Rosetta Stone 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

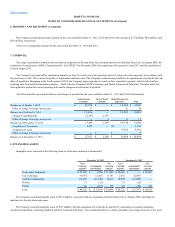

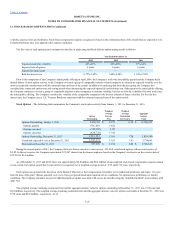

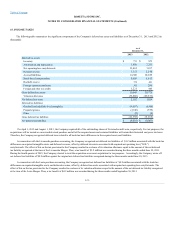

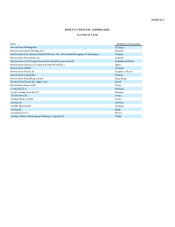

The following table summarizes the significant components of the Company's deferred tax assets and liabilities as of December 31, 2013 and 2012 (in

thousands):

Deferred tax assets:

Inventory

$731

$873

Amortization and depreciation

1,450

7,273

Net operating loss carryforwards

13,461

3,107

Deferred revenue

3,153

2,548

Accrued liabilities

10,308

10,189

Stock-based compensation

5,009

5,613

Bad debt reserve

374

441

Foreign currency translation

341

286

Foreign and other tax credits

1,221

445

Gross deferred tax assets

36,048

30,775

Valuation allowance

(33,866)

(29,671)

Net deferred tax assets

2,182

1,104

Deferred tax liabilities:

Goodwill and indefinite lived intangibles

(9,687)

(8,400)

Prepaid expenses

(2,100)

(759)

Other

(5)

(6)

Gross deferred tax liabilities

(11,792)

(9,165)

Net deferred tax liabilities

$(9,610)

$ (8,061)

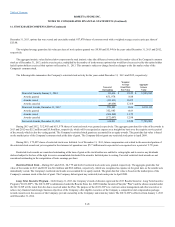

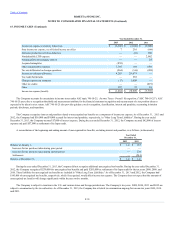

On April 1, 2013 and August 1, 2013, the Company acquired all of the outstanding shares of Livemocha and Lexia, respectively. For tax purposes, the

acquisitions will be treated as a non-taxable stock purchase and all of the acquired assets and assumed liabilities will retain their historical carryover tax bases.

Therefore, the Company recognized deferred taxes related to all book/tax basis differences in the acquired assets and liabilities.

In connection with the Livemocha purchase accounting, the Company recognized net deferred tax liabilities of $1.2 million associated with the book/tax

differences on acquired intangible assets and deferred revenue, offset by deferred tax assets associated with acquired net operating loss ("NOL")

carryforwards. The effect of this on the tax provision for the Company resulted in a release of its valuation allowance equal to the amount of the net deferred

tax liability recognized at the time of the Livemocha Merger. Thus, a tax benefit of $1.2 million was recorded during the three months ended June 30, 2013.

During the fourth quarter of 2013, the Company elected to treat the acquisition as an asset acquisition for tax purposes. Accordingly, the Company wrote off

net deferred tax liabilities of $0.9 million against the original net deferred tax liabilities recognized during the three months ended June 30, 2013.

In connection with the Lexia purchase accounting, the Company recognized net deferred tax liabilities of $4.2 million associated with the book/tax

differences on acquired intangible assets and deferred revenue, offset by deferred tax assets associated with acquired net operating loss carryforwards. The

effect of this on the tax provision for the Company resulted in a release of its valuation allowance equal to the amount of the net deferred tax liability recognized

at the time of the Lexia Merger. Thus, a tax benefit of $4.2 million was recorded during the three months ended September 30, 2013.

F-33