Shutterfly 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

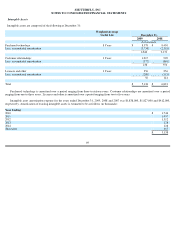

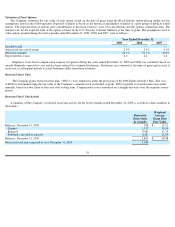

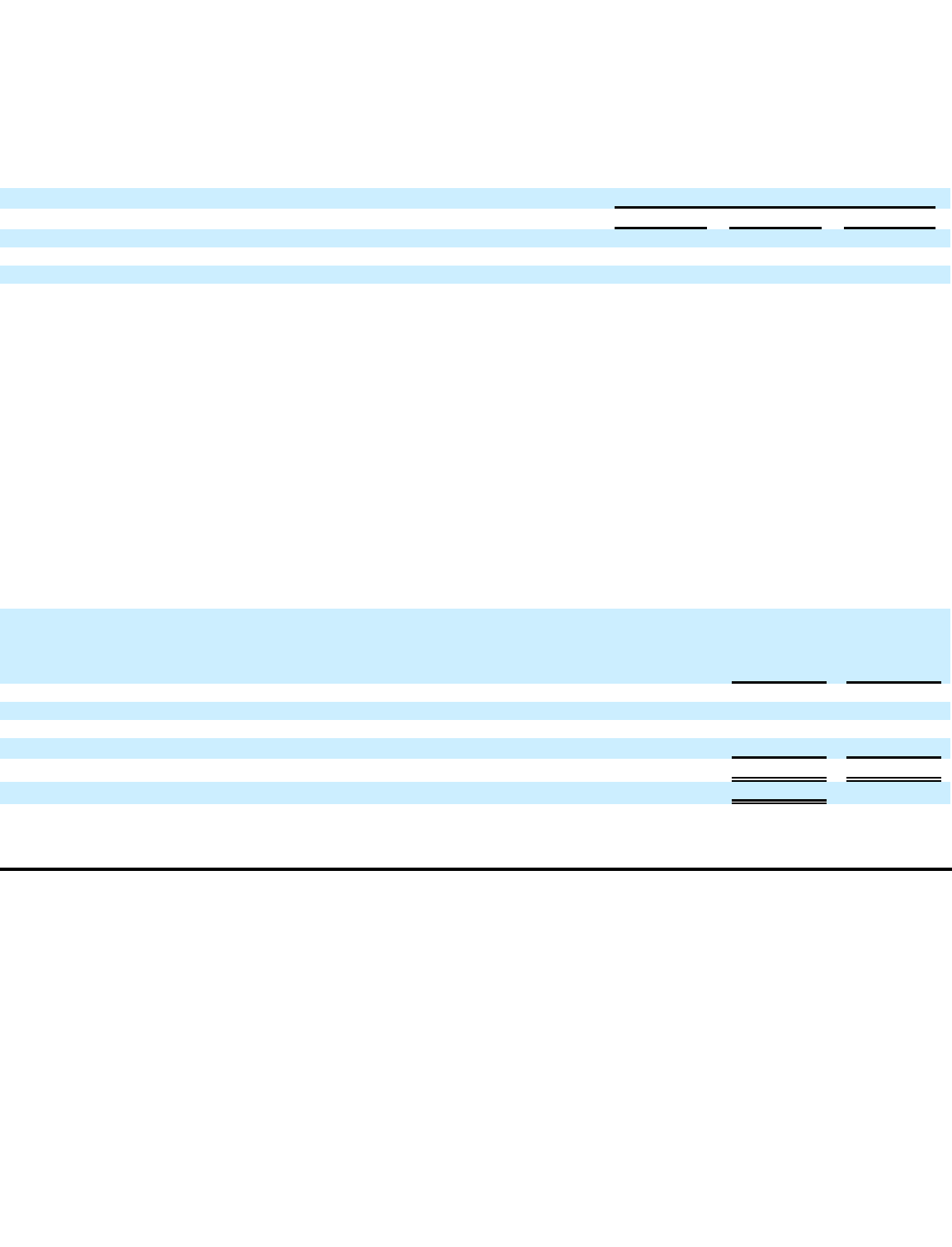

Valuation of Stock Options

The Company estimated the fair value of each option award on the date of grant using the Black-Scholes option-

pricing model and the

assumptions noted in the following table. Expected volatility is based on the historical and implied volatility of a peer group of publicly traded

entities. The expected term of options gave consideration to historical exercises, post vest cancellations and the options contractual term. The

risk-

free rate for the expected term of the option is based on the U.S. Treasury Constant Maturity at the time of grant. The assumptions used to

value options granted during the twelve months ended December 31, 2009, 2008, and 2007, were as follows:

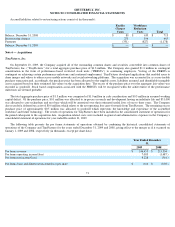

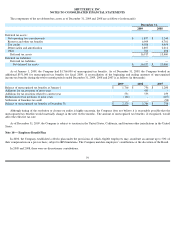

Employee stock-

based compensation expense recognized during the years ended December 31, 2009 and 2008 was calculated based on

awards ultimately expected to vest and has been reduced for estimated forfeitures. Forfeitures are estimated at the time of grant and revised, if

necessary, in subsequent periods if actual forfeitures differ from those estimates.

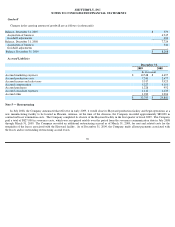

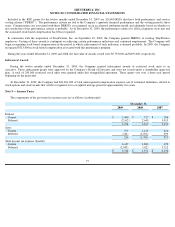

Restricted Stock Units

The Company grants restricted stock units (“RSUs”) to its employees under the provisions of the 2006 Equity Incentive Plan. The cost

of RSUs is determined using the fair value of the Company's common stock on the date of grant. RSUs typically vest and become exercisable

annually, based on a two, three or four year total vesting term. Compensation cost is amortized on a straight-line basis over the requisite service

period.

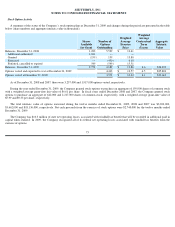

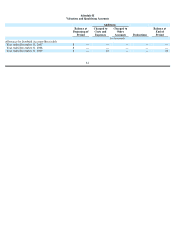

Restricted Stock Unit Activity

A summary of the Company’

s restricted stock unit activity for the twelve months ended December 31, 2009, is as follows (share numbers in

thousands):

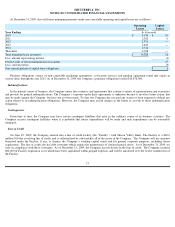

Year Ended December 31,

2009

2008

2007

Dividend yield

—

—

—

Annual risk free rate of return

2.3

%

2.5

%

4.1

%

Expected volatility

54.1

%

51.7

%

45.0

%

Expected term (years)

4.6

4.4

4.4

Restricted

Stock Units

& Awards

Weighted

Average

Grant Date

Fair Value

Balances, December 31, 2008

958

$

12.11

Granted

1,513

10.58

Released

(398)

13.74

Forfeited, cancelled or expired

(182)

12.89

Balances, December 31, 2009

1,891

$

10.48

Restricted stock units expected to vest, December 31, 2009

1,546

76