Shutterfly 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

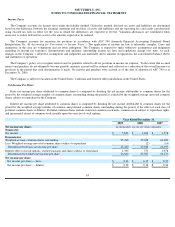

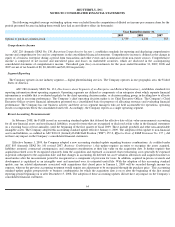

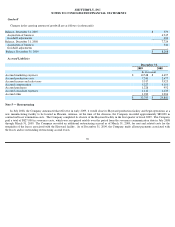

The following weighted-

average outstanding options were excluded from the computation of diluted net income per common share for the

periods presented because including them would have had an anti-dilutive effect (in thousands):

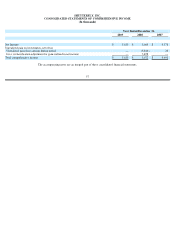

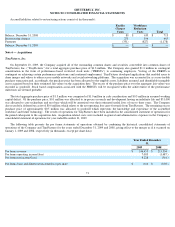

Comprehensive Income

ASC 220 (formerly SFAS No. 130, Reporting Comprehensive Income

), establishes standards for reporting and displaying comprehensive

income and comprehensive loss and its components in the consolidated financial statements. Comprehensive income is defined as the change in

equity of a business enterprise during a period from transactions and other events and circumstances from non-

owner sources. Comprehensive

income is composed of net income and unrealized gains and losses on marketable securities, which are disclosed in the accompanying

consolidated statements of comprehensive income. Unrealized gain (loss) on investments for the years ended December 31, 2009, 2008 and

2007 are net of tax benefit of $0, $3,148,000 and $13,000 respectively.

Segment Reporting

The Company operates in one industry segment —

digital photofinishing services. The Company operates in one geographic area, the United

States of America.

ASC 280 (formerly SFAS No. 131, Disclosures about Segments of an Enterprise and Related Information

), establishes standards for

reporting information about operating segments. Operating segments are defined as components of an enterprise about which separate financial

information is available that is evaluated regularly by the chief operating decision maker, or decision making group, in deciding how to allocate

resources and in assessing performance. The Company’s chief operating decision maker is its Chief Executive Officer. The Company’

s Chief

Executive Officer reviews financial information presented on a consolidated basis for purposes of allocating resources and evaluating financial

performance. The Company has one business activity and there are no segment managers who are held accountable for operations, operating

results or components below the consolidated unit level. Accordingly, the Company reports as a single operating segment.

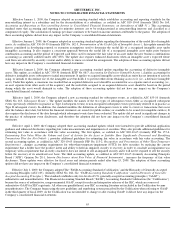

Recent Accounting Pronouncements

In February 2008, the FASB issued an accounting standard update that delayed the effective date of fair value measurements accounting

for all non-financial assets and non-

financial liabilities, except for items that are recognized or disclosed at fair value in the financial statements

on a recurring basis (at least annually), until the beginning of the first quarter of fiscal 2009. These include goodwill and other non-

amortizable

intangible assets. The Company adopted this accounting standard update effective January 1, 2009. The adoption of this update to non-

financial

assets and liabilities, as codified in ASC 820-10 (formerly FASB Staff Position ("FSP") 157-2, Effective Date of FASB Statement No. 157

), did

not have any impact on the Company’s consolidated financial statements.

Effective January 1, 2009, the Company adopted a new accounting standard update regarding business combinations. As codified under

ASC 805 (formerly SFAS No. 141 revised 2007, Business Combinations

), this update requires an entity to recognize the assets acquired,

liabilities assumed, contractual contingencies, and contingent consideration at their fair value on the acquisition date. It further requires that

acquisition-

related costs be recognized separately from the acquisition and expensed as incurred; that restructuring costs generally be expensed

in periods subsequent to the acquisition date; and that changes in accounting for deferred tax asset valuation allowances and acquired income tax

uncertainties after the measurement period be recognized as a component of provision for taxes. In addition, acquired in-

process research and

development is capitalized as an intangible asset and amortized over its estimated useful life. With the adoption of this accounting standard

update, any tax related adjustments associated with acquisitions that closed prior to January 1, 2009 will be recorded through income tax

expense, whereas the previous accounting treatment would require any adjustment to be recognized through the purchase price. This accounting

standard update applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual

reporting period beginning on or after December 15, 2008. The adoption of these accounting updates did not have any impact on the Company’

s

consolidated financial statements.

Year Ended December 31,

2009

2008

2007

Options to purchase common stock

2,559

4,230

385

64