Rosetta Stone 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

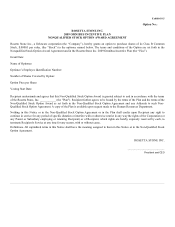

of the Option Price for the Option Shares to be acquired in accordance with the terms and conditions of this Agreement and the Plan.

(b) If Optionee is entitled to exercise the vested and exercisable portion of the Option, and wishes to do so, in

whole or part, Optionee shall (i) deliver to the Company a fully completed and executed notice of exercise, in such form as may be

designated by the Company in its sole discretion, specifying the exercise date and the number of Option Shares to be purchased

pursuant to such exercise and (ii) remit to the Company in a form satisfactory to the Company, in its sole discretion, the Option Price

for the Option Shares to be acquired on exercise of the Option, plus an amount sufficient to satisfy any withholding tax obligations of

the Company that arise in connection with such exercise (as determined by the Company) in accordance with the provisions of the

Plan.

(c) The Company’s obligation to deliver shares of the Stock to Optionee under this Agreement is subject to and

conditioned upon Optionee satisfying all tax obligations associated with Optionee’s receipt, holding and exercise of the Option. Unless

otherwise approved by the Committee, all such tax obligations shall be payable in accordance with the provisions of the Plan.

(d) The Company and its Affiliates and subsidiaries, as applicable, shall be entitled to deduct from any

compensation otherwise due to Optionee the amount necessary to satisfy all such taxes.

(e) Upon full payment of the Option Price and satisfaction of all applicable tax obligations, and subject to the

applicable terms and conditions of the Plan and the terms and conditions of this Agreement, the Company shall cause certificates for

the shares purchased hereunder to be delivered to Optionee or cause an uncertificated book-entry representing such shares to be made.

6. . Unless the Option terminates earlier as provided in this Section 6 the Option shall terminate

and become null and void at the close of business at the Company’s principal business office on the day before the date of the tenth

anniversary of the Grant Date (the “Option General Expiration Date”). If Optionee ceases to be an employee of the Company or any

Subsidiary Corporation for any reason the Option shall not continue to vest after such cessation of service as an employee of the

Company or Subsidiary Corporation.

(a) If Optionee ceases to be an employee of the Company or any Subsidiary Corporation due to death or

Disability, (i) the portion of the Option that was exercisable on the date of such cessation shall remain exercisable for, and shall

otherwise terminate and become null and void at the close of business at the Company’s principal business office on the day that is

six (6) months after the date of such death or Disability, but in no event after the Option General Expiration Date; and (ii) the portion of

the Option that was not exercisable on the date of such cessation shall be forfeited and become null and void immediately upon such

cessation.

(b) If Optionee ceases to be an employee of the Company or a Subsidiary Corporation due to Cause, all of the

Option shall be forfeited and become null and void immediately upon such cessation, whether or not then exercisable. For purposes of

this Section 6(b) the term "Cause" means the occurrence of one of the following events: (i) commission of a felony or a crime

involving moral turpitude or the commission of any other act or omission involving dishonesty in the performance of his duties to the

Company, an Affiliate or Subsidiary Corporation or fraud; (ii) substantial and repeated failure to perform duties of the office held by

Optionee as reasonably directed by the Company; (iii) gross negligence or willful misconduct with respect to the Company or any

Subsidiary Corporations; (iv) material breach of any employment agreement between Optionee and the Company that is not cured

within ten (10) days after receipt of written