Shutterfly 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

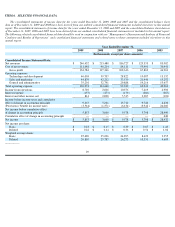

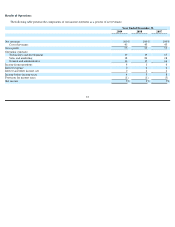

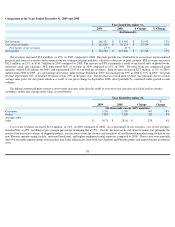

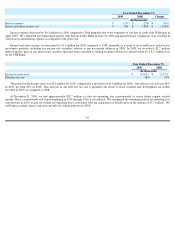

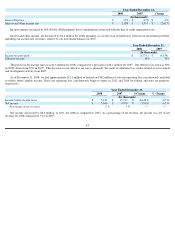

Interest Expense.

Interest expense consists of interest costs recognized under our capital lease obligations as well as costs associated with

our line of credit facility.

Interest and other income, net

. Interest and other income, net consists of the interest earned on our cash and investment accounts as well as

gains/losses on our trading securities and the Right from UBS entitling us to sell at par value auction-

rate securities previously purchased

from UBS (approximately $47.9 million, par value) at anytime during a two-year period from June 30, 2010 through July 2, 2012.

Income Taxes. Historically, we have only been subject to taxation in the United States because we only operate within the United States.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States, or

GAAP. The preparation of these consolidated financial statements requires us to make estimates and assumptions that affect the reported

amounts of assets, liabilities, revenues, costs and expenses and related disclosures. We base our estimates on historical experience and on various

other assumptions that we believe to be reasonable under the circumstances. In many instances, we could have reasonably used different

accounting estimates, and in other instances, changes in the accounting estimates are reasonably likely to occur from period to period.

Accordingly, actual results could differ significantly from the estimates made by our management. To the extent that there are material

differences between these estimates and actual results, our future financial statement presentation of our financial condition or results of

operations will be affected.

In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP and does not require management’

s

judgment in its application, while in other cases, management

’

s judgment is required in selecting among available alternative accounting

standards that allow different accounting treatment for similar transactions. We believe that the accounting policies discussed below are the most

critical to understanding our historical and future performance, as these policies relate to the more significant areas involving management’

s

judgments and estimates.

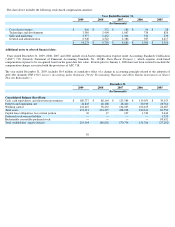

Revenue Recognition. We generate revenues primarily from the printing and shipping of prints and other photo-

based products, advertising

services and commercial print services. We generally recognize revenues from product sales upon shipment when persuasive evidence of an

arrangement exists (typically through the use of a credit card or receipt of a check), the selling price is fixed or determinable and collection of

resulting receivables is reasonably assured. Revenues from amounts billed to customers, including prepaid orders, are deferred until shipment of

fulfilled orders.

We provide our customers with a 100% satisfaction guarantee whereby products can be returned within a 30-

day period for a reprint or

refund. We maintain an allowance for estimated future returns based on historical data. During the year ended December 31, 2009, returns

totaled less than 1% of net revenues and have been within management’s expectations.

We periodically provide incentive offers to our customers in exchange for setting up an account and to encourage purchases. Such offers

include free products and percentage discounts on current purchases. Discounts, when accepted by customers, are treated as a reduction to the

purchase price of the related transaction and are included in net revenues. Production costs related to free products are included in costs of

revenues upon redemption. Shipping charged to customers is recognized as revenue at the time of shipment.

Our advertising revenues are derived from the sale of online advertisements on our website. Advertising revenues are recognized as

“impressions” (i.e., the number of times that an advertisement appears in pages viewed by users of our website) are delivered; as “clicks” (

which

are generated each time users on our website click through our advertisements to an advertiser’

s designated website) are provided to advertisers;

or ratably over the term of the agreement with the expectation that the advertisement will be delivered ratably over the contract period.

34