Shutterfly 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

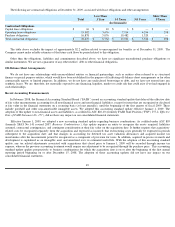

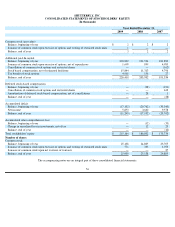

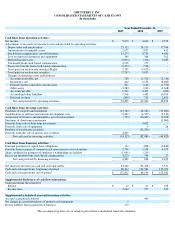

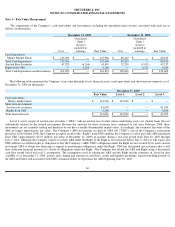

SHUTTERFLY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

The accompanying notes are an integral part of these consolidated financial statements.

Year Ended December 31,

2009

2008

2007

Cash flows from operating activities:

Net income

$

5,853

$

3,660

$

9,578

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization

25,122

24,211

17,384

Amortization of intangible assets

2,072

1,827

412

Stock

-

based compensation, net of forfeitures

14,273

9,750

4,686

Loss on disposal of property and equipment

346

308

262

Deferred income taxes

(2,903

)

(312

)

5,685

Tax benefit from stock

-

based compensation

4,965

156

-

Excess tax benefits from stock

-

based compensation

(3,273

)

(538

)

-

Loss/(gain) on auction rate securities Rights

2,747

(9,013

)

-

Loss/(gain) on auction rate securities

(2,747

)

9,013

-

Changes in operating assets and liabilities:

Accounts receivable, net

520

(1,512

)

(2,316

)

Inventories, net

642

1,178

(2,290

)

Prepaid expenses and other current assets

501

(120

)

(1,750

)

Other assets

(3,282

)

(243

)

(1,668

)

Accounts payable

1,947

2,431

(602

)

Accrued and other liabilities

7,966

5,482

10,390

Deferred revenue

(859

)

762

2,421

Net cash provided by operating activities

53,890

47,040

42,192

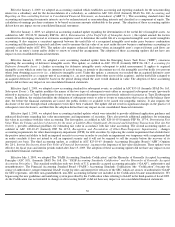

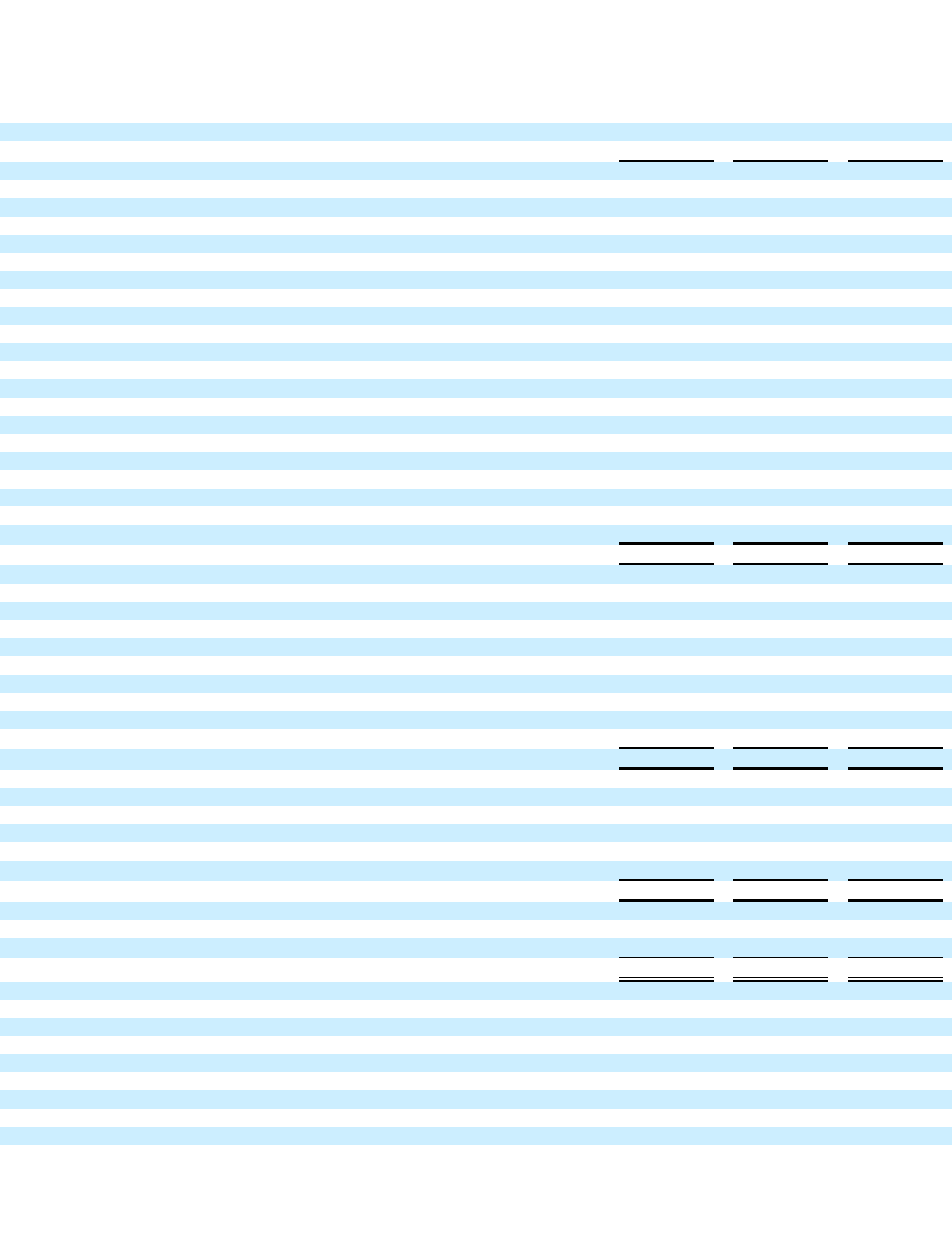

Cash flows from investing activities:

Purchases of property and equipment

(13,762

)

(18,220

)

(31,881

)

Capitalization of software and website development costs

(3,891

)

(4,527

)

(3,112

)

Acquisition of business and intangibles, net of cash acquired

(795

)

(10,097

)

(2,858

)

Purchases of short term investments

-

-

(3,000

)

Proceeds from sale of short term investments

-

3,002

-

Proceeds from sale of equipment

-

6

28

Purchase of auction rate securities

-

(52,250

)

-

Proceeds from the sale of auction rate securities

4,325

-

-

Net cash used in investing activities

(14,123

)

(82,086

)

(40,823

)

Cash flows from financing activities:

Principal payments of capital lease obligations

(91

)

(808

)

(2,840

)

Proceeds from issuance of common stock upon exercise of stock options

2,740

1,158

4,975

Shares withheld for payment of employee's withholding tax liability

(1,041

)

(260

)

-

Excess tax benefits from stock

-

based compensation

3,273

538

27

Net cash provided by financing activities

4,881

628

2,162

Net increase/(decrease) in cash and cash equivalents

44,648

(34,418

)

3,531

Cash and cash equivalents, beginning of period

88,164

122,582

119,051

Cash and cash equivalents, end of period

$

132,812

$

88,164

$

122,582

Supplemental disclosures of cash flow information:

Cash paid during the period for:

Interest

$

12

$

47

$

198

Income taxes

2,644

535

812

Supplemental schedule of non

-

cash investing activities

Accrued acquisition liabilities

-

400

-

Net change in accrued purchases of property and equipment

2

-

-

Escrow liability from acquisition of business

150

-

-