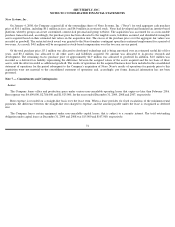

Shutterfly 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

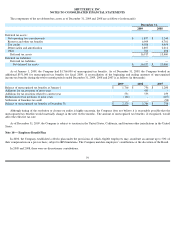

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

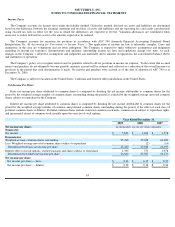

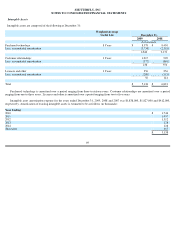

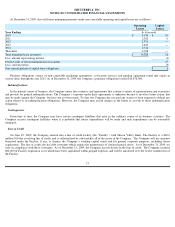

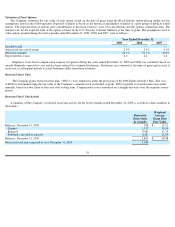

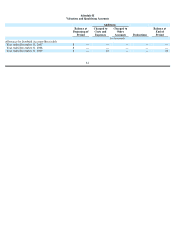

At December 31, 2009, the total future minimum payments under non-cancelable operating and capital leases are as follows:

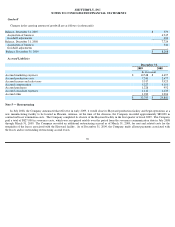

Purchase obligations consist of non-cancelable marketing agreements, co-

location services and printing equipment rental that expire at

various dates through the year 2013. As of December 31, 2009, the Company’s purchase obligations totaled $16,878,000.

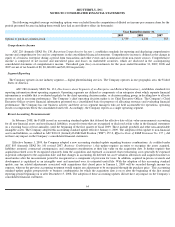

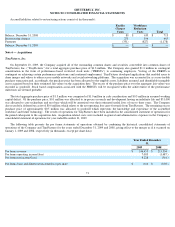

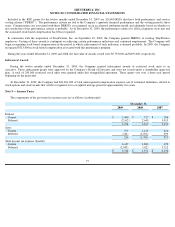

Indemnifications

In the normal course of business, the Company enters into contracts and agreements that contain a variety of representation and warranties

and provide for general indemnifications. The Company’

s exposure under these agreements is unknown because it involves future claims that

may be made against the Company, but have not yet been made. To date, the Company has not paid any claims or been required to defend any

action related to its indemnification obligations. However, the Company may record charges in the future as a result of these indemnification

obligations.

Contingencies

From time to time, the Company may have certain contingent liabilities that arise in the ordinary course of its business activities. The

Company accrues contingent liabilities when it is probable that future expenditures will be made and such expenditures can be reasonably

estimated.

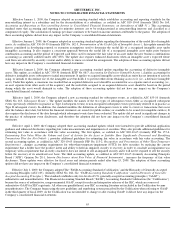

Line of Credit

On June 29, 2009, the Company entered into a line of credit facility (the “Facility”)

with Silicon Valley Bank. The Facility is a $20.0

million 360-day revolving line of credit, and is collateralized by substantially all of the assets of the Company.

The Company will use amounts

borrowed under the Facility, if any, to finance the Company’

s working capital needs and for general corporate purposes, including future

acquisitions. The line of credit also has debt covenants which require the maintenance of certain financial ratios. As of December 31, 2009, we

were in compliance with those covenants. As of December 31, 2009, the Company has not drawn on the line of credit. The Company incurred

$82,000 of Facility origination costs which have been capitalized within prepaid expenses and will be amortized over the twelve month term of

the Facility.

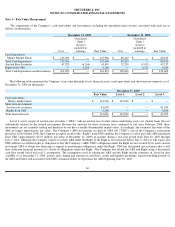

Operating

Leases

Capital

Leases

Year Ending:

In thousands

2010

$

3,676

$

10

2011

2,302

6

2012

2,371

—

2013

2,441

—

2014

2,514

Thereafter

2,078

—

Total minimum lease payments

$

15,382

16

Less: amount representing interest

(1

)

Present value of future minimum lease payments

15

Less: current portion

(9

)

Non

-

current portion of capital lease obligations

$

6

73