Rosetta Stone 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

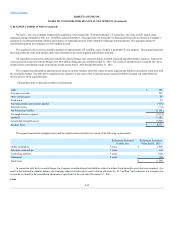

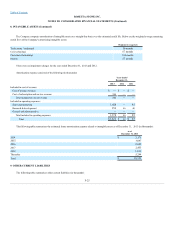

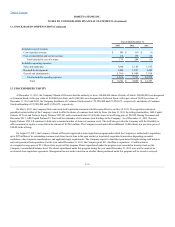

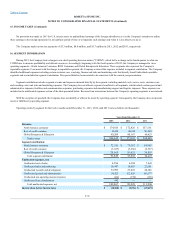

Included in cost of revenue:

Cost of product revenue

$ 109

$110

$30

Cost of subscription and service revenue

66

178

25

Total included in cost of revenue

175

288

55

Included in operating expenses:

Sales and marketing

1,840

1,185

1,932

Research & development

1,460

1,547

2,448

General and administrative

5,766

4,989

7,918

Total included in operating expenses

9,066

7,721

12,298

Total

$9,241

$ 8,009

$ 12,353

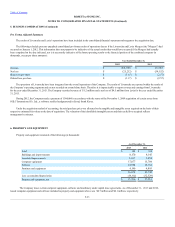

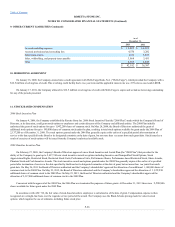

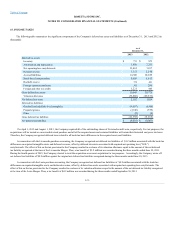

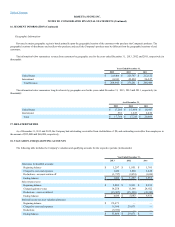

At December 31, 2013, the Company's Board of Directors had the authority to issue 200,000,000 shares of stock, of which 190,000,000 were designated

as Common Stock, with a par value of $0.00005 per share, and 10,000,000 were designated as Preferred Stock, with a par value of $0.001 per share. At

December 31, 2013 and 2012, the Company had shares of Common Stock issued of 22,588,484 and 21,950,671, respectively, and shares of Common

Stock outstanding of 21,588,484 and 21,950,671, respectively.

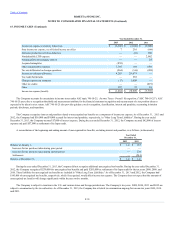

On May 8, 2013, the Company filed a universal shelf registration statement which became effective on May 30, 2013. The registration statement

permitted certain holders of the Company’s stock to offer the shares of common stock held by them. On June 11, 2013 the selling shareholders, ABS Capital

Partners IV Trust and Norwest Equity Partners VIII, LP, sold a combined total of 3,490,000 shares at an offering price of $16.00. During November and

December 2013, ABS Capital Partners IV Trust sold the remainder of its common stock holdings in the Company. As of December 31, 2013, Norwest

Equity Partners VIII, LP continues to hold only a nominal number of shares of common stock. The shelf also provides the Company with the flexibility to

offer an amount of equity or issue debt in the amount of $150.0 million. The Company issued and sold an additional 10,000 shares at a per share price of

$16.00 in the offering.

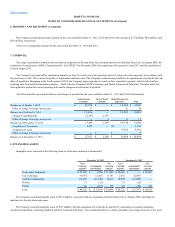

On August 22, 2013, the Company’s Board of Directors approved a share repurchase program under which the Company is authorized to repurchase

up to $25 million of its outstanding common stock from time to time in the open market or in privately negotiated transactions depending on market

conditions, other corporate considerations, and applicable legal requirements. The Company expects to fund the repurchases through existing cash balances

and cash generated from operations. For the year ended December 31, 2013, the Company paid $11.4 million to repurchase 1.0 million shares

at a weighted average price of $11.44 per share as part of this program. Shares repurchased under the program were recorded as treasury stock on the

Company’s consolidated balance sheet. The shares repurchased under this program during the year ended December 31, 2013 were not the result of an

accelerated share repurchase agreement. Management has not made a decision on whether shares purchased under this program will be retired or reissued.

F-30