Shutterfly 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

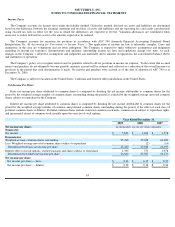

Note 1 — Description of Business

Shutterfly, Inc., (the “Company”)

was incorporated in the state of Delaware in 1999 and began its services in December 1999. The

Company is an Internet-

based social expression and personal publishing service that enables customers to share, print and preserve their

memories by leveraging a technology-

based platform and manufacturing processes. The Company provides customers a full range of products

and services to organize and archive digital images; share pictures; order prints and create an assortment of personalized items such as cards and

stationery, calendars and photo books. The Company is headquartered in Redwood City, California.

Note 2 — Summary of Significant Accounting Policies

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of the Company and its wholly-

owned subsidiaries. All

intercompany transactions and balances have been eliminated.

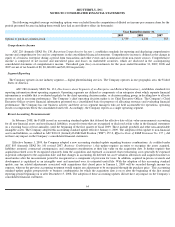

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets

and liabilities at the date of the financial statements as well as the reported amounts of revenues and expenses during the reporting period.

Significant items subject to such estimates and assumptions include, among others, intangible assets valuation and useful lives, excess and

obsolete inventories, deferred tax valuation allowance, restructuring and legal contingencies. Actual results could differ from these estimates.

Subsequent Events Evaluation

Management has reviewed and evaluated material subsequent events from the balance sheet date of December 31, 2009 through the

financial statements issue date of February 8, 2010. All appropriate subsequent event disclosures have been made in the notes to the Company's

consolidated financial statements.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with original maturities (at the date of purchase) of three months or less to

be cash equivalents. Management determines the appropriate classification of cash equivalents at the time of purchase and reevaluates such

designations at each balance sheet date. Cash equivalents consist principally of money market funds and commercial paper.

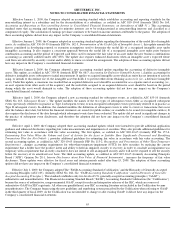

Investments

The Company evaluates declines in fair value of marketable securities in accordance with Accounting Standards Codification (“ASC”) 320-

10 (formerly Statement Financial Accounting Standard Board ("SFAS") No. 115,

Accounting for Certain Investments in Debt and Equity

Securities

), and related authoritative guidance issued by the FASB in order to determine the classification of the decline in fair value as

“temporary” or “other-than-temporary.”

A temporary decline in fair value results in an unrealized loss being recorded in the other

comprehensive income (loss) component of stockholders equity. Such an unrealized loss does not affect net income (loss) for the applicable

accounting period. An other-than–

temporary decline in fair value is recorded as a realized loss in the consolidated statement of operations and

reduces net income (loss) for the applicable accounting period. The differentiating factors between these classifications include the length of

time and extent to which the market value has been less than cost, the financial condition of the issuer, and the ability and intent of the Company

to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in market value.

59