Shutterfly 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

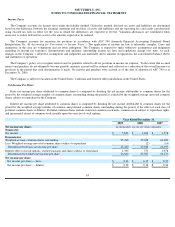

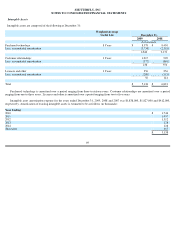

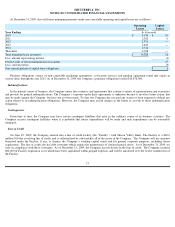

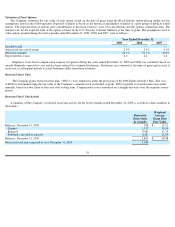

Goodwill

Changes in the carrying amount of goodwill are as follows (in thousands):

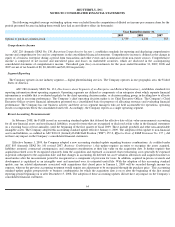

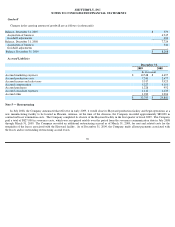

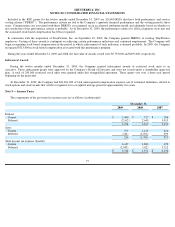

Accrued Liabilities

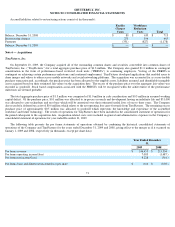

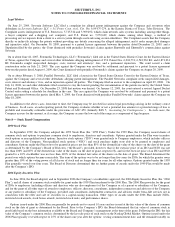

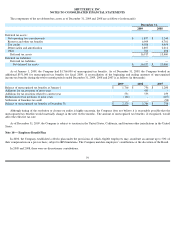

Note 5 — Restructuring

In July 2008, the Company announced that effective in early 2009, it would close its Hayward production facility and begin operations at a

new manufacturing facility to be located in Phoenix, Arizona. At the time of the decision, the Company recorded approximately $80,000 in

contractual lease termination costs. The Company completed its closure of the Hayward facility in the first quarter of fiscal 2009. The Company

paid a total of $827,000 in severance costs, which was recognized ratably over the period from the severance communication date in July 2008

through March 31, 2009. The Company recorded an additional restructuring accrual as of March 31, 2009, for rent and related costs for the

remainder of the leases associated with the Hayward facility. As of December 31, 2009, the Company made all rent payments associated with

the leases and no outstanding restructuring accrual exists.

Balance, December 31, 2007

$

379

Acquisition of business

6,945

Goodwill adjustments

400

Balance, December 31, 2008

7,724

Acquisition of business

544

Goodwill adjustments

-

Balance, December 31, 2009

$

8,268

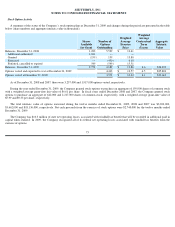

December 31,

2009

2008

In thousands

Accrued marketing expenses

$

10,548

$

6,697

Accrued production costs

7,241

2,677

Accrued income and sales taxes

5,517

5,923

Accrued compensation

5,227

4,110

Accrued purchases

1,228

952

Accrued consultant expenses

1,112

1,439

Accrued other

1,920

3,004

$

32,793

$

24,802

70