Rosetta Stone 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

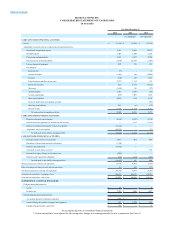

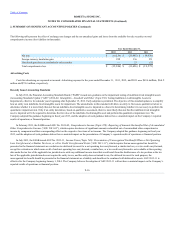

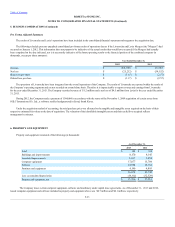

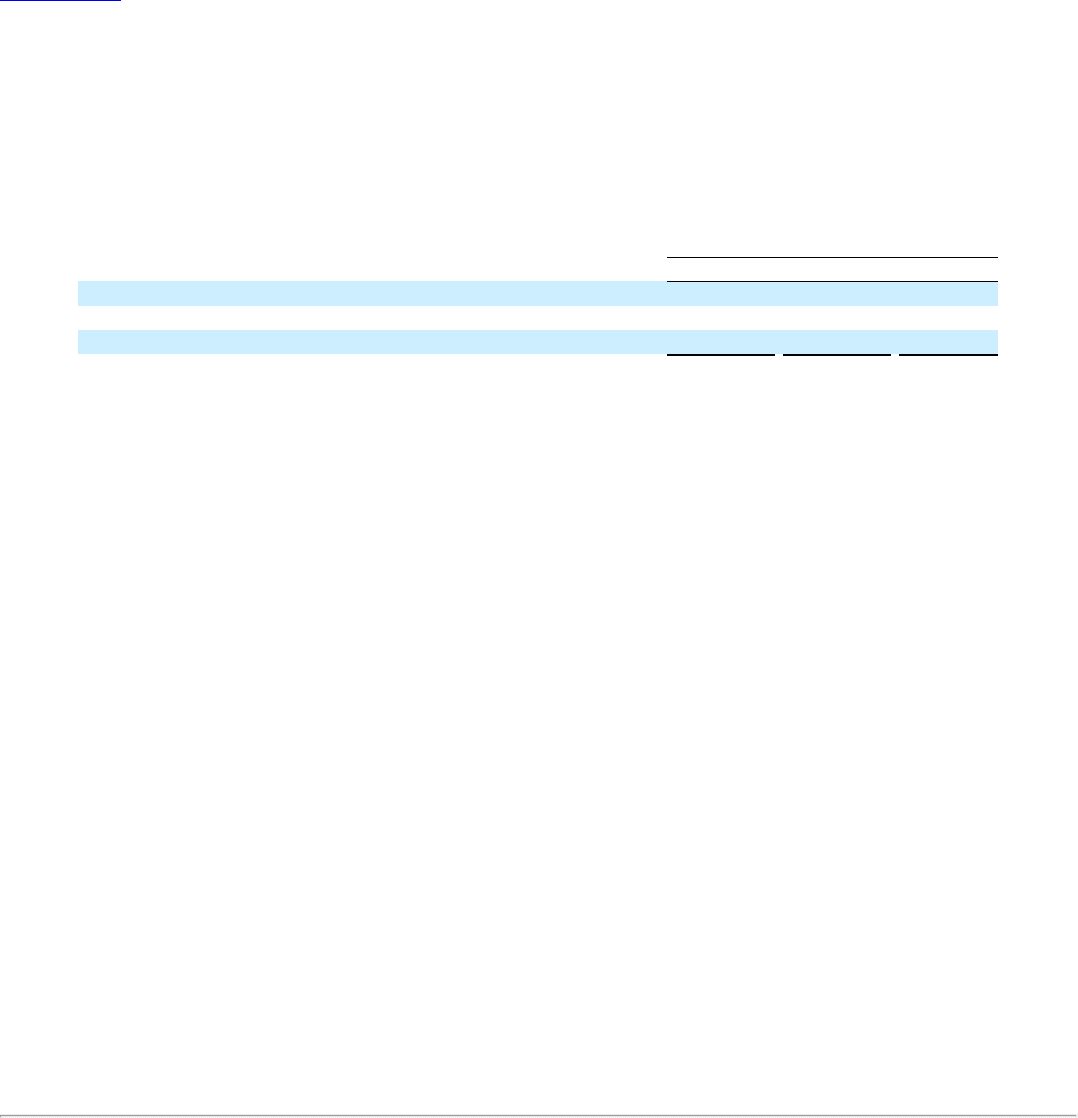

The following table presents the effect of exchange rate changes and the net unrealized gains and losses from the available-for-sale securities on total

comprehensive income (loss) (dollars in thousands):

Net loss

$(16,134)

$ (33,985)

$(19,650)

Foreign currency translation gain

188

336

98

Unrealized gain (loss) on available-for-sale securities

—

23

(23)

Total comprehensive loss

$(15,946)

$ (33,626)

$(19,575)

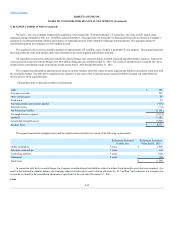

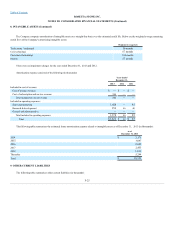

Costs for advertising are expensed as incurred. Advertising expense for the years ended December 31, 2013, 2012, and 2011 were $63.6 million, $66.2

million and $74.4 million, respectively.

In July 2012, the Financial Accounting Standards Board (“FASB”) issued new guidance on the impairment testing of indefinite-lived intangible assets

(Accounting Standards Update (“ASU”) 2012-02, (Topic 350): Testing Indefinite-Lived Intangible Assets for

Impairment), effective for calendar years beginning after September 15, 2012. Early adoption is permitted. The objective of this standard update is to simplify

how an entity tests indefinite-lived intangible assets for impairment. The amendments in this standard will allow an entity to first assess qualitative factors to

determine whether it is more likely than not that an indefinite-lived intangible asset is impaired as a basis for determining whether it is necessary to perform the

quantitative impairment test. Only if an entity determines, based on qualitative assessment, that it is more likely than not that the indefinite-lived intangible

asset is impaired will it be required to determine the fair value of the indefinite-lived intangible asset and perform the quantitative impairment test. The

Company adopted this guidance beginning in fiscal year 2013, and the adoption of such guidance did not have a material impact on the Company’s reported

results of operations or financial position.

In February 2013, the FASB issued ASU No. 2013-02,

(“ASU 2013-02”), which requires disclosure of significant amounts reclassified out of accumulated other comprehensive

income by component and their corresponding effect on the respective line items of net income. The Company adopted this guidance beginning in fiscal year

2013, and the adoption of such guidance did not have a material impact on the presentation of Company’s reported results of operations or financial position.

In July 2013, the FASB issued ASU No. 2013-11

(“ASU 2013-11”), which requires that an unrecognized tax benefit be

presented in the financial statements as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward,

except for a situation in which some or all of such net operating loss carryforward, a similar loss, or a tax credit carryforward is not available at the reporting

date under the tax law of the applicable tax jurisdiction to settle any additional income taxes that would result from the disallowance of a tax position or the tax

law of the applicable jurisdiction does not require the entity to use, and the entity does not intend to use, the deferred tax asset for such purpose, the

unrecognized tax benefit should be presented in the financial statements as a liability and should not be combined with deferred tax assets. ASU 2013-11 is

effective for the Company beginning January 1, 2014. The Company believes the adoption of ASU 2013-11 will not have a material impact on the Company’s

reported results of operations or financial position.

F-16