Rosetta Stone 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

made under the revolving credit agreement. As of December 31, 2014, we were in compliance with all of the covenants under the revolving credit agreement.

We believe our current cash and cash equivalents, short-term investments and funds generated from our operations or drawn from our revolving credit

facility will be sufficient to meet our working capital and capital expenditure requirements through the foreseeable future, including at least the next

12 months. Thereafter, we may need to raise additional funds through public or private financings or additional borrowings to develop or enhance products,

to fund expansion, to respond to competitive pressures or to acquire complementary products, businesses or technologies. If required, additional financing

may not be available on terms that are favorable to us, if at all. If we raise additional funds through the issuance of equity or convertible debt securities, the

percentage ownership of our stockholders will be reduced and these securities might have rights, preferences and privileges senior to those of our current

stockholders.

As a result of our strategic realignment and our focus on the needs of more serious learners, we expect that our total expenditures will decrease in the

near term as the size of the Consumer business declines, partially offset by increases in our Global Enterprise & Education business. In addition, our business

is affected by variations in seasonal trends. These seasonal trends create a situation in which we typically expend cash in the first and second quarters of the

year and generate cash in the third and fourth quarters of the year. Also, as our Global Enterprise & Education segment grows, we expect that a larger portion

of our sales transactions will continue to take place at the end of each quarter. In addition, we extend payments to certain vendors in order to minimize the

amount of working capital deployed in the business. We expect these trends to continue.

The total amount of cash that was held by foreign subsidiaries as of December 31, 2014 was $17.3 million. If we were to repatriate the cash from our

foreign subsidiaries, we may be subject to a significant tax liability.

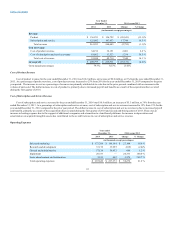

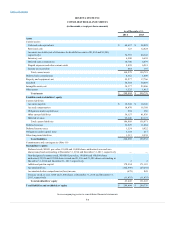

Cash Flow Analysis

Net cash provided by operating activities was $6.7 million for the year ended December 31, 2014 compared to $8.1 million for the year ended

December 31, 2013, a decrease of $1.4 million. The decrease in net cash provided by operating activities was primarily due to an increase in our net loss after

adjusting for depreciation, amortization, stock compensation, loss on foreign currency transactions, bad debt expense, deferred income taxes, loss on disposal

of equipment, amortization of debt issuance costs, and loss on impairment. This was partially offset by favorable fluctuations in working capital, primarily

deferred revenue of $48.9 million which is principally due to the sales of subscription services in our Global Enterprise & Education language and literacy

sales channels and Fit Brains.

Net cash used in investing activities was $39.1 million for the year ended December 31, 2014, compared to net cash used of $46.9 million for the year

ended December 31, 2013, a decrease of $7.8 million. Net cash used by investing activities related primarily to the $41.7 million for the 2014 acquisitions

(net of cash) of Vivity and Tell Me More, a decrease in restricted cash related to the Vivity acquisition of $12.3 million, and $9.7 million in purchase of

property and equipment primarily associated with capitalized labor for internal-use software development.

Net cash used in financing activities was $0.3 million for the year ended December 31, 2014 compared to cash used in financing activities of $10.5

million for the year ended December 31, 2013. Net cash used in financing activities during the year ended December 31, 2014 was primarily due to payments

made under capital lease obligations of $0.6 million and payment of debt issuance costs of $0.4 million, offset by net cash provided of $0.7 million from the

exercise of stock options.

During the last three years, inflation has not had a material effect on our business and we do not expect that inflation or changing prices will materially

affect our business in the foreseeable future.

Off-Balance Sheet Arrangements

We do not engage in any off-balance sheet financing arrangements. We do not have any interest in entities referred to as variable interest entities, which

include special purpose entities and other structured finance entities.

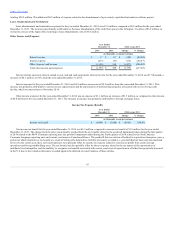

Contractual Obligations

As discussed in Notes 9 and 16 of Item 8, , we lease buildings, parking spaces, equipment, and office

space under operating lease agreements. We also lease certain equipment, software and a building near Versailles, France under capital lease agreements. The

following table summarizes our future minimum rent

48