Rosetta Stone 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

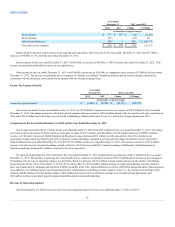

Income tax expense (benefit)

$28,909

$(7,769)

$36,678

(472.1)%

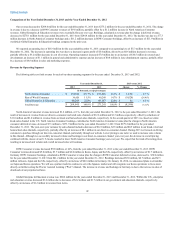

Income tax expense for the year ended December 31, 2012 was $28.9 million, compared to an $7.8 million income tax benefit for the year ended

December 31, 2011. The change primarily resulted from a $24.9 million non-cash charge associated with establishing a valuation allowance for our U.S. and

certain foreign operations in 2012, $2.3 million related to our inability to recognize tax benefits associated with current year losses in certain foreign operations

and $9.0 million U.S. tax benefit in 2011 related to carry back of operating losses and credits to prior years.

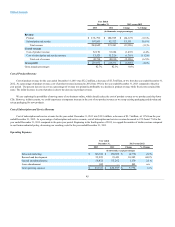

Cash, cash equivalents, and short-term investments were $98.8 million and $148.2 million for the years ended December 31, 2013 and 2012,

respectively. The decrease in cash is the result of the acquisitions of Livemocha and Lexia in 2013. In addition, $12.3 million of cash was held in escrow and

classified as restricted cash at December 31, 2013 related to our acquisition of Vivity which closed on January 2, 2014. Our primary operating cash

requirements include the payment of salaries, incentive compensation, employee benefits and other personnel related costs, as well as direct advertising

expenses, costs of office facilities and costs of information technology systems. We fund these requirements through cash flow from our operations.

We expect that our future growth, including future acquisitions, may continue to require additional working capital. Our future capital requirements will

depend on many factors, including development of new products, market acceptance of our products, the levels of advertising and promotion required to

launch additional products and improve our competitive position in the marketplace, the expansion of our sales, support and marketing organizations, the

establishment of additional offices in the United States and worldwide and building the infrastructure necessary to support our growth, the response of

competitors to our products and our relationships with suppliers and clients. We have experienced increases in our expenditures consistent with the growth in

our operations and personnel, and we anticipate that our expenditures will continue to increase in the future. We believe that anticipated cash flows from

operations and existing cash reserves will provide sufficient liquidity to fund our business and meet our obligations for at least the next 12 months.

The total amount of cash that was held by foreign subsidiaries as of December 31, 2013 was $19.1 million. If we were to repatriate the cash from our

foreign subsidiaries, a significant tax liability may result.

Cash Flow Analysis

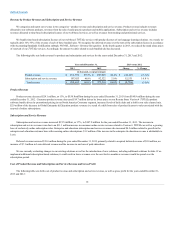

Net cash provided by operating activities was $8.1 million for the year ended December 31, 2013 compared to $34.9 million for the year ended

December 31, 2012, a decrease of $26.8 million. The decrease in net cash provided by operating activities was primarily due to an increase in our net loss

after adjusting for depreciation, amortization, stock compensation, bad debt expense, deferred income taxes and loss on disposal of equipment. Net loss,

adjusted for these items, totaled $0.6 million for the year ended December 31, 2013 compared to $10.7 million for the year ended December 31, 2012. In 2012,

we also collected $6.5 million of income tax refunds compared to $0.8 million in 2013, a decrease of $5.7 million. The remainder of the decrease in cash

provided by operating activities is due to fluctuations in working capital including increases in accounts receivable and increases in prepaids and other current

assets.

Net cash used in investing activities was $46.9 million for the year ended December 31, 2013, compared to net cash provided of $5.5 million for the

year ended December 31, 2012, a decrease of $52.5 million. Net cash used by investing activities related primarily to the $25.7 million for the acquisitions

(net of cash) of Livemocha and Lexia, a payment of $12.3 million, representing funds in escrow at year end related to the pending acquisition of Vivity Labs

Inc., and $8.9 million in purchase of property and equipment.

Net cash used in financing activities was $10.5 million for the year ended December 31, 2013 compared to cash provided by financing activities of

$0.6 million for the year ended December 31, 2012. Net cash used in financing activities during the

52