Rosetta Stone 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

totaling $20.2 million. The additional $0.2 million of expense related to the abandonment of a previously capitalized internal-use software project.

Lease Abandonment and Termination

Lease abandonment and termination expenses for the year ended December 31, 2014 were $3.8 million, compared to $0.8 million for the year ended

December 31, 2013. The increase was primarily attributable to the lease abandonment of the sixth floor space in the Arlington, VA office of $3.2 million, as

well as the closure of the Japan office resulting in lease abandonment costs of $0.4 million.

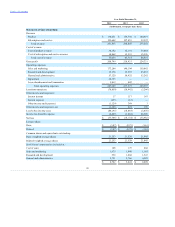

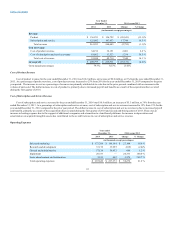

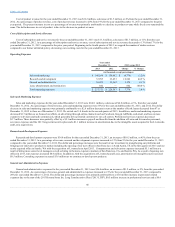

Interest income

$ 17

$ 117

$ (100)

(85.5)%

Interest expense

(233)

(61)

(172)

282.0 %

Other (expense) and income

(1,129)

368

(1,497)

(406.8)%

Total other income and (expense)

$ (1,345)

$ 424

$ (1,769)

(417.2)%

Interest income represents interest earned on our cash and cash equivalents. Interest income for the year ended December 31, 2014 was $17 thousand, a

decrease of $0.1 million, or 85%, from the year ended December 31, 2013.

Interest expense for the year ended December 31, 2014 was $0.2 million, an increase of $0.2 million, from the year ended December 31, 2013. This

increase was primarily attributable to interest on our capital leases and the amortization of deferred financing fees associated with our revolving credit

facility, which we entered into in November 2014.

Other income (expense) for the year ended December 31, 2014 was an expense of $1.1 million, an increase of $1.5 million, as compared to other income

of $0.4 million for the year ended December 31, 2013. The increase in expense was primarily attributable to foreign exchange losses.

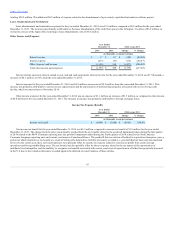

Income tax benefit

$ (6,489)

$ (1,884)

$ (4,605)

244.4%

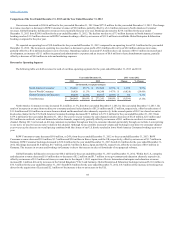

Our income tax benefit for the year ended December 31, 2014 was $6.5 million, compared to income tax benefit of $1.9 million for the year ended

December 31, 2013. The change from the prior year primarily resulted from the tax benefits related to the goodwill impairment taken during the first quarter

of 2014 related to the ROW Consumer reporting unit, the goodwill impairment taken during the fourth quarter of 2014 related to the North America

Consumer Language reporting unit, and current year losses in Canada and France. The goodwill that was written off related to acquisitions from prior years, a

portion of which resulted in a tax benefit as a result of writing off a deferred tax liability previously recorded (i.e., goodwill had tax basis and was amortized

for tax). In the current year, these tax benefit amounts were partially offset by income tax expense related to current year profits from certain foreign

operations and foreign withholding taxes. The tax benefit was also partially offset by the tax expense related to the tax impact of the amortization of

indefinite lived intangibles, and the inability to recognize tax benefits associated with current year losses of operations in all other foreign jurisdictions and

in the U.S. due to the valuation allowance recorded against the deferred tax asset balances of these entities.

43