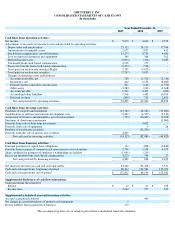

Shutterfly 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

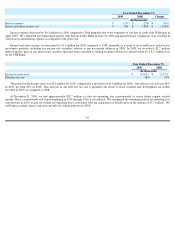

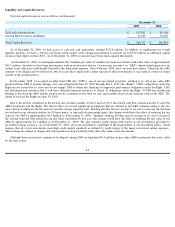

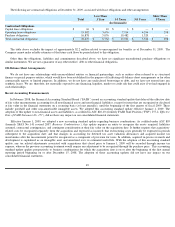

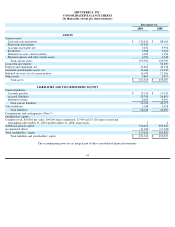

The following are contractual obligations at December 31, 2009, associated with lease obligations and other arrangements:

The table above excludes the impact of approximately $2.2 million related to unrecognized tax benefits as of December 31, 2009. The

Company cannot make reliable estimates of the future cash flows by period related to this obligation.

Other than the obligations, liabilities and commitments described above, we have no significant unconditional purchase obligations or

similar instruments. We are not a guarantor of any other entities’ debt or other financial obligations.

Off-Balance Sheet Arrangements

We do not have any relationships with unconsolidated entities or financial partnerships, such as entities often referred to as structured

finance or special purpose entities, which would have been established for the purpose of facilitating off-

balance sheet arrangements or for other

contractually narrow or limited purposes. In addition, we do not have any undisclosed borrowings or debt, and we have not entered into any

synthetic leases. We are, therefore, not materially exposed to any financing, liquidity, market or credit risk that could arise if we had engaged in

such relationships.

Recent Accounting Pronouncements

In February 2008, the Financial Accounting Standard Board (“FASB”)

issued an accounting standard update that delayed the effective date

of fair value measurements accounting for all non-financial assets and non-

financial liabilities, except for items that are recognized or disclosed

at fair value in the financial statements on a recurring basis (at least annually), until the beginning of the first quarter of fiscal 2009. These

include goodwill and other non-

amortizable intangible assets. We adopted this accounting standard update effective January 1, 2009. The

adoption of this update to non-financial assets and liabilities, as codified in ASC 820-10 (formerly FASB Staff Position ("FSP") 157-2,

Effective

Date of FASB Statement No. 157

), did not have any impact on our consolidated financial statements.

Effective January 1, 2009, we adopted a new accounting standard update regarding business combinations. As codified under ASC 805

(formerly SFAS No. 141 revised 2007, Business Combinations

), this update requires an entity to recognize the assets acquired, liabilities

assumed, contractual contingencies, and contingent consideration at their fair value on the acquisition date. It further requires that acquisition-

related costs be recognized separately from the acquisition and expensed as incurred; that restructuring costs generally be expensed in periods

subsequent to the acquisition date; and that changes in accounting for deferred tax asset valuation allowances and acquired income tax

uncertainties after the measurement period be recognized as a component of provision for taxes. In addition, acquired in-

process research and

development is capitalized as an intangible asset and amortized over its estimated useful life. With the adoption of this accounting standard

update, any tax related adjustments associated with acquisitions that closed prior to January 1, 2009 will be recorded through income tax

expense, whereas the previous accounting treatment would require any adjustment to be recognized through the purchase price. This accounting

standard update applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual

reporting period beginning on or after December 15, 2008. The adoption of these accounting updates did not have any impact on our

consolidated financial statements.

Total

Less Than

1 Year

1

-

3 Years

3

-

5 Years

More Than

5 Years

(In thousands)

Contractual Obligations

Capital lease obligations

$

16

$

10

$

6

$

—

$

—

Operating lease obligations

15,382

3,676

7,114

4,294

298

Purchase obligations

16,878

5,076

10,482

1,320

—

Total contractual obligations

$

32,276

$

8,762

$

17,602

$

5,614

$

298

49