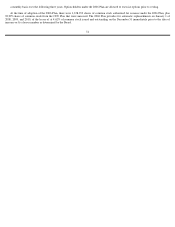

Note 3 – Fair Value Measurement

The components of the Company’

s cash equivalents and investments, including the unrealized gains (losses) associated with each are as

follows (in thousands):

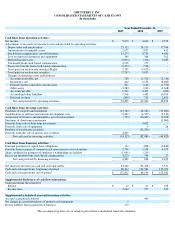

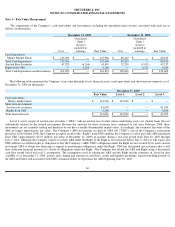

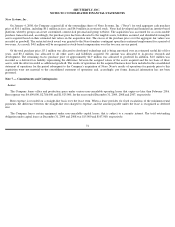

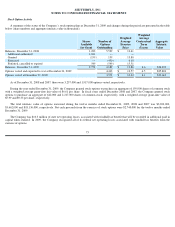

The following table represents the Company’s fair value hierarchy for its financial assets (cash equivalents and short term investments) as of

December 31, 2009 (in thousands):

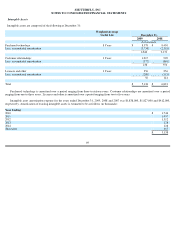

Level 3 assets consist of auction rate securities (“ARS”)

with an auction reset feature whose underlying assets are student loans that are

substantially backed by the federal government. Because the auctions for these securities have continued to fail since February 2008, these

investments are not currently trading and therefore do not have a readily determinable market value. Accordingly, the estimated fair value of the

ARS no longer approximates par value. The Company’s ARS investments are held by UBS AG ("UBS"), one of the Company’

s investment

providers. In November 2008, the Company accepted an offer (the “Right”)

from UBS entitling the Company to sell at par value ARS purchased

from UBS (approximately $47.9 million, par value at December 31, 2009) at anytime during a two-

year period from June 30, 2010 through

July 2, 2012. Although the Company expects to sell its ARS under the Right, if the Right is not exercised before July 2, 2012, it will expire and

UBS will have no further rights or obligation to buy the Company’s ARS. UBS’

s obligations under the Right are not secured by its assets and do

not require UBS to obtain any financing to support its performance obligations under the Right. UBS has disclaimed any assurance that it will

have sufficient financial resources to satisfy its obligations under the Right. The Company has valued the ARS and Right using a discounted

cash flow model based on Level 3 assumptions. The assumptions used in valuing the ARS and the Right include estimates of, based on data

available as of December 31, 2009, interest rates, timing and amount of cash flows, credit and liquidity premiums, expected holding periods of

the ARS and bearer risk associated with UBS’s financial ability to repurchase the ARS beginning June 30, 2010.

December 31, 2009

December 31, 2008

Cost

Unrealized

Gains /

(Losses)

included in

earnings

Fair Value

Cost

Unrealized

Gains /

(Losses)

included in

earnings

Fair Value

Cash Equivalents

Money Market Funds

$

113,966

$

—

$

113,966

$

80,410

$

—

$

80,410

Total Cash Equivalents

113,966

—

113,966

80,410

—

80,410

Auction Rate Securities

47,925

(6,266

)

41,659

52,250

(9,013

)

43,237

Rights from UBS

—

6,266

6,266

—

9,013

9,013

Total Cash Equivalents and Investments

$

161,891

$

—

$

161,891

$

132,660

$

—

$

132,660

December 31, 2009

Fair Value

Level 1

Level 2

Level 3

Cash equivalents:

Money market funds

$

113,966

$

113,966

$

—

$

—

Short

-

term investments:

Auction rate securities

41,659

—

—

41,659

Rights from UBS

6,266

—

—

6,266

Total financial assets

$

161,891

$

113,966

$

—

$

47,925

66