Shutterfly 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

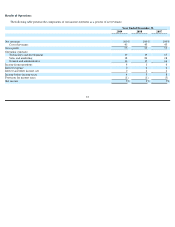

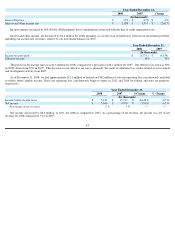

Interest expense decreased by $0.1 million for 2009 compared to 2008 primarily due to the expiration of our line of credit with JP Morgan in

April 2009. We completed our replacement facility with Silicon Valley Bank on June 29, 2009 and incurred lower origination costs resulting in

a decrease in amortization expense as compared to the prior year.

Interest and other income, net decreased by $2.1 million for 2009 compared to 2008, primarily as a result of an overall lower yield on our

investment portfolio, including our auction rate securities, relative to our investment balances in 2008. In 2009, we recorded a $2.7 million

mark-to-market gain on our auction-

rate securities that have been classified as trading securities which was entirely offset by a $2.7 million loss

on the UBS Right.

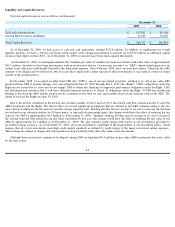

The provision for income taxes was $3.5 million for 2009, compared to a provision of $1.6 million for 2008. Our effective tax rate was 38%

in 2009, up from 30% in 2008. This increase in our effective tax rate is primarily the result of lower research and development tax credits

recorded in 2009, as compared to 2008.

At December 31, 2009, we had approximately $32.7 million of state net operating loss carryforwards to reduce future regular taxable

income. These carryforwards will expire beginning in 2014 through 2016, if not utilized. We recognized the remaining federal net operating loss

carryforward in 2009, except for federal net operating losses associated with our acquisition of TinyPictures in the amount of $1.7 million. We

will begin accruing current cash taxes payable for federal purposes in 2010.

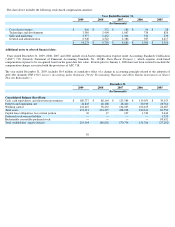

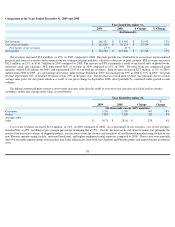

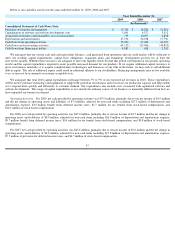

Year Ended December 31,

2009

2008

Change

(In thousands)

Interest expense

$

(157

)

$

(273

)

$

(116

)

Interest and other income, net

$

814

$

2,898

$

(2,084

)

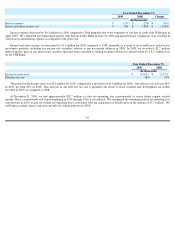

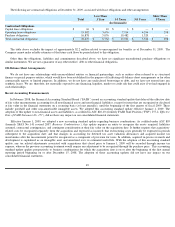

Year Ended December 31,

2009

2008

(In thousands)

Income tax provision

$

(3,514

)

$

(1,571

)

Effective tax rate

38

%

30

%

40