Rosetta Stone 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

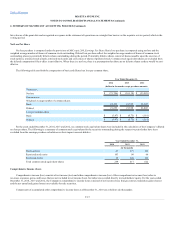

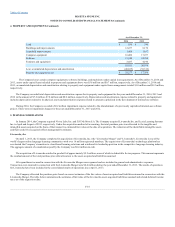

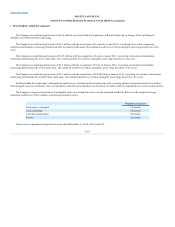

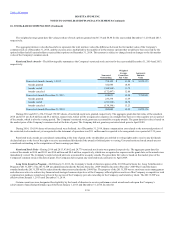

The Company allocated the purchase price based on current estimates of the fair values of assets acquired and liabilities assumed in connection with the

Lexia Merger. The table below summarizes the estimates of fair value of the Lexia assets acquired, liabilities assumed and related deferred income taxes as of

the acquisition date.

The Company finalized its allocation of the purchase price for Lexia as of June 30, 2014. The purchase price was allocated as follows (in thousands):

Cash

$ 263

Accounts receivable

2,404

Other current assets

105

Fixed assets

255

Accounts payable and accrued expenses

(899)

Deferred revenue

(1,223)

Net deferred tax liability

(4,210)

Net tangible assets acquired

(3,305)

Goodwill

9,938

Amortizable intangible assets

14,500

Purchase price

$ 21,133

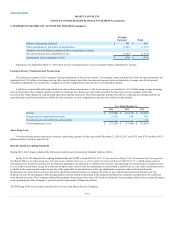

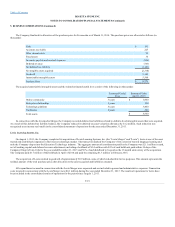

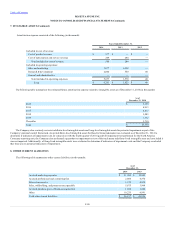

The acquired amortizable intangible assets and the related estimated useful lives consist of the following (in thousands):

Estimated Useful

Lives

Estimated Value

August 1, 2013

Enterprise relationships

10 years

$ 9,400

Technology platform

7 years

4,100

Tradename

5 years

1,000

Total assets

$ 14,500

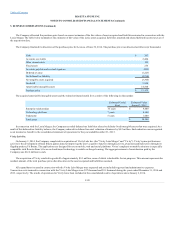

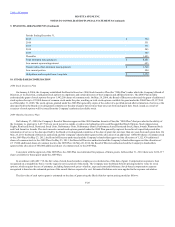

In connection with the Lexia Merger, the Company recorded deferred tax liabilities related to definite-lived intangible assets that were acquired. As a

result of this deferred tax liability balance, the Company reduced its deferred tax asset valuation allowance by $4.2 million. Such reduction was recognized

as an income tax benefit in the consolidated statement of operations for the year ended December 31, 2013.

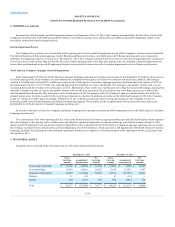

Vivity Labs Inc.

On January 2, 2014, the Company completed its acquisition of Vivity Labs Inc. (the "Vivity Labs Merger" and "Vivity"). Vivity’s principal business

activity is the development of brain fitness games aimed at improving the user’s cognitive function through activity, awareness and motivation through its

flagship product, Fit Brains. The applications are designed for use on mobile, web and social platforms. Vivity’s emphasis on mobile solutions is especially

compatible with Rosetta Stone’s focus on cloud-based technology to enable on-the-go learning. The aggregate amount of consideration paid by the

Company was $12.2 million in cash.

The acquisition of Vivity resulted in goodwill of approximately $9.3 million, none of which is deductible for tax purposes. This amount represents the

residual amount of the total purchase price after allocation to the assets acquired and liabilities assumed.

All expenditures incurred in connection with the Vivity Labs Merger were expensed and are included in general and administrative expenses.

Transaction costs incurred in connection with the Vivity Labs Merger were $57 thousand and $51 thousand during the years ended December 31, 2014 and

2013, respectively. The results of operations for Vivity have been included in the consolidated results of operations since January 2, 2014.

F-20