Shutterfly 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

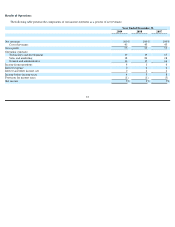

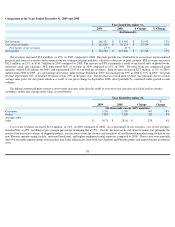

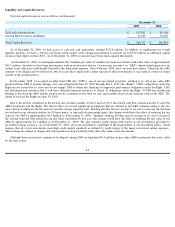

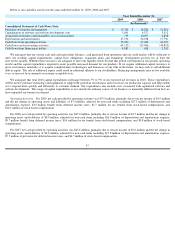

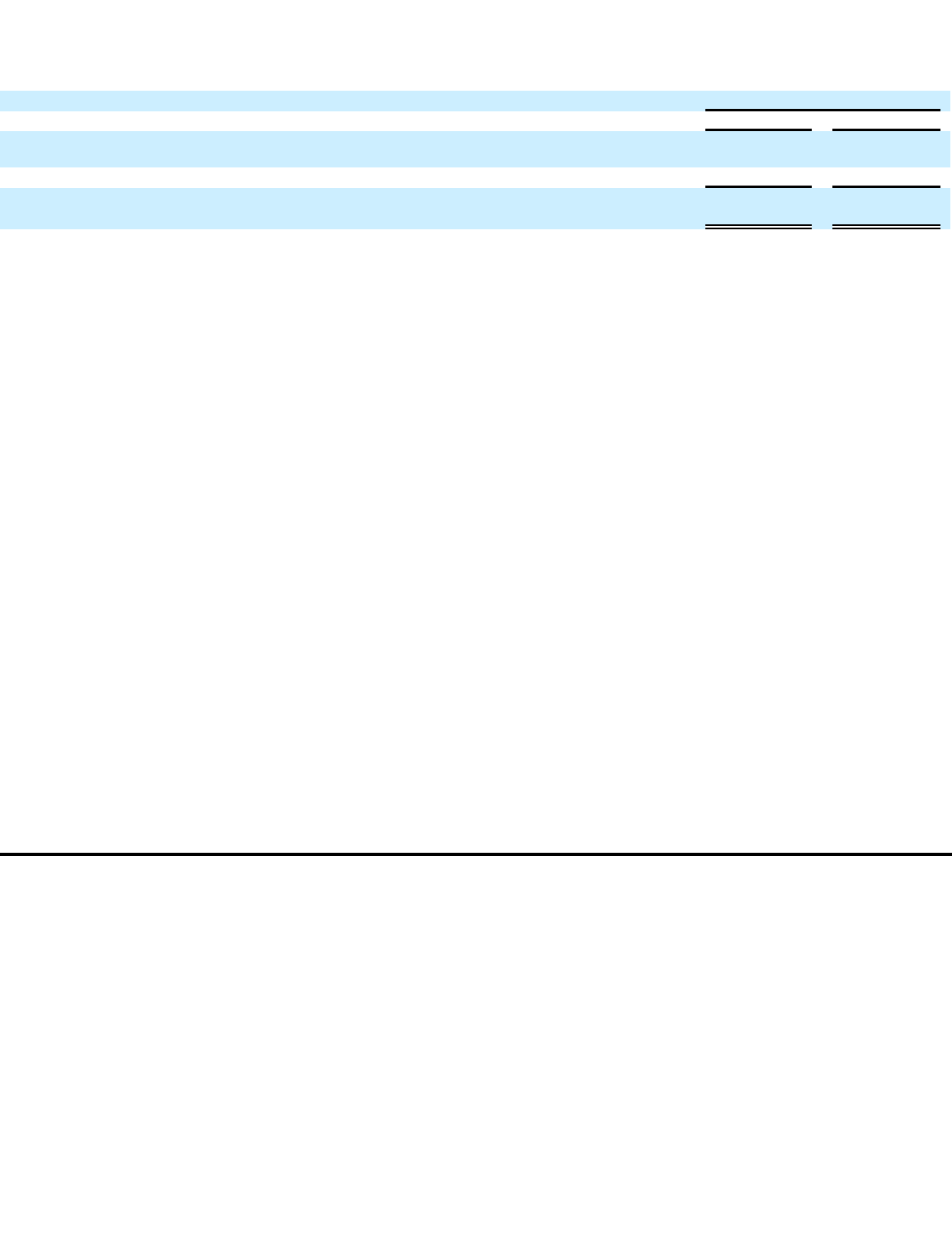

Liquidity and Capital Resources

Our total capital resources were as follows (in thousands):

As of December 31, 2009, we had access to cash and cash equivalents, totaling $132.8 million. In addition, to supplement our overall

liquidity position, we have a 360-

day revolving credit facility with a financial institution to provide up to $20.0 million in additional capital

resources that expires in June 2010. As of December 31, 2009, no amounts have been drawn against this facility.

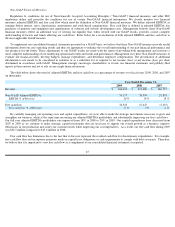

At December 31, 2009, we held approximately $47.9 million par value of variable rate bond investments with a fair value of approximately

$41.7 million, classified as short-term investments, with an auction reset feature (“auction rate securities”

or "ARS") whose underlying assets are

student loans which are substantially backed by the federal government. Since February 2008, these auctions have failed. Therefore the ARS

continue to be illiquid and we will not be able to access these funds until a future auction of these investments is successful or a buyer is found

outside of the auction process.

In November 2008, we accepted an offer from UBS AG (“UBS”),

one of our investment providers, entitling us to sell at par value ARS

purchased from UBS at anytime during a two-year period from June 30, 2010 through July 2, 2012 (the "Right"). UBS’

s obligations under the

Right are not secured by its assets and do not require UBS to obtain any financing to support its performance obligations under the Right. UBS

has disclaimed any assurance that it will have sufficient financial resources to satisfy its obligations under the Right. If UBS has insufficient

funding to buy back the ARS and the auction process continues to fail, then we may incur further losses on the carrying value of the ARS. We

intend to exercise the Rights on June 30, 2010.

Due to the adverse conditions in the auction rate securities market, we have used a level 3 discounted cash flow valuation model to value the

ARS investments and the Right. We believe there are several significant assumptions that are utilized in our ARS valuation analysis, the two

most critical of which are the discount rate and the average expected term. Holding all other factors constant, if we were to increase the discount

rate utilized in our valuation analysis by 50 basis points, or one-

half of a percentage point, this change would have the effect of reducing the fair

value of our ARS by approximately $0.9 million

as of December 31, 2009. Similarly, holding all other factors constant, if we were to increase

the average expected term utilized in our fair value calculation by one year, this change would have the effect of reducing the fair value of our

ARS by approximately $1.1 million

as of December 31, 2009. We also consider credit ratings with respect to our investments provided by

investment ratings agencies. As of December 31, 2009, all of our investments conformed to the requirements of our investment policy, which

requires that all of our investments meet high credit quality standards as defined by credit ratings of the major investment ratings agencies.

These ratings are subject to change and a downgrade in rating would adversely affect the value of our investments.

Although these investments continue to be illiquid, during 2009 we liquidated $4.3 million (at par value) ARS investments that were called

by the state issuers.

December 31,

2009

2008

Cash and cash equivalents

$

132,812

$

88,164

Auction Rate Securities and Rights

47,925

52,250

Total Capital Resources

$

180,737

$

140,414

44