Shutterfly 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

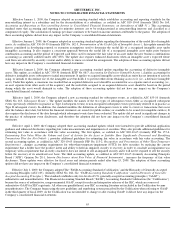

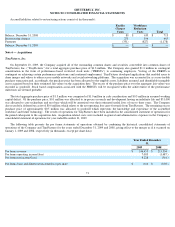

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

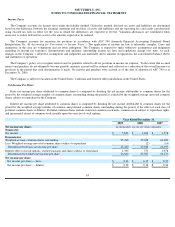

Property and Equipment

Property and equipment, including equipment under capital leases, are stated at historical cost, less accumulated depreciation and amortization.

Depreciation and amortization are computed using the straight-

line method over the estimated lives of the assets, generally three to five years.

Amortization of equipment acquired under capital lease obligations is computed using the straight-

line method over the shorter of the remaining

lease term or the estimated useful life of the related assets, generally three to four years. Leasehold improvements are amortized over their

estimated useful lives, or the lease term if shorter, generally three to seven years. Upon retirement or sale, the cost and related accumulated

depreciation are removed from the balance sheet and the resulting gain or loss is reflected in operating expenses. Major additions and

improvements are capitalized, while replacements, maintenance and repairs that do not extend the life of the asset are charged to expense as

incurred.

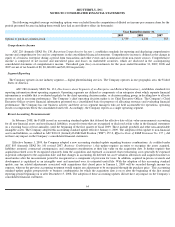

Software and Website Development Costs

The Company capitalizes eligible costs associated with software developed or obtained for internal use in accordance with ASC 350

(formerly Statement of Position 98-1, Accounting for the Costs of Computer Software Developed or Obtained for Internal Use , and

Emerging

Issues Task Force

00-02, Accounting for Web Site Development Costs ) .

Accordingly, the Company expenses all costs that relate to the planning

and post implementation phases. Payroll and payroll related costs and stock based compensation incurred in the development phase are

capitalized and amortized over the product’

s estimated useful life, generally three years. Costs associated with minor enhancements and

maintenance for the Company’s website are expensed as incurred.

Long

-Lived Assets

The Company reviews long-

lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of

an asset may not be recoverable in accordance with ASC 360-10 (formerly Statement of Financial Accounting Standards No. 144,

Accounting

for the Impairment or Disposal of Long

-Lived Assets

). Recoverability is measured by comparison of the carrying amount to the future net cash

flows which the assets are expected to generate. If such assets are considered to be impaired, the impairment to be recognized is measured by the

amount by which the carrying amount of the assets exceeds the projected discounted future cash flows arising from the asset using a discount

rate determined by management to be commensurate with the risk inherent to the Company’s current business model.

Goodwill and Intangible Assets

The Company accounts for intangible assets and goodwill in accordance with ASC 350 (formerly SFAS No. 142,

Goodwill and Other

Intangible Assets

). Goodwill and intangible assets with indefinite lives are not amortized but are tested for impairment on an annual basis during

the Company's fourth quarter or whenever events or changes in circumstances indicate that the carrying amount of these assets may not be

recoverable. Intangible assets with finite useful lives are amortized using the straight-

line method over their useful lives and are reviewed for

impairment in accordance with ASC 360, (formerly SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets ) .

Intangible assets are amortized on a straight-line basis over the estimated useful lives which range from one to sixteen years.

For goodwill analysis, the Company operates under one reporting unit. The Company determined the fair value of its reporting unit based

on its enterprise value. This reporting unit was not at risk of failing step one of the annual goodwill impairment test for years ended December

31, 2009 and 2008.

61