Shutterfly 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

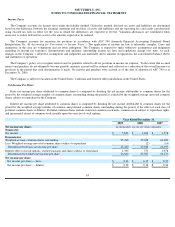

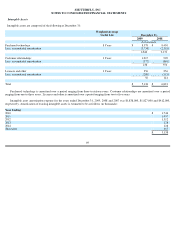

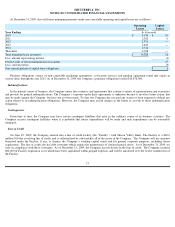

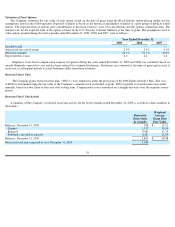

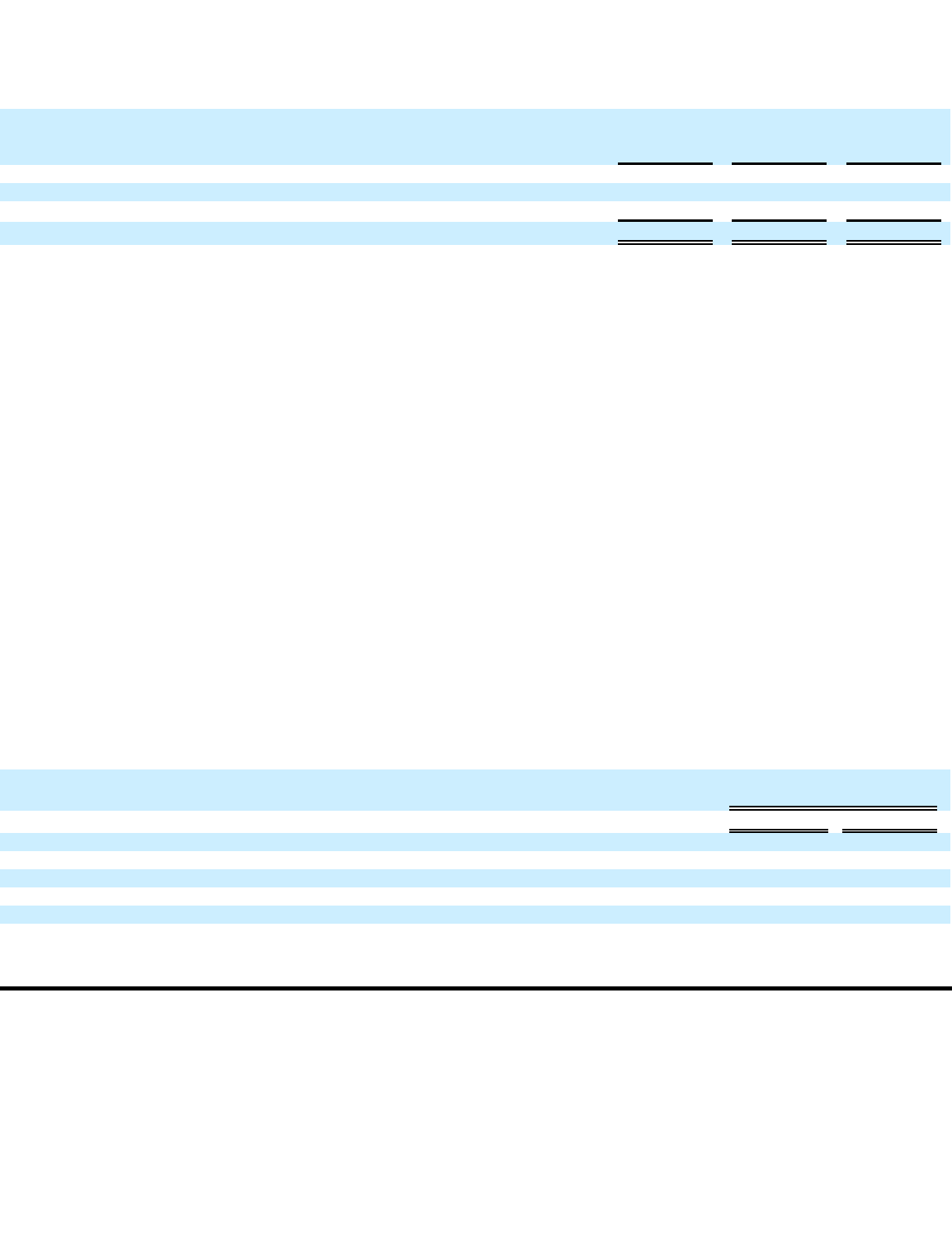

Accrued liabilities related to restructuring actions consist of (in thousands):

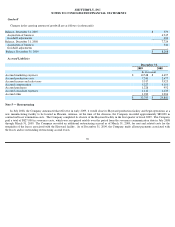

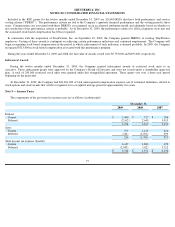

Note 6 — Acquisitions

TinyPictures, Inc.

On September 10, 2009, the Company acquired all of the outstanding common shares and securities convertible into common shares of

TinyPictures, Inc. (“TinyPictures”)

for a total aggregate purchase price of $1.3 million. The Company also granted $1.3 million in contingent

consideration in the form of performance-based restricted stock units (“PBRSUs”)

to continuing employees. Vesting of the PBRSUs is

contingent on achieving certain performance milestones and continued employment. TinyPictures developed applications that enabled users to

share images and videos to others across mobile networks and social networking platforms. The acquisition was accounted for as a non-

taxable

purchase transaction and, accordingly, the purchase price has been allocated to the tangible assets, liabilities assumed, and identifiable intangible

assets acquired based on their estimated fair values on the acquisition date. The excess of the purchase price over the aggregate fair values was

recorded as goodwill. Stock based compensation associated with the PBRSUs will be recognized when the achievement of the performance

milestones are deemed probable.

The total aggregate purchase price of $1.3 million was comprised of $1.0 million in cash consideration and $0.3 million in assumed working

capital deficit. Of the purchase price, $0.1 million was allocated to in-

process research and development having an indefinite life and $51,000

was allocated to core technology and user base which will be amortized over their estimated useful lives of one to three years. The Company

also recorded a deferred tax asset of $0.6 million which relates to the net operating loss carry-

forwards from TinyPictures. The remaining excess

purchase price of approximately $0.5 million was allocated to goodwill which represents the knowledge and experience of the assembled

workforce and future technology. The results of operations for TinyPictures have been included in the consolidated statement of operations for

the period subsequent to the acquisition date. Acquisition-related costs were included in general and administrative expenses in the Company’

s

consolidated statement of operations for year ended December 31, 2009.

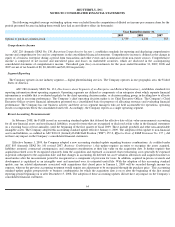

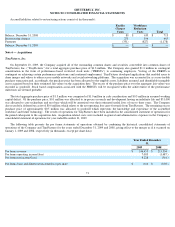

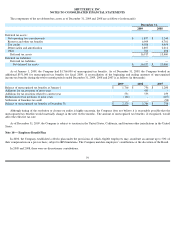

The following table presents the pro forma statements of operations obtained by combining the historical consolidated statements of

operations of the Company and TinyPictures for the years ended December 31, 2009 and 2008, giving effect to the merger as if it occurred on

January 1, 2009 and 2008, respectively (in thousands, except per share data):

Facility

Closure

Costs

Workforce

Reduction

Costs

Total

Balance, December 31, 2008

$

80

$

633

$

713

Restructuring charges

271

194

465

Payments

(351)

(827)

(1,178)

Balance, December 31, 2009

$

—

$

—

$

—

Year Ended

December

31,

2009

2008

Pro forma revenue

$

246,453

$

213,504

Pro forma operating income/(loss)

7,083

(1,487

)

Pro forma net income/(loss)

4,228

(561

)

Pro forma basic and diluted net income/(loss) per share

$

0.16

$

(0.02

)

71