Shutterfly 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

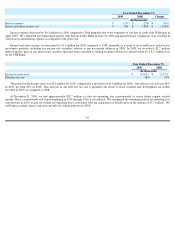

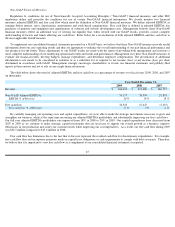

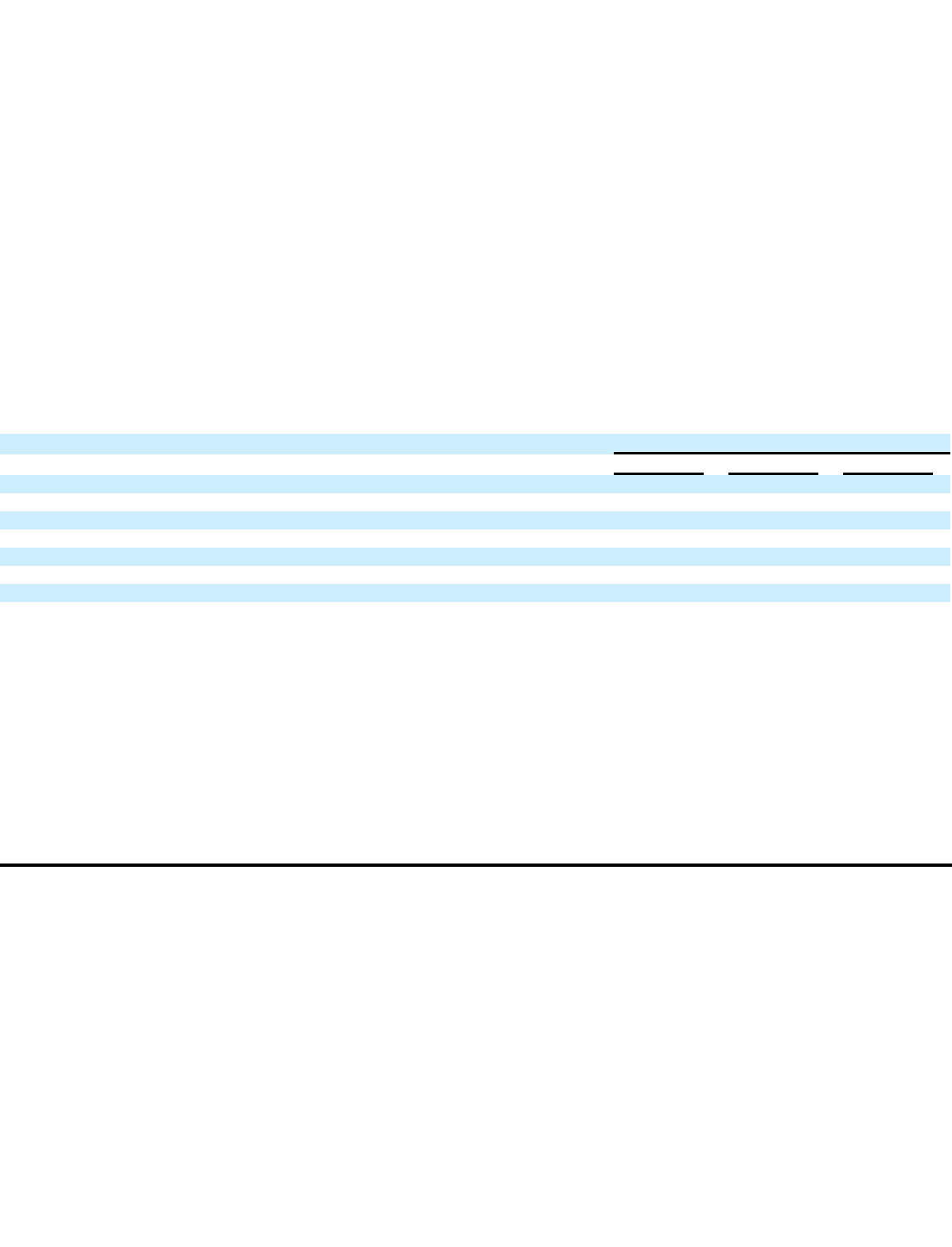

Non-GAAP Financial Measures

Regulation G, conditions for use of Non-Generally Accepted Accounting Principles ("Non-

GAAP") financial measures, and other SEC

regulations define and prescribe the conditions for use of certain Non-

GAAP financial information. We closely monitor two financial

measures, adjusted EBITDA and free cash flow which meet the definition of Non-

GAAP financial measures. We define adjusted EBITDA as

earnings before interest, taxes, depreciation, amortization and stock-

based compensation. Free cash flow is defined as adjusted EBITDA less

purchases of property and equipment and capitalization of software and website development costs. Management believes these Non-

GAAP

financial measures reflect an additional way of viewing our liquidity that, when viewed with our GAAP results, provides a more complete

understanding of factors and trends affecting our cash flows. Refer below for a reconciliation of both adjusted EBITDA and free cash flow to

the most applicable GAAP measure.

To supplement our consolidated financial statements presented on a GAAP basis, we believe that these Non-

GAAP measures provide useful

information about our core operating results and thus are appropriate to enhance the overall understanding of our past financial performance and

our prospects for the future. These adjustments to our GAAP results are made with the intent of providing both management and investors a

more complete understanding of our underlying operational results and trends and performance. Management uses these Non-

GAAP measures to

evaluate our financial results, develop budgets, manage expenditures, and determine employee compensation. The presentation of additional

information is not meant to be considered in isolation or as a substitute for or superior to net income (loss) or net income (loss) per share

determined in accordance with GAAP. Management strongly encourages shareholders to review our financial statements and publicly-

filed

reports in their entirety and not to rely on any single financial measure.

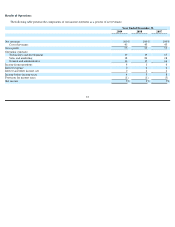

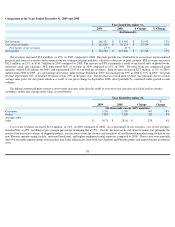

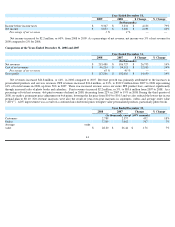

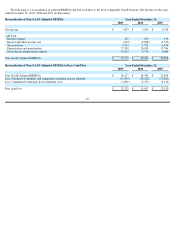

The table below shows the trend of adjusted EBITDA and free cash flow as a percentage of revenue over fiscal years 2009, 2008, and 2007

(in thousands):

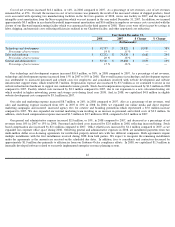

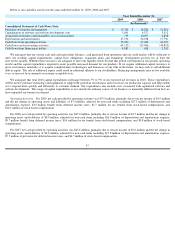

By carefully managing our operating costs and capital expenditures, we were able to make the strategic investments necessary to grow and

strengthen our business, while at the same time increasing our adjusted EBITDA profitability and substantially improving our free cash flows.

Our full year adjusted EBITDA profitability rate improved from 18% in 2008 to 20% in 2009. Our capital expenditures have decreased from

2007 to 2009 as we continue to make strategic capital investments that are necessary to support our overall growth as a business, improve

efficiencies in our production and satisfy our customer needs while improving our cost imperatives. As a result, our free cash flow during 2009

was $32.5 million compared to $15.6 million in 2008.

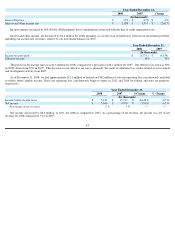

Free cash flow has limitations due to the fact that it does not represent the residual cash flow for discretionary expenditures. For example,

free cash flow does not incorporate payments made on capital lease obligations or cash requirements to comply with debt covenants. Therefore,

we believe that it is important to view free cash flow as a compliment to our consolidated financial statements as reported.

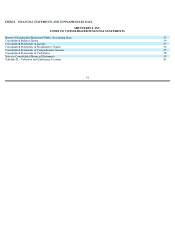

Year Ended December 31,

2009

2008

2007

Revenue

$

246,432

$

213,480

$

186,727

Non

-

GAAP Adjusted EBITDA

50,177

38,394

32,858

EBITDA % of Revenue

20

%

18

%

18

%

Free cash flow

32,522

15,647

(2,135

)

Free cash flow % of Revenue

13

%

7

%

-

1

%

45