Shutterfly 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

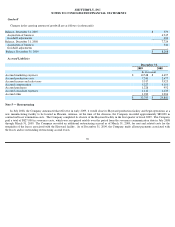

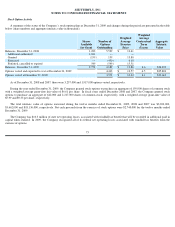

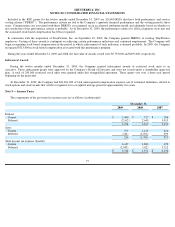

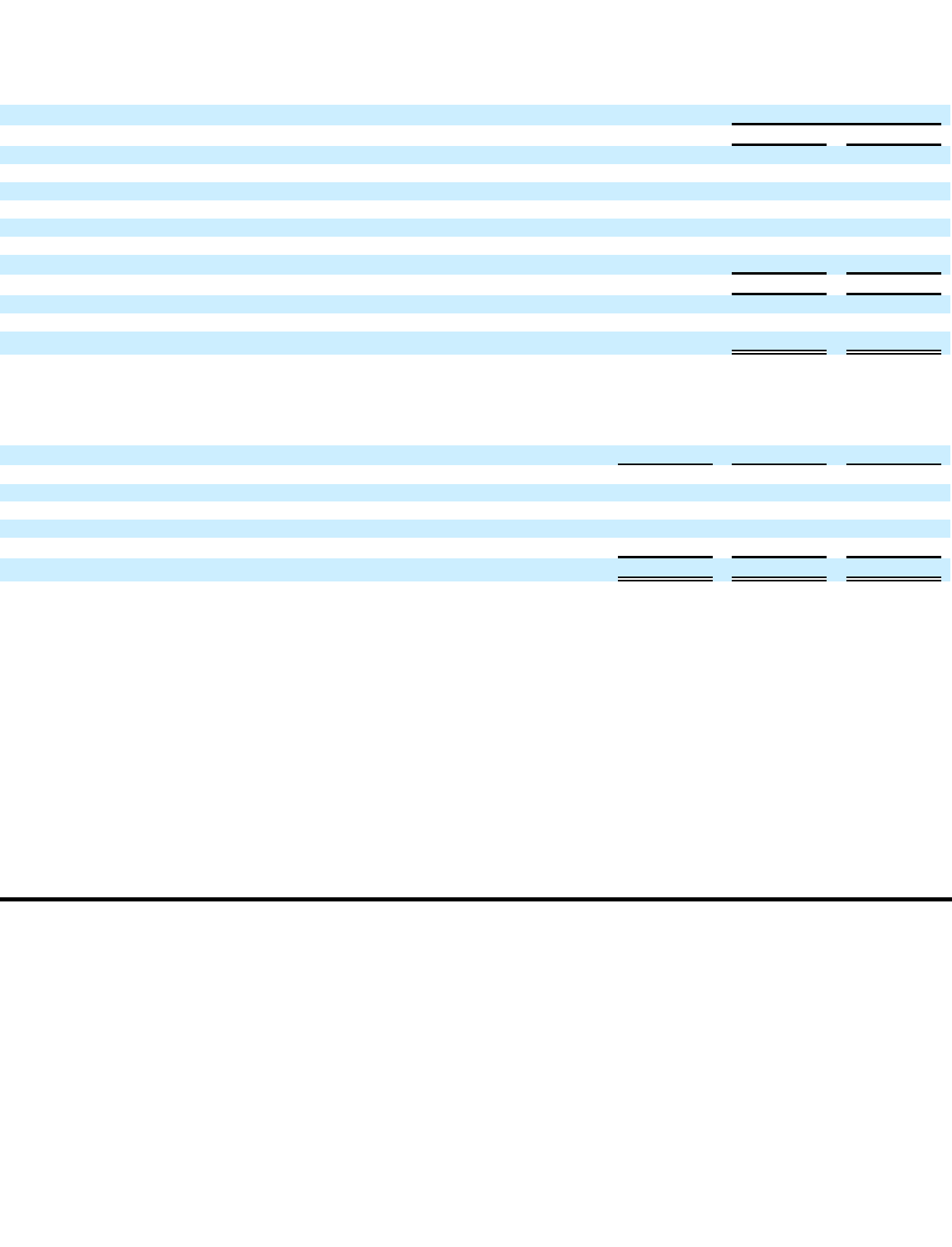

The components of the net deferred tax assets as of December 31, 2009 and 2008 are as follows (in thousands):

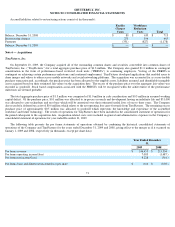

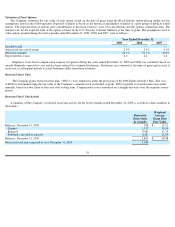

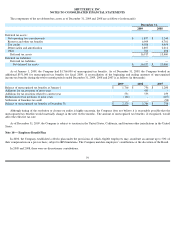

As of January 1, 2009, the Company had $1,766,000 of unrecognized tax benefits. As of December 31, 2009, the Company booked an

additional $551,000 for unrecognized tax benefits for fiscal 2009. A reconciliation of the beginning and ending amounts of unrecognized

income tax benefits during the twelve month periods ended December 31, 2009, 2008 and 2007 is as follows (in thousands):

Although timing of the resolution or closure on audits is highly uncertain, the Company does not believe it is reasonably possible that the

unrecognized tax benefits would materially change in the next twelve months.

The amount of unrecognized tax benefits, if recognized, would

affect the effective tax rate.

As of December 31, 2009, the Company is subject to taxation in the United States, California, and fourteen other jurisdictions in the United

States.

Note 10 — Employee Benefit Plan

In 2000, the Company established a 401(k) plan under the provisions of which eligible employees may contribute an amount up to 50% of

their compensation on a pre-tax basis, subject to IRS limitations. The Company matches employees’ contributions at the discretion of the Board.

In 2009 and 2008, there were no discretionary contributions.

December 31,

2009

2008

Deferred tax assets:

Net operating loss carryforwards

$

1,837

$

1,240

Reserves and other tax benefits

6,909

4,701

Tax credits

4,508

4,499

Depreciation and amortization

2,897

2,612

Other

766

408

Deferred tax assets

16,917

13,460

Deferred tax liabilities:

Deferred tax liabilities

—

—

Net deferred tax assets

$

16,917

$

13,460

2009

2008

2007

Balance of unrecognized tax benefits at January 1

$

1,766

$

756

$

1,200

Additions for tax positions of prior years

-

455

-

Additions for tax positions related to current year

551

555

259

Reductions for tax positions of prior years

(138

)

-

(607

)

Settlement of franchise tax audit

-

-

(96

)

Balance of unrecognized tax benefits at December 31

$

2,179

$

1,766

$

756

79