Shutterfly 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

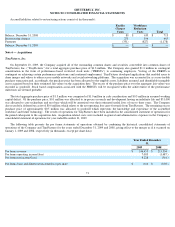

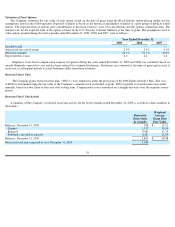

Included in the RSU grants for the twelve months ended December 31, 2009 are 326,000 RSUs that have both performance and service

vesting criteria (“PBRSU”). The performance criteria are tied to the Company’

s quarterly financial performance and the vesting period is three

years. Compensation cost associated with these PBRSUs is recognized on an accelerated attribution model and ultimately based on whether or

not satisfaction of the performance criteria is probable. As of December 31, 2009, the performance criteria for all fiscal quarters were met and

the associated stock based compensation has been recognized.

In connection with the acquisition of TinyPictures, Inc. on September 10, 2009, the Company granted PBRSUs to existing TinyPictures

employees. Vesting of these awards is contingent on achieving certain performance milestones and continued employment. The Company will

begin recognizing stock based compensation in the period in which achievement of each milestone is deemed probable. In 2009, the Company

recognized $313,000 in stock based compensation associated with this performance program.

During the years ended December 31, 2009 and 2008, the fair value of awards vested were $5,733,000 and $699,000, respectively.

Inducement Awards

During the twelve months ended December 31, 2009, the Company granted inducement awards of restricted stock units to an

executive. These inducement grants were approved by the Company’

s Board of Directors and were not issued under a shareholder approved

plan. A total of 200,000 restricted stock units were granted under this nonqualified agreement. These grants vest over a three year period

beginning on the grant date.

At December 31, 2009, the Company had $21,401,000

of total unrecognized compensation expense, net of estimated forfeitures, related to

stock options and stock awards that will be recognized over a weighted-average period of approximately two years.

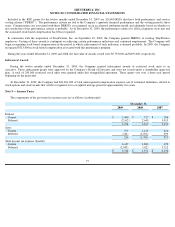

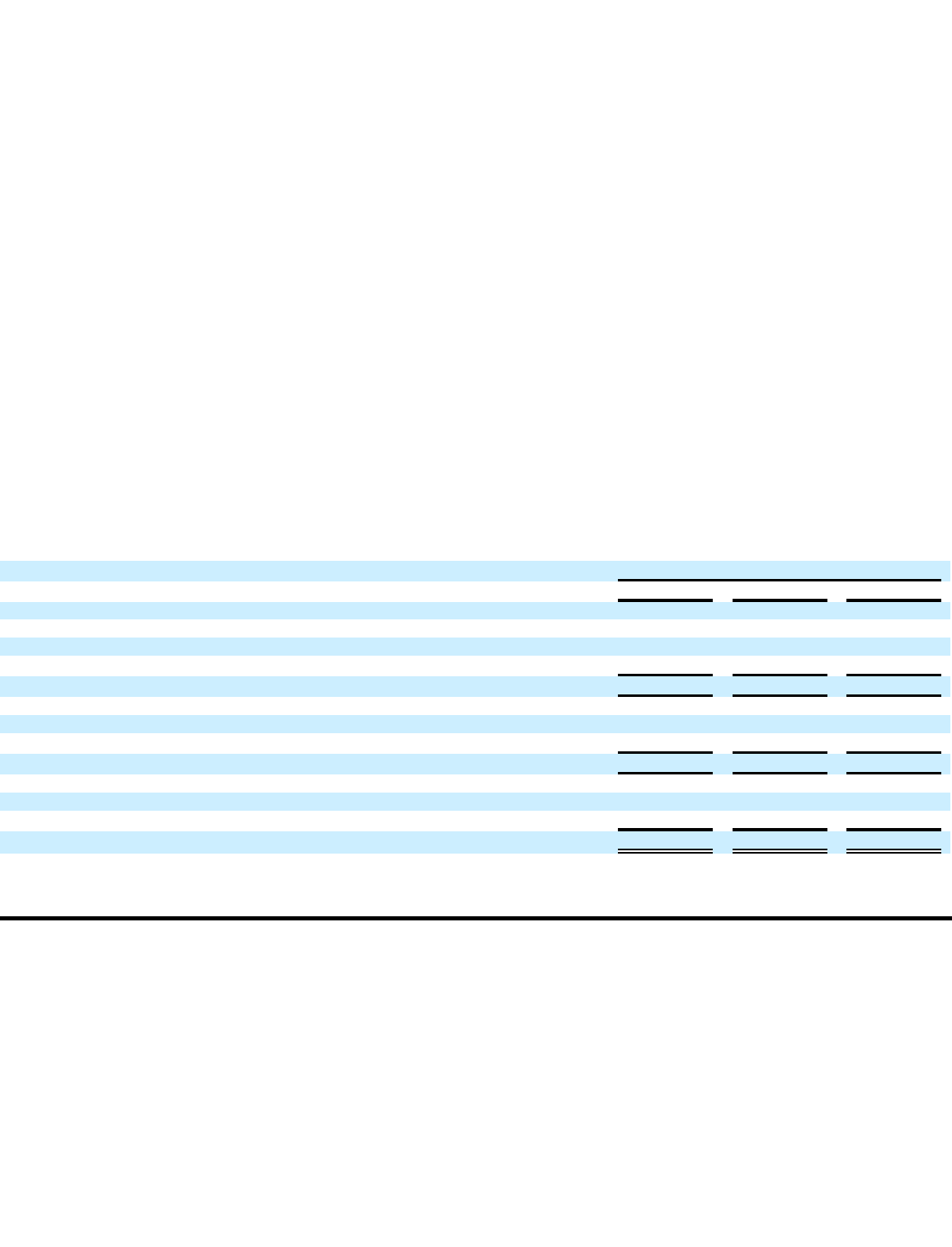

Note 9 — Income Taxes

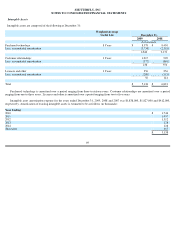

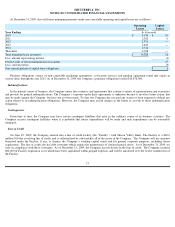

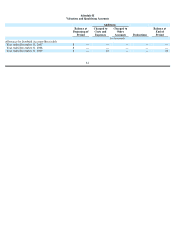

The components of the provision for income taxes are as follows (in thousands):

December 31,

2009

2008

2007

Federal:

Current

$

5,440

$

727

$

206

Deferred

(2,162

)

2,640

5,013

3,278

3,367

5,219

State:

Current

977

1,156

216

Deferred

(741)

(2,952)

699

236

(1,796)

915

Total income tax expense (benefit):

Current

6,417

1,883

422

Deferred

(2,903)

(312)

5,712

$

3,514

$

1,571

$

6,134

77