Rosetta Stone 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Our operating expenses primarily consist of personnel costs, direct advertising and marketing expenses and professional fees associated with contract

product development, legal, accounting and consulting. Personnel costs for each category of operating expenses include salaries, bonuses, stock-based

compensation and employee benefit costs. When certain events occur, we also recognize operating expenses related to asset impairment and operating lease

terminations.

Our sales and marketing expenses consist primarily of direct advertising expenses related to television, print, radio, online and

other direct marketing activities, personnel costs for our sales and marketing staff, and commissions earned by our sales personnel. Sales commissions are

generally paid at the time the customer is invoiced. However, sales commissions are deferred and recognized as expense in proportion to when the related

revenue is recognized. In connection with our new strategy of focusing on the Global Enterprise & Education segment, we intend to reduce the number of

marketing and promotional campaigns that we run, focusing more on brand messaging that withstands the test of time, and less on promotional pricing.

Research and development expenses consist primarily of personnel costs and contract development fees associated with

the development of our solutions. Our development efforts are primarily based in the U.S. and are devoted to modifying and expanding our offering portfolio

through the addition of new content and new paid and complementary products and services to our language-learning, literacy, and brain fitness solutions.

We expect our investment in research and development expenses to increase in future years as we fund product initiatives that we expect to provide us with

significant benefits in the future.

General and administrative expenses consist primarily of shared services, such as personnel costs of our executive,

finance, legal, human resources and other administrative personnel, as well as accounting and legal professional services fees including professional service

fees related to acquisition and other corporate expenses. We expect our general and administrative expenses to decline as we take steps to reduce our non-

Global Enterprise & Education headcount as well as other cost reductions.

Impairment expenses consist primarily of goodwill impairment and impairment expense related to the abandonment of previously

capitalized internal-use software projects.

Lease abandonment and termination expenses include the recognition of costs associated with the termination

or abandonment of certain of our office operating leases, such as early termination fees and expected lease termination costs.

Interest and other income (expense) primarily consist of interest income, interest expense, foreign exchange gains and losses, and income from

litigation settlements. Interest expense is primarily related to interest on our capital leases and the amortization of deferred financing fees associated with our

revolving credit facility. Interest income represents interest received on our cash and cash equivalents. Fluctuations in foreign currency exchange rates in our

foreign subsidiaries cause foreign exchange gains and losses. Legal settlements are related to agreed upon settlement payments from various anti-piracy

enforcement efforts.

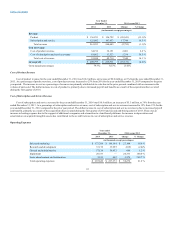

Income tax (benefit) expense consists of federal, state and foreign income taxes. For the year ended December 31, 2014, we incurred an income tax

benefit of $6.5 million based on losses before taxes of $80.2 million resulting in a worldwide effective tax rate was approximately 8.1%. The tax rate resulted

from tax benefits related to the tax impact of the goodwill impairment charges taken in the first and fourth quarters of 2014 and tax benefits related to current

year losses in Canada and France. The tax benefits were only partially offset by tax expense related to current year income of operations in Germany and the

UK, foreign withholding taxes, and the tax impact of amortization of indefinite lived intangible assets.

We regularly evaluate the recoverability of our deferred tax assets and establish a valuation allowance, if necessary, to reduce the deferred tax assets to

an amount that is more likely than not to be realized (a likelihood of more than 50 percent). Significant judgment is required to determine whether a

valuation allowance is necessary and the amount of such valuation allowance, if appropriate.

In assessing the recoverability of our deferred tax assets, we consider all available evidence, including:

• the nature, frequency, and severity of cumulative financial reporting losses in recent years;

• the carryforward periods for the net operating loss, capital loss, and foreign tax credit carryforwards;

• predictability of future operating profitability of the character necessary to realize the asset;

31