Shutterfly 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

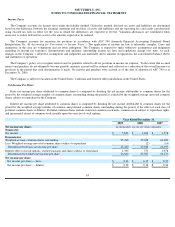

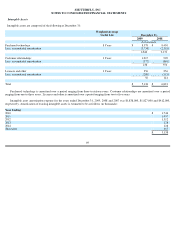

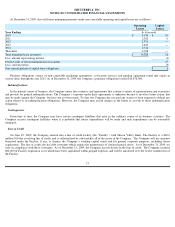

Property and Equipment

Property and equipment includes $1,212,000 and $3,356,000 of equipment and software under capital leases at December 31, 2009 and

2008, respectively. Accumulated depreciation of assets under capital leases totaled $1,199,000 and $3,010,000 at December 31, 2009 and 2008,

respectively.

Depreciation and amortization expense for the years ended December 31, 2009, 2008 and 2007 was $25,122,000, $24,211,000 and

$17,384,000, respectively.

Total capitalized software and website development costs, net of accumulated amortization totaled $8,629,000 and $7,133,000

at

December 31, 2009 and 2008, respectively. These amounts included $1,571,000 and $1,590,000 of stock based compensation expense at

December 31, 2009 and 2008 respectively. Amortization of capitalized costs totaled approximately $3,314,000, $2,456,000 and $1,467,000 for

the years ended December 31, 2009, 2008 and 2007, respectively.

During the year ended December 31, 2009, the Company retired $8,910,000 of fully depreciated property and equipment, primarily

building leasehold improvements and equipment associated with the closure of the Company's Hayward production facility.

During 2009, the Company recorded a loss of $266,000 associated with the impairment of certain computer equipment.

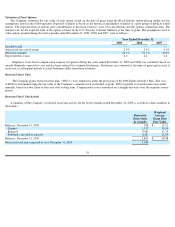

December 31,

2009

2008

In thousands

Computer and other equipment

$

84,754

$

78,299

Software

7,122

7,450

Leasehold improvements

6,848

8,933

Furniture and fixtures

2,956

2,609

Capitalized software and website development costs

17,494

12,622

119,174

109,913

Less: Accumulated depreciation and amortization

(77,329

)

(61,805

)

Net property and equipment

$

41,845

$

48,108

68