Rosetta Stone 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

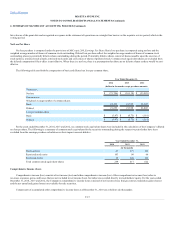

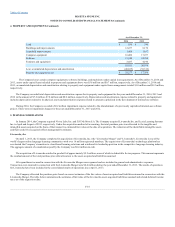

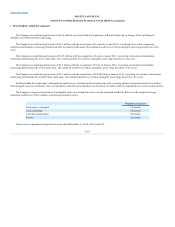

Land

$ 950

$ 390

Buildings and improvements

12,477

8,170

Leasehold improvements

1,408

1,657

Computer equipment

16,400

17,077

Software

31,240

24,594

Furniture and equipment

3,457

4,190

65,932

56,078

Less: accumulated depreciation and amortization

(40,655)

(38,312)

Property and equipment, net

$ 25,277

$ 17,766

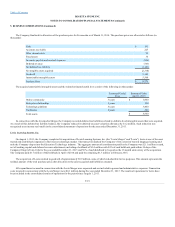

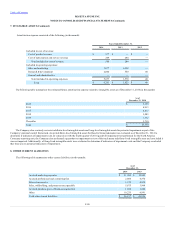

The Company leases certain computer equipment, software, buildings, and machinery under capital lease agreements. As of December 31, 2014 and

2013, assets under capital lease included in property and equipment above was $5.6 million and $0.7 million, respectively. As of December 31, 2014 and

2013, accumulated depreciation and amortization relating to property and equipment under capital lease arrangements totaled $1.0 million and $0.2 million,

respectively.

The Company recorded total depreciation and amortization expense for its property and equipment for the years ended December 31, 2014, 2013 and

2012 in the amount of $7.6 million, $7.8 million and $8.0 million, respectively. Depreciation and amortization expense related to property and equipment

includes depreciation related to its physical assets and amortization expense related to amounts capitalized in the development of internal-use software.

During 2014, the Company recorded a $0.2 million impairment expense related to the abandonment of a previously capitalized internal-use software

project. There were no impairment charges for the years ended December 31, 2013 and 2012.

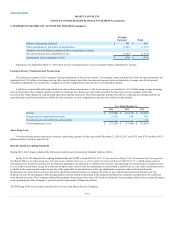

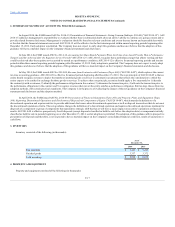

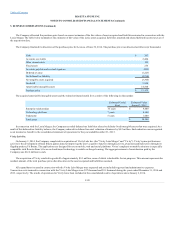

In January 2014, the Company acquired Vivity Labs, Inc. and Tell Me More S.A. The Company acquired Livemocha Inc. and Lexia Learning Systems

Inc. in April and August of 2013, respectively. Under the acquisition method of accounting, the total purchase price was allocated to the tangible and

intangible assets acquired on the basis of their respective estimated fair values at the date of acquisition. The valuation of the identifiable intangible assets

and their useful lives acquired reflects management's estimates.

Livemocha, Inc.

On April 1, 2013, the Company completed its acquisition of Livemocha, Inc. (the “Livemocha Merger” and "Livemocha"). Livemocha is one of the

world’s largest online language-learning communities with over 16 million registered members. The acquisition of Livemocha's technology platform has

accelerated the Company’s transition to cloud-based learning solutions and reinforced its leadership position in the competitive language-learning industry.

The aggregate amount of consideration paid by the Company was $8.4 million in cash.

The acquisition of Livemocha resulted in goodwill of approximately $5.2 million, none of which is deductible for tax purposes. This amount represents

the residual amount of the total purchase price after allocation to the assets acquired and liabilities assumed.

All expenditures incurred in connection with the Livemocha Merger were expensed and are included in general and administrative expenses.

Transaction costs incurred in connection with the Livemocha Merger were $0.4 million during the year ended December 31, 2013. The results of operations

for Livemocha have been included in the consolidated results of operations since April 1, 2013.

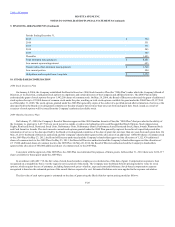

The Company allocated the purchase price based on current estimates of the fair values of assets acquired and liabilities assumed in connection with the

Livemocha Merger. The table below summarizes the estimates of fair value of the Livemocha assets acquired, liabilities assumed and related deferred income

taxes as of the acquisition date.

F-18