Rosetta Stone 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

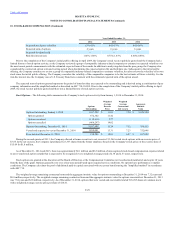

operations. For the year ended December 31, 2013, the Company paid $11.4 million to repurchase 1.0 million shares at a weighted average price of $11.44

per share as part of this program. No shares were repurchased during the year ended December 31, 2014. Shares repurchased under the program were recorded

as treasury stock on the Company’s consolidated balance sheet. The shares repurchased under this program during the year ended December 31, 2013 were

not the result of an accelerated share repurchase agreement. Management has not made a decision on whether shares purchased under this program will be

retired or reissued.

Holders of the Company's common stock are entitled to receive dividends when and if declared by the Board of Directors out of assets or funds legally

available for that purpose. Future dividends are dependent on the Company's financial condition and results of operations, the capital requirements of its

business, covenants associated with financing arrangements, other contractual restrictions, legal requirements, regulatory constraints, industry practice and

other factors deemed relevant by its Board of Directors.

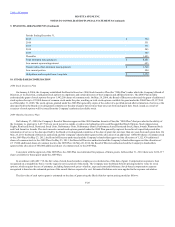

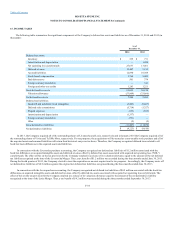

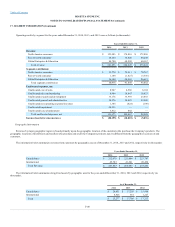

The Company maintains a defined contribution 401(k) Plan (the "Plan"). The Company matches employee contributions to the Plan up to 4% of their

compensation. The Company recorded expenses for the Plan totaling $2.2 million, $1.9 million, and $1.6 million for the years ended December 31, 2014,

2013 and 2012, respectively.

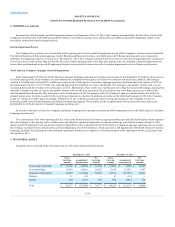

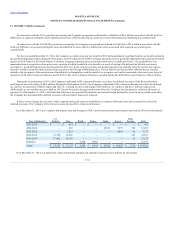

On January 9, 2014, the Company completed its acquisition of Tell Me More, a company organized under the laws of France. At acquisition, the plan

was to fully integrate Tell Me More into the operations of the Company. Following the acquisition, the Company undertook a plan to review the financial

performance of the Company and of the French entity and as a result the Company identified the need to reduce expenses. In the second quarter of 2014, the

Company began to create a plan to address the economic issues of the business through the reduction of expense. The result of this economic planning was to

reduce headcount within certain business units of the French entity.

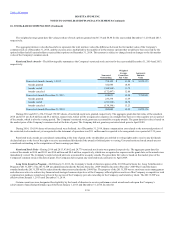

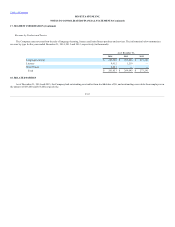

Under the requirements of French Labour Law, there is an expectation on the part of both the employer and employee that if an employee is terminated,

the employer will be required to pay a minimum amount of severance. Accordingly, the Company has concluded that the termination benefits to be paid to

certain employees as the result of the reduction in force in France are payable based upon an ongoing benefit arrangement. A severance liability becomes

probable and estimable when the Company received approval from the French Labour Administration and the specific employees to be impacted were

determined. These criteria were met in the third quarter of 2014 and the Company recorded an accrual and the related expense of $1.0 million. Severance

payments totaling $0.5 million related to this reduction in force were paid during the fourth quarter of 2014 and the remaining liability of $0.5 million is

expected to be paid in 2015.

During 2014, the Company initiated other actions across its business to reduce headcount in order to align resources to support business needs. The

Company recorded $3.2 million in severance costs associated with these actions. As of December 31, 2014, $2.3 million was paid during 2014 and the

remaining liability of $0.9 million is expected to be paid during 2015.

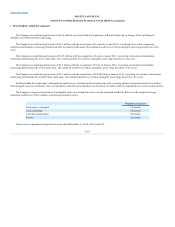

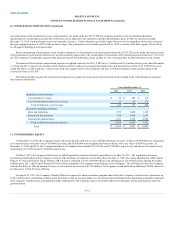

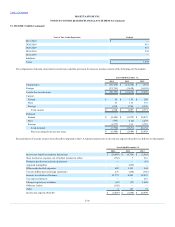

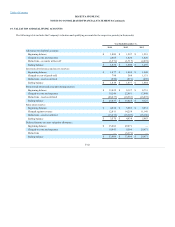

As part of the Company’s effort to reduce general and administrative expenses through a planned space consolidation at its Arlington, Virginia

headquarters location, the Company incurred a lease abandonment charge of $3.2 million for the year ended December 31, 2014. Prior to January 31, 2014,

the Company occupied the 6th and 7th floors at its Arlington, Virginia headquarters. The Company estimated the liability under the operating lease

agreements and accrued lease abandonment costs in accordance with ASC 420, ("ASC 420"), as the Company has no future

economic benefit from the abandoned space and the lease does not terminate until December 31, 2018. All leased space related to the 6th floor was

abandoned and ceased to be used by the Company on January 31, 2014.

In March 2013 Rosetta Stone Japan Inc. partially abandoned its Japan office as a result of excess office space due to reduction in staff along with overall

local operations business performance. The Company estimated the liability under the operating lease agreement reduced for anticipated sublease income in

accordance with ASC 420 as the Company has no future economic benefit from the abandoned space and the lease does not terminate until February 28,

2015. As of March 31, 2014, the Company ceased to use the remaining office space in this facility and simultaneously negotiated and paid a lease

F-32