Rosetta Stone 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

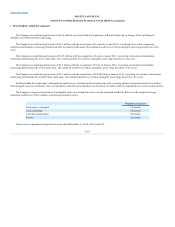

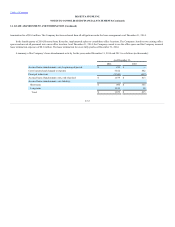

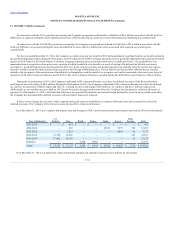

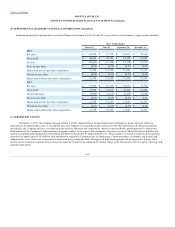

In connection with the Vivity purchase accounting, the Company recognized net deferred tax liabilities of $0.9 million associated with the book/tax

differences on acquired intangible assets and deferred revenue, offset by deferred tax assets associated with acquired net operating loss carryforwards.

In connection with the Tell Me More purchase accounting, the Company recognized net deferred tax liabilities of $1.4 million associated with the

book/tax differences on acquired intangible assets and deferred revenue, offset by deferred tax assets associated with acquired net operating loss

carryforwards.

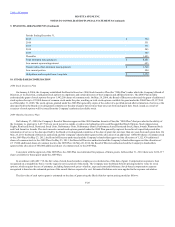

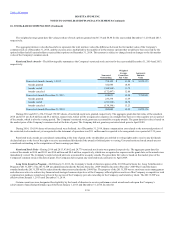

For the year ended December 31, 2014, the Company recorded an income tax benefit of $6.5 million primarily resulting from the tax benefits related to

the goodwill impairment taken during the first quarter of 2014 related to the ROW Consumer reporting unit, the goodwill impairment taken during the fourth

quarter of 2014 related to the North America Consumer Language reporting unit, and current year losses in Canada and France. The goodwill that was

impaired related to acquisitions from prior years, a portion of which resulted in a tax benefit as a result of writing off a deferred tax liability previously

recorded (i.e., goodwill had tax basis and was amortized for tax). In the current year, these tax benefit amounts were partially offset by income tax expense

related to current year profits from certain foreign operations and foreign withholding taxes. The tax benefit was also partially offset by the tax expense

related to the tax impact of the amortization of indefinite lived intangibles, and the inability to recognize tax benefits associated with current year losses of

operations in all other foreign jurisdictions and in the U.S. due to the valuation allowance recorded against the deferred tax asset balances of these entities.

During the second quarter of 2012, the Company established a full valuation allowance to reduce the deferred tax assets of the Korea subsidiary

resulting in a non-cash charge of $0.4 million. During the third quarter of 2012, the Company established a full valuation allowance to reduce the deferred

tax assets of its operations in Brazil, Japan, and the U.S., resulting in a non-cash charge of $0.4 million, $2.1 million, and $23.1 million, respectively.

Additionally, no tax benefits were provided on 2012 losses incurred in foreign jurisdictions where the Company has determined a valuation allowance is

required. As of December 31, 2012, a full valuation allowance was provided for domestic and certain foreign deferred tax assets in those jurisdictions where

the Company has determined the deferred tax assets will more likely than not be realized.

If future events change the outcome of the Company's projected return to profitability, a valuation allowance may not be required to reduce the

deferred tax assets. The Company will continue to assess the need for a valuation allowance.

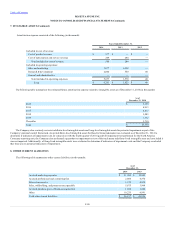

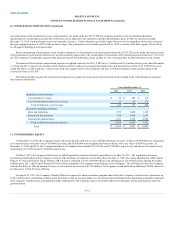

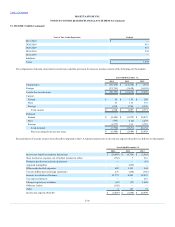

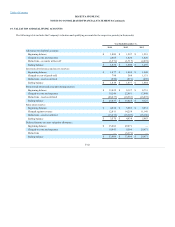

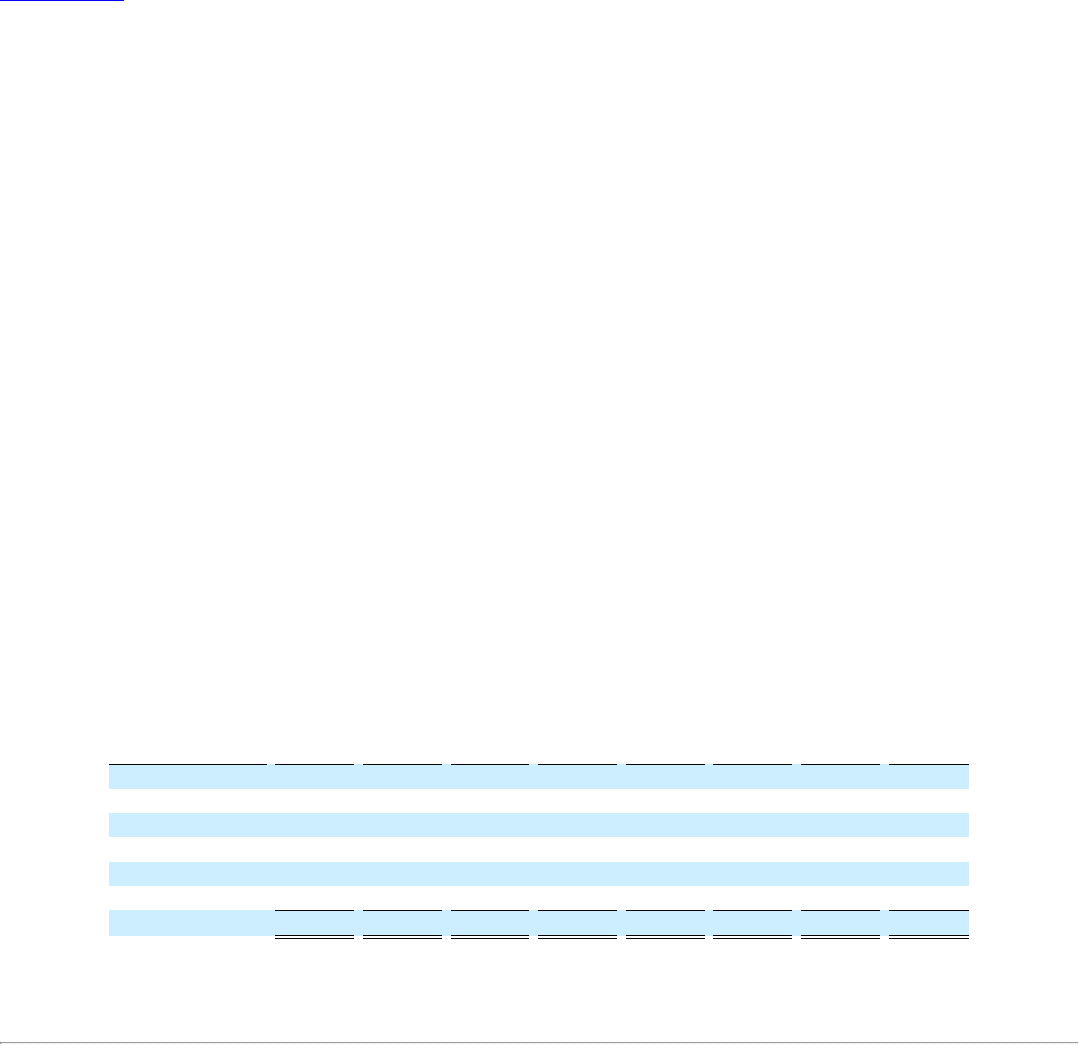

As of December 31, 2014, the Company had federal, state and foreign tax NOL carryforward amounts and expiration periods as follows (in thousands):

2015-2019

$ —

$ 481

$ —

$ —

$ —

$ —

$ —

$ 481

2020-2024

—

803

—

—

10,932

5,978

740

18,453

2025-2029

—

3,623

—

—

—

4,042

92

7,757

2030-2034

21,700

16,066

—

—

—

—

865

38,631

2035-2039

17,892

14,582

—

—

—

—

39

32,513

Indefinite

—

—

6,244

9,943

—

—

—

16,187

Totals

$ 39,592

$ 35,555

$ 6,244

$ 9,943

$ 10,932

$ 10,020

$ 1,736

$ 114,022

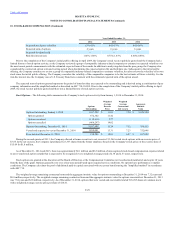

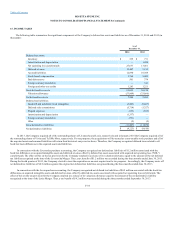

As of December 31, 2014, our federal tax credit carryforward amounts and expiration periods were as follows (in thousands):

F-35