Rosetta Stone 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

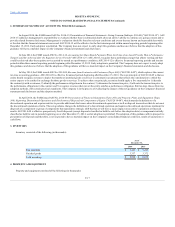

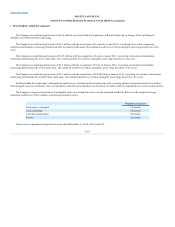

In connection with the annual goodwill impairment analysis performed as of June 30, 2014, the Company determined that the fair value of each of the

Company's reporting units with remaining goodwill balances exceeded its carrying value, and therefore no additional goodwill impairment charges were

recorded in connection with the annual analysis.

Interim Impairment Review

The Company also routinely reviews goodwill at the reporting unit level for potential impairment as part of the Company’s internal control framework.

The Global Enterprise & Education Language, Global Enterprise & Education Literacy, and North America Fit Brains reporting units were evaluated to

determine if a triggering event has occurred. As of December 31, 2014, the Company concluded that there were no indicators of impairment that would cause

it to believe that it is more likely than not that the fair value of these reporting units is less than the carrying value. Accordingly, a detailed impairment test

has not been performed and no goodwill impairment charges were recorded in connection with the interim impairment reviews of these reporting units.

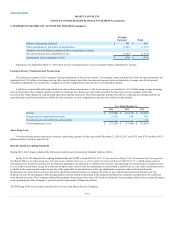

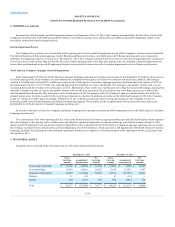

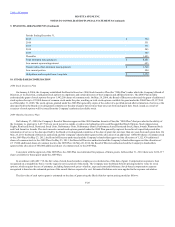

North America Consumer Language Goodwill Impairment

In the fourth quarter of 2014, the North America Consumer Language reporting unit experienced a decline in the demand for its products and services at

its current pricing levels. In an attempt to increase demand, the Company lowered prices in its direct-to-consumer and retail sales channels. This strategy

resulted in 293,808 units sold and $47.3 million in revenue for the North America Consumer Language reporting unit during the fourth quarter of 2014. In

the fourth quarter of 2013, 216,775 units were sold and generated $54.0 million in revenue. Despite the 35% increase in the number of units sold, revenue

recognized decreased by 12% due to the lower prices in 2014. Additionally, these results were significantly lower than the forecasted bookings, meaning that

while the Company was able to increase the number of units sold over the year ago period, the per unit price was lower than expected. As a result of the

reduced demand and the need to offer lower prices in the fourth quarter of 2014 to generate sales, the Company began to evaluate whether the decline in

demand at prior price levels has resulted in the need for a permanent price decline. In addition, given the results in the fourth quarter of 2014, the Company

began to evaluate its overall long-term strategy. In March 2015, the Company announced a plan to realign and reorganize the Company to focus on

profitable growth in the Global Enterprise and Education operating segment. The new plan results in significantly lower projected revenue and overall

profitability for its North America Consumer Language reporting unit.

As a result of the above events, the Company considered it appropriate to perform an interim goodwill impairment test for the North America Consumer

Language reporting unit.

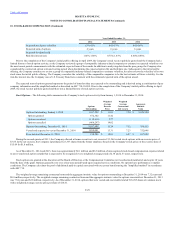

The combination of the lower reporting unit fair value of the North America Consumer Language reporting unit and the identification of unrecognized

fair value changes to the carrying values of other assets and liabilities (primarily tradename, developed technology and deferred revenue) in Step 2 of the

interim goodwill impairment test, resulted in a negative implied fair value of goodwill for the North America Consumer Language reporting unit. As a result,

the Company recorded its best estimate of the goodwill impairment loss of $18.0 million, which represents a full impairment of the North America Consumer

Language goodwill. Any adjustment to the estimated impairment loss based on completion of the measurement of the impairment will be recognized in the

first quarter of 2015.

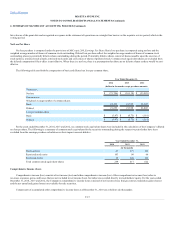

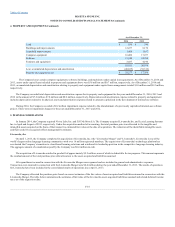

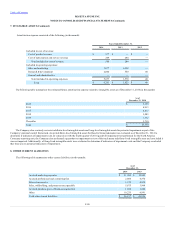

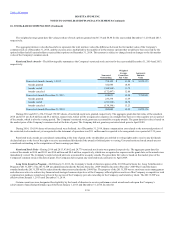

Intangible assets consisted of the following items as of the dates indicated (in thousands):

Trade name/ trademark

$ 12,526

$ (1,062)

$ 11,464

$ 11,807

$ (158)

$ 11,649

Core technology

15,890

(5,661)

10,229

9,954

(3,207)

6,747

Customer relationships

26,889

(14,344)

12,545

22,152

(11,720)

10,432

Website

12

(12)

—

12

(12)

—

Patents

300

(161)

139

300

(122)

178

Total

$ 55,617

$ (21,240)

$ 34,377

$ 44,225

$ (15,219)

$ 29,006

F-24