Rosetta Stone 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

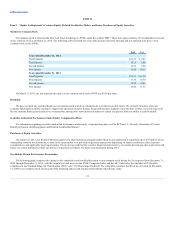

Table of Contents

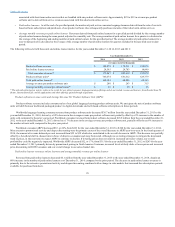

evidence of fair value, requirements that we deliver services for significant enhancements or modifications to customize our software for a particular customer

or material customer acceptance criteria.

Our consumer language-learning packages that include perpetual software and online services have increased our costs as a percentage of revenue, and

these and future product introductions may not succeed and may harm our business, financial results and reputation.

Our consumer language-learning packages integrate our language-learning software solutions with online services, which provide opportunities for

practice with dedicated language conversation coaches and other language learners to increase language socialization. The online services associated with

this software packagehave decreased our margins. Customers may choose to not engage with conversation coaches or be willing to pay higher prices to do

so. In addition, we are required to defer recognition of a portion of each sale of this packaged softwarein connection with the terms of our online service

periods. We cannot assure you that our software package offeringswill be successful or profitable, or if they are profitable, that they will provide an adequate

return on capital expended. If our software package offering is not successful, our business, financial results and reputation may be harmed.

Substantially all of our inventory is located in one warehouse facility. Any damage or disruption at this facility could cause significant financial loss,

including loss of revenue and harm to our reputation.

Substantially all of our inventory is located in one warehouse facility. We could experience significant interruption in the operation of this facility or

damage or destruction of our inventory due to natural disasters, accidents, failures of the inventory locator or automated packing and shipping systems or

other events. If a material portion of our inventory were to be damaged or destroyed, we might be unable to meet our contractual obligations which could

cause us significant financial loss, including loss of revenue and harm to our reputation. As our business continues to move online, we expect that this risk

will diminish over time.

Provisions in our organizational documents and in the Delaware General Corporation Law may prevent takeover attempts that could be beneficial to our

stockholders.

Provisions in our second amended and restated certificate of incorporation and second amended and restated bylaws, and in the Delaware General

Corporation Law, may make it difficult and expensive for a third party to pursue a takeover attempt we oppose even if a change in control of our company

would be beneficial to the interests of our stockholders. Any provision of our second amended and restated certificate of incorporation or second amended

and restated bylaws or Delaware law that has the effect of delaying or deterring a change in control could limit the opportunity for our stockholders to receive

a premium for their shares of our common stock, and could also affect the price that some investors are willing to pay for our common stock. Our board of

directors has the authority to issue up to 10,000,000 shares of preferred stock in one or more series and to fix the powers, preferences and rights of each series

without stockholder approval. The ability to issue preferred stock could discourage unsolicited acquisition proposals or make it more difficult for a third

party to gain control of our company, or otherwise could adversely affect the market price of our common stock. Further, as a Delaware corporation, we are

subject to Section 203 of the Delaware General Corporation Law. This section generally prohibits us from engaging in mergers and other business

combinations with stockholders that beneficially own 15% or more of our voting stock, or with their affiliates, unless our directors or stockholders approve

the business combination in the prescribed manner.

None.

Our corporate headquarters are located in Arlington, Virginia, where we occupy space on one floor of an office building under a lease that ends

December 31, 2018. For more information about our Arlington, Virginia lease and subleases, please see Note 16 of Item 8,

We currently own two facilities in Harrisonburg, Virginia, that provide operations and customer support services. We lease another

facility in Virginia for use as a packing and distribution center for all of our U.S. and some of our international fulfillment.

In addition, the Company leases property in various locations in the U.S. and around the world as sales offices, for research and development activities,

operations, product distribution, data centers, and market research. Our international locations are in or near cities including the following: Versailles, France;

London, United Kingdom; Seoul, South Korea; Beijing and Shanghai, China; Vancouver, Canada; São Paulo, Brazil; Cologne, Germany; and Madrid, Spain.

22