Rosetta Stone 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

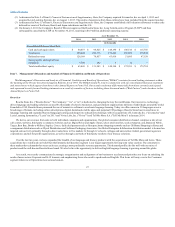

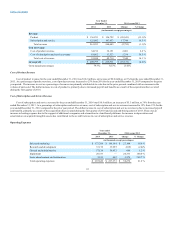

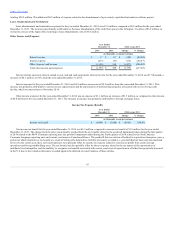

In connection with the annual goodwill impairment analysis performed as of June 30, 2014, we determined that the fair value of each of our reporting

units with material goodwill balances exceeded its carrying value, and therefore no goodwill impairment charges were recorded in connection with the

annual analysis. There were no goodwill impairments in 2013 and 2012.

We conducted reviews on the remaining goodwill balances at the reporting unit level for potential impairment as of the end of the third and fourth

quarters in 2014 and concluded that there were no indicators of impairment that would cause us to believe that it is more likely than not that the fair value of

our reporting units is less than the carrying value other than for the North America Consumer Language reporting unit as of December 31, 2014. Accordingly,

a detailed impairment test has not been performed, other than for the North America Consumer Language reporting unit as of December 31, 2014, discussed

below.

As described above, in March 2015, we announced a plan to realign and reorganize the Company to focus on profitable growth in the Global Enterprise

& Education segment. The accelerated focus on the Global Enterprise and Education segment is expected to result in significantly lower projected revenue

and bookings as well as overall profitability in the North America Consumer Language reporting unit. As a result, we determined that sufficient indication

existed to require performance of an interim goodwill impairment analysis for this reporting unit.

The combination of the lower reporting unit fair value of the North America Consumer Language reporting unit and the identification of unrecognized

fair value changes to the carrying values of other assets and liabilities (primarily tradename, developed technology and deferred revenue) in Step 2 of the

interim goodwill impairment test, resulted in an implied fair value of goodwill below the carrying value of goodwill for the North America Consumer

Language reporting unit. As a result, we recorded our best estimate of the goodwill impairment loss of $18.0 million, which represents a full impairment of

the North America Consumer Language goodwill. Any adjustment to the estimated impairment loss based on completion of the measurement of the

impairment will be recognized in the first quarter of 2015.

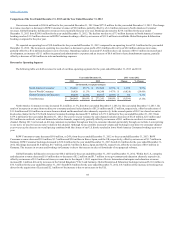

Intangible assets consist of acquired technology, including developed and core technology, customer related assets, trade name and trademark and

other intangible assets. Those intangible assets with finite lives are recorded at cost and amortized on a straight line basis over their expected lives. Intangible

assets with finite lives are reviewed routinely for potential impairment as part of our internal control framework. As an indefinite-lived intangible asset, the

Rosetta Stone tradename is routinely reviewed to determine if indicators of impairment exist. We have the option to first assess qualitative factors to

determine whether it is more likely than not that an indefinite-lived intangible asset is impaired as a basis for determining whether it is necessary to perform

the quantitative test. If necessary, the quantitative test is performed by comparing the fair value of indefinite lived intangible assets to the carrying value. In

the event the carrying value exceeds the fair value of the assets, the assets are written down to their fair value. There has been no impairment of intangible

assets during 2014, 2013 and 2012.

As part of our internal control framework we evaluate the recoverability of our long-lived assets. An impairment of long-lived assets is recognized in

the event that the net book value of such assets exceeds the future undiscounted net cash flows attributable to such assets. Impairment, if any, is recognized in

the period of identification to the extent the carrying amount of an asset exceeds the fair value of such asset. During 2014, we recorded a $0.2 million

impairment expense related to the abandonment of a software project that was previously capitalized. There were no impairment charges for the years ended

December 31, 2013 and 2012.

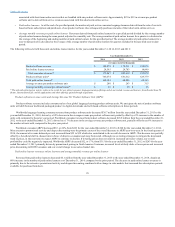

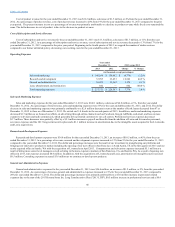

We believe that the accounting estimate for the realization of deferred tax assets is a critical accounting estimate because judgment is required in

assessing the likely future tax consequences of events that have been recognized in our financial statements or tax returns. Although it is possible there will

be changes that are not anticipated in our current estimates, we believe it is unlikely such changes would have a material period-to-period impact on our

financial position or results of operations.

We use the asset and liability approach to accounting for income taxes. Deferred tax assets and liabilities represent the future tax consequences of the

differences between the financial statement carrying amounts of assets and liabilities versus the tax bases of assets and liabilities. Under this method, deferred

tax assets are recognized for deductible temporary differences, and operating loss and tax credit carryforwards. Deferred tax liabilities are recognized for

taxable temporary differences.

We reduce the carrying amounts of deferred tax assets by a valuation allowance if, based on available evidence, it is more likely than not that such

assets will not be realized. Accordingly, the need to establish valuation allowances for deferred tax

36