Shutterfly 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

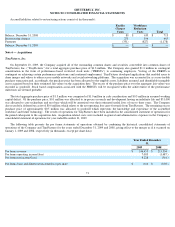

During the year ended December 31, 2009 the Company liquidated $4.3 million (at par value) ARS investments that were called by various

issuers. The Company intends to exercise the UBS Right on June 30, 2010, and as a result, these ARS investments and the Right are classified

as short-term investments as of December 31, 2009.

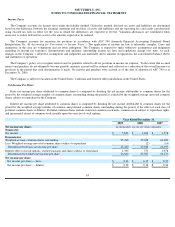

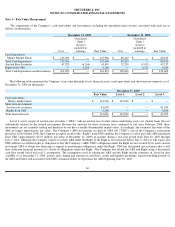

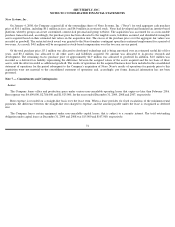

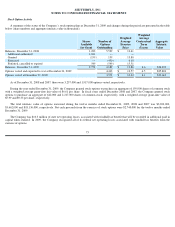

The following table provides a summary of changes in fair value of the Company’

s ARS investments and the Right which are both Level 3

assets as of December 31, 2009 (in thousands):

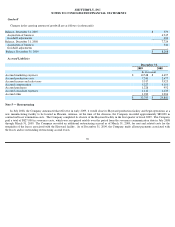

Note 4 — Balance Sheet Components

Intellectual Property Prepaid Royalties

In 2009, the Company entered into patent license agreements with various third parties. The Company has accounted for these agreements

as prepaid royalties that are amortized over the remaining life of the patents. Amortization expense is recorded as a component of cost of

revenue. The current portion of the prepaid royalty is recorded as a component of prepaid expenses and the long term portion is recorded in

other assets as of December 31, 2009. Total amortization for these license agreements in 2009 was $234,000.

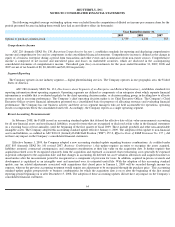

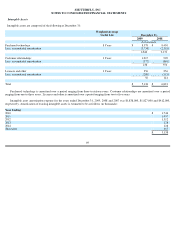

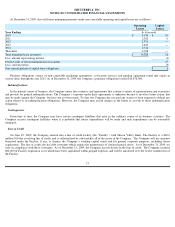

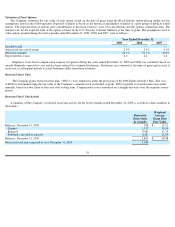

As of December 31, 2009, the Company had a balance of $5.1 million in unamortized prepaid royalties. Amortization of these licenses is

estimated as follows (in thousands):

Rights

ARS

Balance at December 31, 2008

$

9,013

$

43,237

Sales of ARS investments

—

(

4,325

)

Unrealized gain/(loss) included in earnings

(2,747

)

2,747

Balance at December 31, 2009

$

6,266

$

41,659

Year Ending:

2010

$

694

2011

694

2012

694

2013

694

2014

694

Thereafter

1,583

$

5,053

67