Shutterfly 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

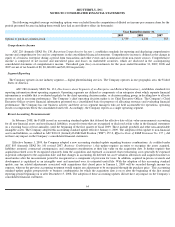

Revenue Recognition

The Company generally recognizes revenue from product sales, net of applicable sales tax upon shipment when persuasive evidence of an

arrangement exists, the selling price is fixed or determinable and collection of resulting receivables is reasonably assured. Revenues from

amounts billed to customers, including prepaid orders, are deferred until shipment of fulfilled orders or until the prepaid period

expires. Shipping charged to customers is recognized as revenue at the time of shipment. The Company recognizes commercial print revenue

upon shipment, consistent with its product revenue policy.

The Company provides its customers with a 100% satisfaction guarantee whereby products can be returned within a 30-

day period for a

reprint or refund. The Company maintains an allowance for estimated future returns based on historical data. The provision for estimated returns

is included in accrued expenses.

The Company periodically provides incentive offers to its customers in exchange for setting up an account and to encourage purchases.

Such offers include free products and percentage discounts on current purchases. Discounts, when accepted by customers, are treated as a

reduction to the purchase price of the related transaction and are presented in net revenues. Production costs related to free products are included

in cost of revenues upon redemption.

The Company’

s advertising revenues are derived from the sale of online advertisements on its website. Advertising revenues are recognized

as “impressions” (

i.e., the number of times that an advertisement appears in pages viewed by users of the Company's website) are delivered; as

“clicks” (which are generated each time users of the Company's website click through the advertisements to an advertiser’

s designated website)

are provided to advertisers; or ratably over the term of the agreement with the expectation that the advertisement will be delivered ratably over

the contract period.

Restructuring Costs

In accordance with ASC 420-10 (formerly SFAS No. 146, Accounting for Costs Associated with Exit or Disposal Activities

), restructuring

costs are recorded as incurred. The Company accrues for lease termination costs at the time a restructuring event takes place. The Company

accrues for severance once the total severance pool has been calculated, approved and communicated, and recognizes the expense ratably over

the required service period, from the communication date to the exit date. The Company also accelerates depreciation using a revised economic

life of the leasehold improvement assets.

Advertising Costs

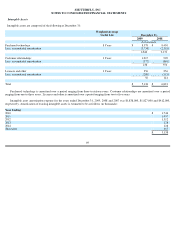

Advertising costs are expensed as incurred, except for direct mail advertising which is expensed when the advertising first takes place. The

Company did not have any capitalized direct mail costs at December 31, 2009 and December 31, 2008. Total advertising costs are included in

selling and marketing expenses and totaled approximately $14,576,000, $14,740,000 and $10,800,000 during the years ended December 31,

2009, 2008 and 2007, respectively.

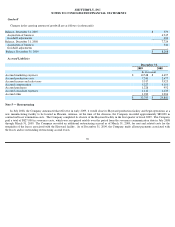

Stock-Based Compensation

The Company accounts for its stock-

based employee compensation plans under the fair value provisions of ASC 718 (formerly SFAS

No. 123R,

Share-Based Payment ). Stock-

based compensation cost is measured at the grant date, based on the fair value of the award, and is

recognized as expense over the requisite service period. Cash flows resulting from the tax benefits due to tax deductions in excess of the

compensation cost recognized for those options (excess tax benefits) are classified as financing cash flows.

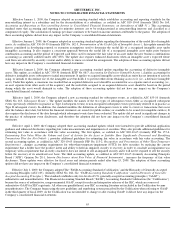

The Company accounts for equity instruments issued to non-

employees in accordance with the provisions of ASC 718 and ASC 505

(formerly Emerging Issues Task Force Abstract No. 96-18, Accounting for Equity Instruments that are Issued to Other than

Employees for

Acquiring, or in Conjunction with Selling, Goods or Services

).

The cost of restricted stock awards and performance based restricted stock awards is determined using the fair value of our common stock

on the date of grant. Compensation expense is recognized for restricted stock awards on a straight-

line basis over the vesting period.

Compensation expense associated with performance based restricted stock awards is recognized on an accelerated attribution model, and

ultimately based on whether or not satisfaction of the performance criteria is probable. If in the future, situations indicate that the performance

criteria are not probable, then no further compensation cost will be recorded, and any previous costs will be reversed.

62