Rosetta Stone 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

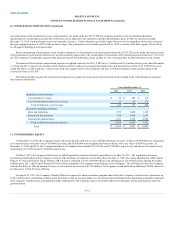

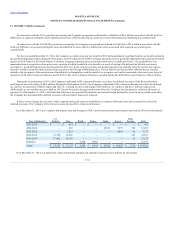

Revolving Line of Credit

On October 28, 2014, Rosetta Stone Ltd (“RSL”), a wholly owned subsidiary of parent company Rosetta Stone Inc., executed a Loan and Security

Agreement with Silicon Valley Bank (“Bank”) to obtain a $25 million revolving credit facility (the “credit facility”). Borrowings by RSL under the credit

facility are guaranteed by the Company as the ultimate parent. The credit facility has a term of three years during which RSL may borrow and re-pay loan

amounts and re-borrow the loan amounts subject to customary borrowing conditions. RSL may elect to have interest on borrowed amounts accrue at either a

LIBOR rate plus a margin of 2.25% percent or a prime rate plus a margin of 1.25% percent. RSL may select LIBOR interest periods of certain defined intervals

ranging from one month to one year. All portions of outstanding loans may be converted from one interest rate method to the other. Proceeds of loans made

under the credit facility may be used as working capital or to fund general business requirements.

All obligations under the credit facility are secured by a security interest on substantially all of the Company’s assets including intellectual property

rights and by a stock pledge by the Company of 100% of their ownership interests in U.S. subsidiaries and 66% of their ownership interests in certain foreign

subsidiaries.

The Company is subject to certain financial and restrictive covenants under the credit facility. The credit facility contains customary affirmative and

negative covenants, including covenants that limit or restrict our ability to, among other things, incur additional indebtedness, dispose of assets, execute a

material change in business, acquire or dispose of an entity, grant liens, make share repurchases, and make distributions, including payment of dividends. The

Company is required to maintain compliance with a capitalization ratio, maintain a minimum Adjusted EBITDA and maintain a minimum level of total

liquidity. As of December 31, 2014, the Company was in compliance with all covenants.

The credit facility contains customary events of default, including among others, non-payment defaults, covenant defaults, bankruptcy and insolvency

defaults, and a change of control default, in each case, subject to customary exceptions. The occurrence of a default event could result in the Bank’s

acceleration of repayment obligations of any loan amounts then outstanding.

The Company incurred and paid $0.4 million of debt issuance costs in connection with this credit facility in the fourth quarter of 2014. Such costs are

included in other non-current assets on the consolidated balance sheet and are being amortized to interest expense over the life of the credit facility on a

straight-line basis.

As of December 31, 2014, there were no borrowings outstanding and the Company was eligible to borrow the entire $25 million of available credit. A

quarterly commitment fee accrues on any unused portion of the credit facility at a nominal annual rate.

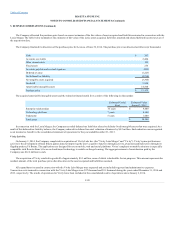

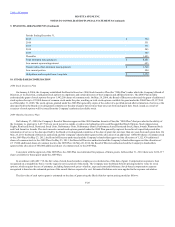

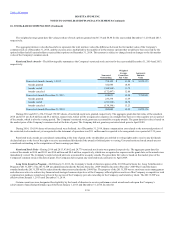

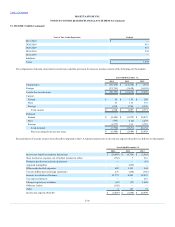

Capital Leases

The Company enters into capital leases under non-committed arrangements for equipment and software. In addition, as a result of the Tell Me More

Merger, the Company assumed a capital lease for a building near Versailles, France, where Tell Me More’s headquarters are located. The fair value of the

lease liability at the date of acquisition was $4.0 million.

During the year ended December 31, 2014, no equipment or software was acquired through the issuance of capital leases. During the year

ended December 31, 2013 the Company acquired $0.7 million in equipment and software through the issuance of capital leases. This non-cash investing

activity has been excluded from the consolidated statement of cash flows.

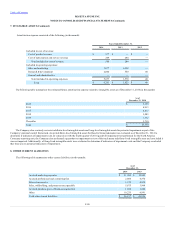

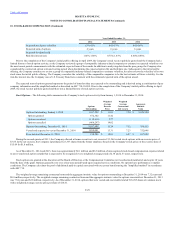

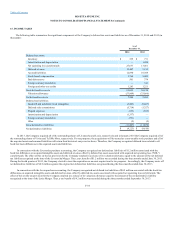

As of December 31, 2014, the future minimum payments under capital leases with initial terms of one year or more are as follows (in thousands):

F-27