Shutterfly 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We recognize commercial print revenue upon shipment, consistent with our product revenue policy.

Inventories.

Our inventories consist primarily of paper, photo book covers and packaging supplies and are stated at the lower of cost on a

first-in, first-

out basis or net realizable value. The value of inventories is reduced by an estimate for excess and obsolete inventories. The

estimate for excess and obsolete inventories is based upon management’

s review of utilization of inventories in light of projected sales, current

market conditions and market trends.

Fair Value

. We record our financial assets and liabilities at fair value. The accounting standard for fair value provides a framework for

measuring fair value, clarifies the definition of fair value and expands disclosures regarding fair value measurements. Fair value is defined as

the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants

at the reporting date. The accounting standard establishes a three-

tier hierarchy, which prioritizes the inputs used in the valuation methodologies

in measuring fair value:

Level 1 – Quoted prices in active markets for identical assets or liabilities

Level 2 –

Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities;

quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for

substantially the full term of the assets or liabilities.

Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or

liabilities.

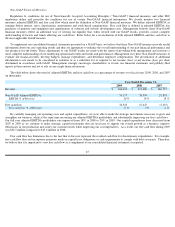

We utilized a discounted cash flow approach to determine the Level 3 valuation for our auction rate securities. The assumptions used in

preparing the

discounted cash flow model include estimates for interest rates, timing and amount of cash flows, credit and liquidity premiums,

and expected holding periods of the auction rate securities. These assumptions are volatile and subject to change as the underlying sources of

these assumptions and market conditions change. They represent our estimates given available data as of December 31, 2009. We also measure

the Rights at fair value, in order to match the changes in the fair value of the auction rate securities.

Goodwill and Intangible Assets. We

account for intangible assets and goodwill in accordance with ASC 350 (formerly Statement of

Financial Accounting Standards (“SFAS”) No. 142, Goodwill and Other Intangible Assets

). Goodwill and intangible assets with indefinite lives

are not amortized but are tested for impairment on an annual basis during our fourth quarter or whenever events or changes in circumstances

indicate that the carrying amount of these assets may not be recoverable. Intangible assets with finite useful lives are amortized using the

straight-line method over their useful lives and are reviewed for impairment in accordance with ASC 360, (formerly SFAS No. 144,

Accounting

for the Impairment or Disposal of Long

-Lived Assets ) .

Intangible assets are amortized on a straight-line basis over the estimated useful lives which range from one to sixteen years.

For annual goodwill impairment analysis, we operate under one reporting unit. We determined the fair value of our reporting unit based on

its enterprise value. This reporting unit was not at risk of failing step one of the annual goodwill impairment test for years ended December 31,

2009 and 2008.

Software and Website Development Costs.

We capitalize eligible costs associated with software developed or obtained for internal use in

accordance with ASC 350-50 (formerly AICPA Statement of Position No. 98-1

Accounting for the Costs of Computer Software Developed or

Obtained for Internal Use and EITF Issue No. 00-2 Accounting for Website Development Costs) . Accordingly, payroll and payroll-

related costs

and stock-based compensation incurred in the development phase are capitalized and amortized over the product’

s estimated useful life, which is

generally three years. Costs associated with minor enhancements and maintenance for our website are expensed as incurred.

35