Shutterfly 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

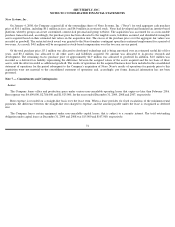

Legal Matters

On June 25, 2009, Soverain Software LLC filed a complaint for alleged patent infringement against the Company and seventeen other

defendants in Soverain Software LLC. v J.C.Penny Corp. et.al., Civ. No. 6:09-CV-

274, in the Eastern District of Texas, Tyler Division. The

Complaint asserts infringement of U.S. Patent nos. 5,715,314 and 5,909,492, which claim network sales systems including, among other things,

a buyer computer and a shopping cart computer, and U.S. Patent no. 7,272,639, which claims, among other things, a method of

processing service requests from a client to a server system through a network using session identifiers. The Complaint asserts that the Company

directly or indirectly infringe the patents without providing any details concerning the alleged infringement, and it seeks unspecified damages

and injunctive relief. On December 30, 2009, pursuant to a patent license agreement between the parties dated December 21, 2009, and a

Stipulation filed by the parties, the Court dismissed with prejudice Soverain's claims against Shutterfly and Shutterfly's counterclaims against

Soverain.

On or about June 18, 2007, Fotomedia Technologies, LLC (“Fotomedia”)

filed suit in the United States District Court for the Eastern District

of Texas, against the Company and several other defendants alleging infringement of U.S. Patent Nos. 6,018,774; 6,542,936 B1; and 6,871,231

B2. Fotomedia sought unspecified damages, costs, interest and attorneys’

fees, and a permanent injunction. The court issued a claim

construction order on July 21, 2009. The case against the Company was resolved by settlement and pursuant to a patent license agreement

between the parties dated August 6, 2009, the Court dismissed with prejudice Fotomedia's claims against the Company on August 20, 2009.

On or about February 5, 2008, Parallel Networks, LLC filed a lawsuit in the United States District Court for the Eastern District of Texas,

against the Company and several other defendants alleging patent infringement. The Parallel Networks complaint seeks unspecified damages,

costs, interest and attorneys’

fees, and an injunction against all parties. The Company filed an answer to the complaint on April 29, 2008. On

July 14, 2008, we and other defendants filed a motion to stay the lawsuit pending the reexamination of the patents-in-

suit by the United States

Patent and Trademark Office. On December 23, 2008 that motion was denied. On January 12, 2009, the court entered a revised Agreed Docket

Control order setting a schedule for deadlines in the case. The case against the Company was resolved by settlement and pursuant to a patent

license agreement between the parties dated May 5, 2009, the Court dismissed with prejudice Parallel Networks’

claims against the Company on

May 18, 2009.

In addition to the above cases, from time to time, the Company may be involved in various legal proceedings arising in the ordinary course

of business. In all cases, at each reporting period, the Company evaluates whether or not a potential loss amount or a potential range of loss is

probable and reasonably estimable under the provisions of ASC 450 (formerly FAS 5, Accounting for Contingencies ).

In such cases, the

Company accrues for the amount, or if a range, the Company accrues the low end of the range as a component of legal expense.

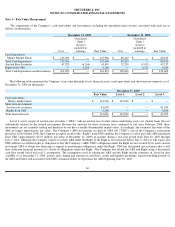

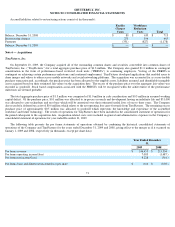

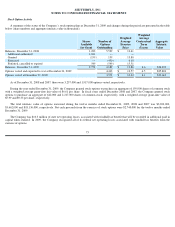

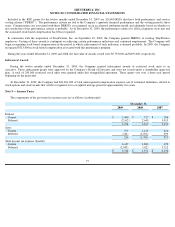

Note 8 — Stock Based Compensation

1999 Stock Plan

In September 1999, the Company adopted the 1999 Stock Plan (the “1999 Plan”).

Under the 1999 Plan, the Company issued shares of

common stock and options to purchase common stock to employees, directors and consultants. Options granted under the Plan were incentive

stock options or non-qualified stock options. Incentive stock options (“ISO”)

were granted only to Company employees, which includes officers

and directors of the Company. Non-qualified stock options (“NSO”)

and stock purchase rights were able to be granted to employees and

consultants. Options under the Plan were to be granted at prices not less than 85% of the deemed fair value of the shares on the date of the grant

as determined by the Company’s Board of Directors (“the Board”),

provided, however, that (i) the exercise price of an ISO and NSO was not

less than 100% and 85% of the deemed fair value of the shares on the date of grant, respectively, and (ii) the exercise price of an ISO and NSO

granted to a 10% stockholder was not less than 110% of the deemed fair value of the shares on the date of grant. The Board determined the

period over which options became exercisable. The term of the options was to be no longer than five years for ISOs for which the grantee owns

greater than 10% of the voting power of all classes of stock and no longer than ten years for all other options. Options granted under the 1999

Plan generally vested over four years. The Board of Directors determined that no further grants of awards under the 1999 Plan would be made

after the Company’s IPO.

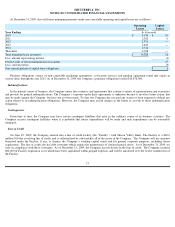

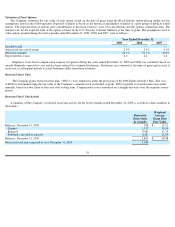

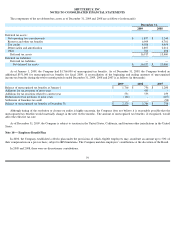

2006 Equity Incentive Plan

In June 2006, the Board adopted, and in September 2006 the Company’s stockholders approved, the 2006 Equity Incentive Plan (the “

2006

Plan”),

and all shares of common stock available for grant under the 1999 Plan transferred to the 2006 Plan. The 2006 Plan provides for the grant

of ISOs to employees (including officers and directors who are also employees) of the Company or of a parent or subsidiary of the Company,

and for the grant of all other types of awards to employees, officers, directors, consultants, independent contractors and advisors of the Company

or any parent or subsidiary of the Company, provided such consultants, independent contractors and advisors render bona-

fide services not in

connection with the offer and sale of securities in a capital-

raising transaction. Other types of awards under the 2006 Plan include NSOs,

restricted stock awards, stock bonus awards, restricted stock units, and performance shares.

Options issued under the 2006 Plan are generally for periods not to exceed 10 years and are issued at the fair value of the shares of common

stock on the date of grant as determined by the Board. Prior to the Company’

s IPO, the Board determined the fair value of common stock in

good faith based on the best information available to the Board and Company’

s management at the time of the grant. Following the IPO, the fair

value of the Company’

s common stock is determined by the last sale price of such stock on the Nasdaq Global Market. Options issued under the

2006 Plan typically vest with respect to 25% of the shares one year after the options

’

vesting commencement date, and the remainder ratably on