Rosetta Stone 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

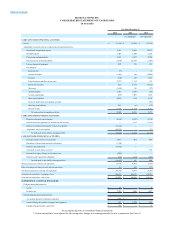

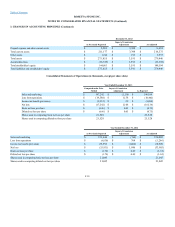

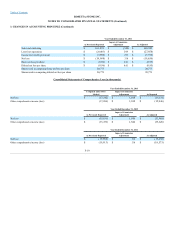

Beginning in the fourth quarter of 2012, the Company began reporting its results in three reportable segments, which resulted in three reporting units for

goodwill impairment purposes—North America Consumer, ROW Consumer, and Global Enterprise & Education. Accordingly, the Company allocated

goodwill from the former Consumer reporting unit to the new reporting units, North America Consumer and ROW Consumer, based on the relative fair value

of each reporting unit as of October 31, 2012. In doing so, the Company evaluated the results of the allocation of goodwill for events or indicators that would

require further impairment testing, noting none. The Company will continue to review for impairment indicators in future periods.

For income tax purposes, the goodwill balance is amortized over a period of 15 years.

Indemnifications are provided of varying scope and size to certain enterprise and education customers against claims of intellectual property

infringement made by third parties arising from the use of its products. The Company has not incurred any costs or accrued any liabilities as a result of such

obligations.

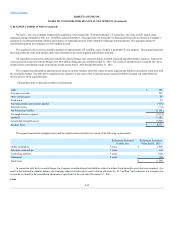

Cost of product revenue consists of the direct and indirect materials and labor costs to produce and distribute the Company's products. Such costs

include packaging materials, computer headsets, freight, inventory receiving, personnel costs associated with product assembly, third-party royalty fees and

inventory storage, obsolescence and shrinkage. The Company believes cost of subscription and service revenue primarily represents costs associated with

supporting the online language learning service, which includes online language conversation coaching, hosting costs and depreciation. Also included are the

costs of credit card processing and customer technical support in both cost of product revenue and cost of subscription and service revenue.

Research and development expenses include employee compensation costs, consulting fees and overhead costs associated with product development.

Software products are developed for sale to external customers. The Company considers technological feasibility to be established when all planning,

designing, coding, and testing has been completed according to design specifications. The Company has determined that technological feasibility for its

software products is reached shortly before the products are released to manufacturing. Costs incurred after technological feasibility is established have not

been material, and accordingly, the Company has expensed all research and development costs when incurred.

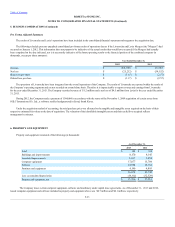

Product development also includes certain software products for internal use. Development costs for internal use software are expensed as incurred until

the project reaches the application development stage, in accordance with ASC 350. Internal-use software is defined to have the following characteristics: (a) the

software is internally developed, or modified solely to meet the entity's internal needs, and (b) during the software's development or modification, no

substantive plan exists or is being developed to market the software externally. Internally developed software is amortized over a three-year useful life.

For the years ended December 31, 2013, 2012 and 2011, the Company capitalized $4.8 million, $2.2 million, and $2.5 million in internal-use

software, respectively.

For the years ended December 31, 2013, 2012 and 2011, the Company recorded amortization expense relating to internal-use software of $1.8 million,

$0.4 million, and $0.9 million.

The Company accounts for income taxes in accordance with ASC topic 740, ("ASC 740"), which provides for an asset and liability

approach to accounting for income taxes. Deferred tax assets and liabilities represent the future tax consequences of the differences between the financial

statement carrying amounts of assets and liabilities versus the tax basis of assets and liabilities. Under this method, deferred tax assets are recognized for

deductible temporary differences, and operating loss and tax credit carryforwards. Deferred liabilities are recognized for taxable temporary differences. Deferred

tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets

will not be realized. The impact of tax rate changes on deferred tax assets and liabilities is recognized in the year that the change is enacted.

F-13