Rosetta Stone 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

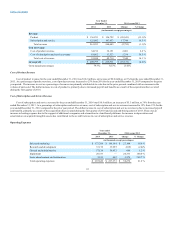

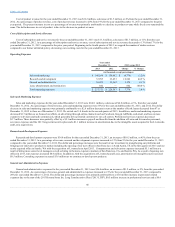

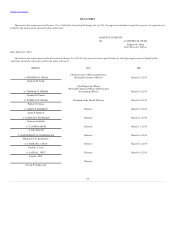

payments under non-cancellable operating and capital lease agreements as of December 31, 2014 and the effect such obligations are expected to have on our

liquidity and cash flow in future periods.

Capitalized leases and other financing

arrangements

$ 4,441

$ 754

$ 1,102

$ 1,090

$ 1,495

Operating leases

15,291

4,836

7,389

3,031

35

Total

$ 19,732

$ 5,590

$ 8,491

$ 4,121

$ 1,530

Recent Accounting Pronouncements

During 2014, we adopted the following recently issued Accounting Standard Updates (ASUs):

In July 2013, the Financial Accounting Standards Board ("FASB") issued ASU No. 2013-11

(“ASU 2013-11”), which requires that an

unrecognized tax benefit be presented in the financial statements as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss,

or a tax credit carryforward, except for a situation in which some or all of such net operating loss carryforward, a similar loss, or a tax credit carryforward is not

available at the reporting date under the tax law of the applicable tax jurisdiction to settle any additional income taxes that would result from the

disallowance of a tax position or the tax law of the applicable jurisdiction does not require the entity to use, and the entity does not intend to use, the

deferred tax asset for such purpose, the unrecognized tax benefit should be presented in the financial statements as a liability and should not be combined

with deferred tax assets. We adopted this guidance beginning in fiscal year 2014 and the adoption of such guidance did not have a material impact on the

presentation of our reported results of operations or financial position.

The following ASUs were recently issued but have not yet been adopted:

In August 2014, the FASB issued ASU No. 2014-15, Presentation of Financial Statements - Going Concern (Subtopic 205-40) ("ASU 2014-15"). ASU

2014-15 addresses management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern and to

provide related footnote disclosures. Management’s evaluation should be based on relevant conditions and events that are known and reasonably knowable

at the date that the financial statements are issued. ASU 2014-15 will be effective for the first interim period within annual reporting periods beginning after

December 15, 2016. Early adoption is permitted. We do not expect to early adopt this guidance and do not believe that the adoption of this guidance will

have a material impact on our financial statements and disclosures.

In June 2014, the FASB issued ASU No. 2014-12,

("ASU 2014-12"). ASU 2014-12 requires that a performance target that affects vesting and that

could be achieved after the requisite service period be treated as a performance condition. ASU 2014-12 is effective for annual reporting periods and interim

periods within those annual reporting periods beginning after December 15, 2015. Early adoption is permitted. We do not expect to early adopt this guidance

and does not believe that the adoption of this guidance will have a material impact on our financial statements and disclosures.

In May 2014, the FASB issued ASU No. 2014-09, ("ASU 2014-09"), which replaces the current

revenue accounting guidance. ASU 2014-09 is effective for annual periods beginning after December 15, 2016. The core principle of ASU 2014-09 is that an

entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the

entity expects to be entitled in exchange for those goods or services. To achieve that core principle, an entity should apply a five step model to 1) identify

the contract(s) with a customer, 2) identify the performance obligations in the contract, 3) determine the transaction price, 4) allocate the transaction price to

the performance obligations in the contract and 5) recognize revenue when (or as) the entity satisfies a performance obligation. Entities may choose from two

adoption methods, with certain practical expedients. We are in the process of evaluating the impact of the new guidance on our financial statements and

disclosures and our adoption method.

In April 2014, the FASB issued ASU No. 2014-08

("ASU 2014-08"), which amends the definition of a discontinued

operation and requires entities to provide additional disclosures about discontinued operations as well as disposal transactions that do not meet the

discontinued operations criteria. The new guidance

49