Rosetta Stone 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Sales commissions from non-cancellable web-based software subscription contracts are deferred and amortized in proportion to the revenue recognized

from the related contract.

The Company recognizes all of the assets acquired, liabilities assumed and contractual contingencies from an acquired company as well as contingent

consideration at fair value on the acquisition date. The excess of the total purchase price over the fair value of the assets and liabilities acquired is recognized

as goodwill. Acquisition-related costs are recognized separately from the acquisition and expensed as incurred. Generally, restructuring costs incurred in

periods subsequent to the acquisition date are expensed when incurred. Subsequent changes to the purchase price (i.e., working capital adjustments) or other

fair value adjustments determined during the measurement period are recorded as adjustments to goodwill.

Cash and cash equivalents consist of highly liquid investments with original maturities of three months or less and demand deposits with financial

institutions.

Restricted cash is generally used to reimburse funds to employees under the Company's flexible benefit plan and as security for a credit card processing

vendor. $12.3 million of restricted cash as of December 31, 2013 was restricted for the payment of the purchase price for the acquisition of Vivity Labs, Inc.

which occurred on January 2, 2014 (see Note 5, Business Combinations).

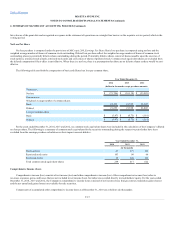

Accounts receivable consist of amounts due to the Company from its normal business activities. The Company provides an allowance for doubtful

accounts to reflect the expected non-collection of accounts receivable based on past collection history and specific risks identified.

Inventories are stated at the lower of cost, determined on a first-in first-out basis, or market. The Company reviews inventory for excess quantities and

obsolescence based on its best estimates of future demand, product lifecycle status and product development plans. The Company uses historical information

along with these future estimates to establish a new cost basis for obsolete and potential obsolete inventory.

Accounts receivable and cash and cash equivalents subject the Company to its highest potential concentrations of credit risk. The Company reserves

for credit losses and does not require collateral on its trade accounts receivable. In addition, the Company maintains cash and investment balances in

accounts at various banks and brokerage firms. The Company has not experienced any losses on cash and cash equivalent accounts to date and the Company

believes it is not exposed to any significant credit risk related to cash. The Company sells products to retailers, resellers, government agencies, and individual

consumers and extends credit based on an evaluation of the customer's financial condition, without requiring collateral. Exposure to losses on receivables is

principally dependent on each customer's financial condition. The Company monitors its exposure for credit losses and maintains allowances for anticipated

losses. No customer accounted for more than 10% of the Company's revenue during the years ended December 31, 2014, 2013 or 2012. The Company had

four customers that collectively accounted for 33% of accounts receivable at December 31, 2014 and four customers that collectively accounted for 31% of

accounts receivable at December 31, 2013. The Company maintains trade credit insurance for certain customers to provide coverage, up to a certain limit, in

the event of insolvency of some customers.

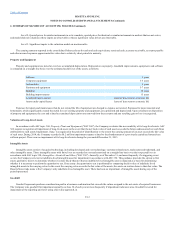

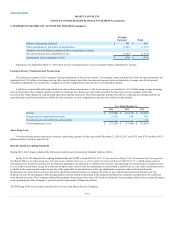

The Company values its assets and liabilities using the methods of fair value as described in ASC topic 820,

("ASC 820"). ASC 820 establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. The three levels of the fair value

hierarchy are described below:

Level 1: Quoted prices for identical instruments in active markets.

F-11