Rosetta Stone 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

associated with short-term online services that are bundled with our product software units. Approximately $25 to $39 in revenue per product

software unit is derived from service revenues associated with this short-term online service.

• As of the end of a specified period, the number of paid, active consumer language-learners derived from the sale of our web-

based software subscription and purchasers of our product software who subsequently purchase renewals of their short-term online services.

• Revenues derived from paid online learners for a specified period divided by the average number

of paid online learners during the same period, adjusted to a monthly rate. The average number of paid online learners for a quarter is calculated as

the average of the beginning and ending number of paid online learners for the specified period. The average number of paid online learners for a

year-to-date period is calculated as the average of the average number of paid online learners for quarters included in the specified year-to-date

period.

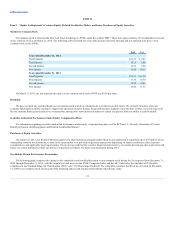

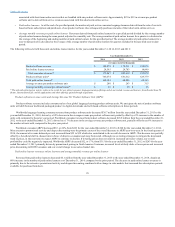

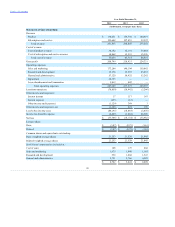

The following table sets forth these unit and online learner metrics for the years ended December 31, 2014, 2013 and 2012:

Product software revenue

$ 148,472

$ 179,211

$ 198,075

Paid online learner revenues

24,595

24,703

14,999

Total consumer revenues*

$ 173,067

$ 203,914

$ 213,074

Product software units*

743,074

681,612

629,779

Total paid online learners*

169,152

94,056

68,393

Average revenue per product software unit

$ 200

$ 263

$ 315

Average monthly revenue per online learner*

$ 16

$ 25

$ 26

Product software revenue includes consumer sales of our global language-learning product software units. We anticipate the mix of product software

units will shift from our traditional packaged product to digital downloads and web-based software subscriptions in future periods.

Worldwide language-learning consumer revenue from product software units decreased $30.7 million from the year ended December 31, 2013 to the

year ended December 31, 2014, driven by a 24% decrease in the average revenue per product software unit, partially offset by a 9% increase in the number of

units sold, compared to the prior year period. Worldwide consumer revenue from product software decreased $18.9 million from the year ended December 31,

2012 to the year ended December 31, 2013, driven by a 17% decrease in the average revenue per product software unit, partially offset by an 8% increase in

the number of units sold, compared to the prior year period.

Worldwide consumer ARPU decreased $63, or 24%, from $263 for the year ended December 31, 2013 to $200 for the year ended December 31, 2014.

More extensive promotional activity and deeper discounting were the primary causes of the overall decrease in ARPU year-over-year. In the fourth quarter of

2014, the amount of revenue deferred per unit increased from $25 to $39 which also contributed to the overall decrease in ARPU. This decrease was partially

offset by a beneficial shift in channel mix in favor of direct-to-consumer and away from retail. Although we are testing strategies to mitigate the downward

trend in prices, in the near term we expect ARPU to continue to decline. If lowering prices does not result in increased unit sales volume, our overall

profitability could be negatively impacted. Worldwide ARPU decreased $52, or 17%, from $315 for the year ended December 31, 2012 to $263 for the year

ended December 31, 2013 primarily driven by promotional pricing in North America Consumer, increased levels of daily deals at lower prices and increased

price discounting in ROW Consumer, and our overall change in our sales channel mix.

Revenue from paid online learners decreased $0.1 million from the year ended December 31, 2013 to the year ended December 31, 2014, despite an

80% increase in the number of paid online learners as of December 31, 2014, compared to the prior period. The decrease in paid online learner revenues is

primarily due to the extensive promotional activity and deeper discounting combined with a change in sales models that increased the subscription periods

available for purchase from short-

29