Rosetta Stone 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

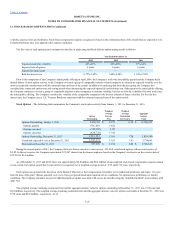

volatility, expected term and forfeitures. Stock-based compensation expense recognized is based on the estimated portion of the awards that are expected to vest.

Estimated forfeiture rates were applied in the expense calculation.

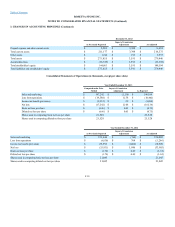

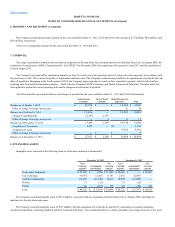

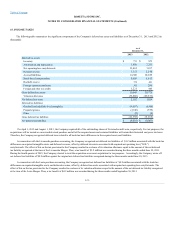

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model as follows:

Expected stock price volatility

64%-67%

64%-66%

57%-64%

Expected term of options

6 years

6 years

6 years

Expected dividend yield

—

—

—

Risk-free interest rate

0.75%-1.65%

0.60%-0.88%

1.14%-2.59%

Prior to the completion of the Company's initial public offering in April 2009, the Company's stock was not publicly quoted and the Company had a

limited history of stock option activity, so the Company reviewed a group of comparable industry-related companies to estimate its expected volatility over the

most recent period commensurate with the estimated expected term of the awards. In addition to analyzing data from the peer group, the Company also

considered the contractual option term and vesting period when determining the expected option life and forfeiture rate. Subsequent to the initial public offering,

the Company continues to review a group of comparable industry-related companies to estimate volatility, but also reviews the volatility of its own stock since

the initial public offering. The Company considers the volatility of the comparable companies to be the best estimate of future volatility. For the risk-free

interest rate, the Company uses a U.S. Treasury Bond rate consistent with the estimated expected term of the option award.

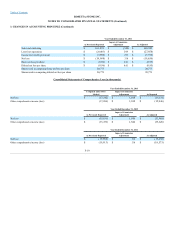

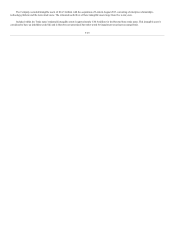

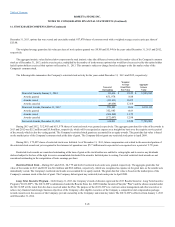

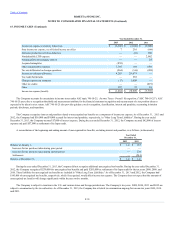

Stock Options—The following table summarizes the Company's stock option activity from January 1, 2013 to December 31, 2013:

Options Outstanding, January 1, 2013

2,470,347

$12.57

6.98

$6,760,327

Options granted

636,656

14.82

Options exercised

(549,722)

5.95

Options cancelled

(629,729)

17.42

Options Outstanding, December 31, 2013

1,927,552

13.61

7.54

2,829,380

Vested and expected to vest at December 31, 2013

1,787,571

13.63

7.43

2,734,041

Exercisable at December 31, 2013

817,870

$13.94

6.08

$1,746,647

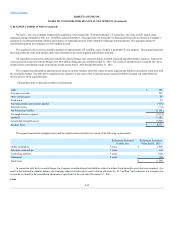

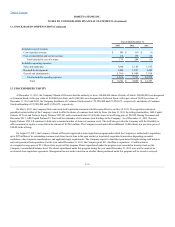

During the second quarter of 2013, the Company allowed a former executive to net exercise 213,564 vested stock options with an exercise price of

$3.85. In the net exercise, the Company repurchased 123,367 shares from the former employee based on the Company's stock price on the exercise date of

$15.09 for $1.0 million.

As of December 31, 2013 and 2012, there was approximately $6.8 million and $6.8 million of unrecognized stock-based compensation expense related

to non-vested stock option awards that is expected to be recognized over a weighted average period of 2.53 and 2.52 years, respectively.

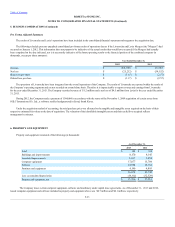

Stock options are granted at the discretion of the Board of Directors or the Compensation Committee (or its authorized member(s) and expire 10 years

from the date of the grant. Options generally vest over a four-year period based upon required service conditions. No options have performance or market

conditions. The Company calculates the pool of additional paid-in capital associated with excess tax benefits using the "simplified method" in accordance with

ASC 718.

The weighted average remaining contractual term and the aggregate intrinsic value for options outstanding at December 31, 2013 was 7.54 years and

$2.8 million, respectively. The weighted average remaining contractual term and the aggregate intrinsic value for options exercisable at December 31, 2012 was

6.98 years and $6.8 million, respectively. As of

F-27