Rosetta Stone 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The Company accounts for uncertainty in income taxes under ASC topic 740-10-25, ("ASC 740-10-25"). ASC

740-10-25 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or

expected to be taken in a tax return. ASC 740-10-25 also provides guidance on derecognition, classification, interest and penalties, accounting in interim

periods, disclosure, and transition.

The Company recognizes interest and penalties related to unrecognized tax benefits as a component of income tax expense (benefit). As of

December 31, 2014 and 2013, the Company had $26,000 and $16,000 accrued for interest and penalties, respectively, in "Other Long Term Liabilities".

During the year ended December 31, 2014, the Company accrued $10,000 of interest expense. During the year ended December 31, 2013, the Company

accrued $7,000 of interest expense.

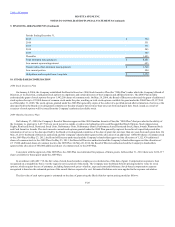

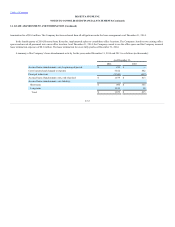

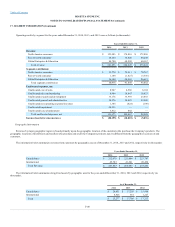

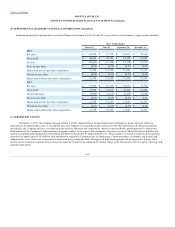

A reconciliation of the beginning and ending amount of unrecognized tax benefits, excluding interest and penalties, is as follows (in thousands):

Balance at January 1,

$ 143

$ 143

Increases for tax positions taken during prior years

322

—

Reductions for tax positions taken during prior years

(2)

—

Lapse of statute of limitations

(17)

—

Balance at December 31,

$ 446

$ 143

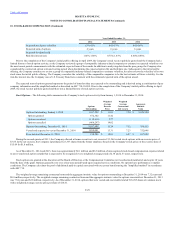

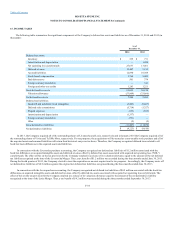

During the years ended December 31, 2014, the Company recorded a net increase of $0.3 million of additional unrecognized tax benefits related to tax

credits claimed in a prior period. The impact to tax expense was immaterial because the credits were primarily offset by a full valuation allowance. In 2013,

the Company did not recognize additional unrecognized tax benefits. These liabilities for unrecognized tax benefits are netted against "Income Tax

Receivable." As of December 31, 2014 and 2013, the Company had $0.4 million and $0.1 million of unrecognized tax benefits, respectively, which if

recognized, $51,000 would affect income tax expense. The Company does not expect that the amounts of unrecognized tax benefits will change significantly

within the next twelve months. It is reasonably possible during the next twelve months that the Company's uncertain tax position may be settled, which

could result in a decrease in the gross amount of unrecognized tax benefits.

The Company is subject to taxation in the U.S. and various states and foreign jurisdictions. The Company's tax years 2009 and forward are subject to

examination by the tax authorities. As of December 31, 2014, the Company is under audit in the U.S. for the income tax years 2009 to 2012. Currently, the

Company expects the IRS audit to be completed in 2015 and will provide additional information at that time. While the ultimate results cannot be predicted

with certainty, the Company believes that the resulting adjustments, if any, will not have a material adverse effect on its consolidated financial condition or

results of operations.

The Company had an accumulated consolidated deficit related to its foreign subsidiaries of $29.4 million at December 31, 2014 and aggregate 2014

losses before income tax related to its foreign subsidiaries of approximately $19.8 million. The Company has certain foreign subsidiaries with aggregate

undistributed earnings of $12.4 million at December 31, 2014. The foreign subsidiaries with aggregate undistributed earnings are considered indefinitely

reinvested as of December 31, 2014. As a result of the multitude of scenarios in which the earnings could be repatriated, if desired, and the complexity of

associated calculations, it is not practicable to estimate the amount of additional tax that might be payable on the undistributed foreign earnings.

The Company made income tax payments of $1.7 million, $3.3 million, and $4.0 million in 2014, 2013 and 2012, respectively.

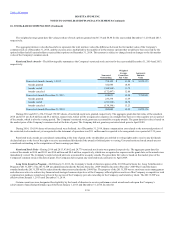

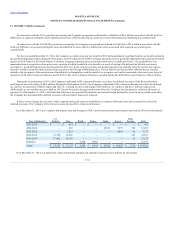

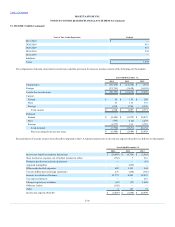

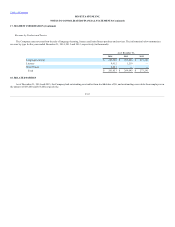

The Company leases copiers, parking spaces, buildings, a warehouse and office space under operating lease and site license arrangements, some of

which contain renewal options. Building, warehouse and office space leases range from 12 months to 74 months. Certain leases also include lease renewal

options.

F-37