Rosetta Stone 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

protection for changes in the manufacturer suggested retail value granted to resellers for the inventory that they have on hand at the date the price protection is

offered is recorded as a reduction to revenue.

We offer customers the ability to make payments for packaged software purchases in installments over a period of time, which typically ranges

between three and five months. Given that these installment payment plans are for periods less than 12 months, a successful collection history has been

established and these fees are fixed and determinable, revenue is recognized at the time of sale, assuming the remaining revenue recognition criteria have been

met. Packaged software is provided to customers who purchase directly from our company with a limited right of return. We also allow our retailers to return

unsold products, subject to some limitations. In accordance with ASC subtopic 985-605-15, Software: Revenue Recognition: Products ("ASC 985-605-

15"), product revenue is reduced for estimated returns, which are based on historical return rates.

In connection with packaged software product sales and online software subscriptions, technical support is provided to customers, including

customers of resellers, via telephone support at no additional cost for up to six months from the time of purchase. As the fee for technical support is included

in the initial licensing fee, the technical support and services are generally provided within one year, the estimated cost of providing such support is deemed

insignificant and no unspecified upgrades/enhancements are offered, technical support revenues are recognized together with the software product and license

revenue. Costs associated with the technical support are accrued at the time of sale.

Sales commissions from non-cancellable SaaS contracts are deferred and amortized in proportion to the revenue recognized from the related contract.

We account for stock-based compensation in accordance Accounting Standards Codification topic 718, ("ASC

718"). Under ASC 718, all stock-based awards, including employee stock option grants, are recorded at fair value as of the grant date and recognized as

expense in the statement of operations on a straight-line basis over the requisite service period, which is the vesting period.

As of December 31, 2013 and 2012, there were approximately $6.8 million and $6.8 million of unrecognized stock-based compensation expense related

to non-vested stock option awards that are expected to be recognized over a weighted average period of 2.53 and 2.52 years, respectively.

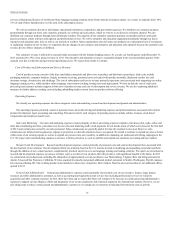

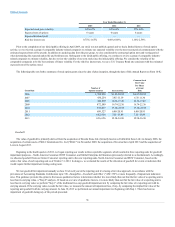

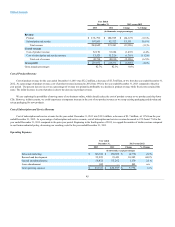

The following table presents the stock-based compensation expense for stock options and restricted stock included in the related financial statement line

items (in thousands):

Included in cost of revenue:

Cost of product revenue

$ 109

$110

$30

Cost of subscription and service revenue

66

178

25

Total included in cost of revenue

175

288

55

Included in operating expenses:

Sales and marketing

1,840

1,185

1,932

Research and development

1,460

1,547

2,448

General and administrative

5,766

4,989

7,918

Total included in operating expenses

9,066

7,721

12,298

Total

$9,241

$ 8,009

$ 12,353

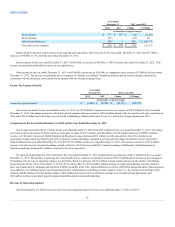

In accordance with ASC topic 718, the fair value of stock-based awards to employees is calculated as of the date of grant. Compensation expense is then

recognized on a straight-line basis over the requisite service period of the award. We use the Black-Scholes pricing model to value our stock options, which

requires the use of estimates, including future stock price volatility, expected term and forfeitures. Stock-based compensation expense recognized is based on

the estimated portion of the awards that are expected to vest. Estimated forfeiture rates were applied in the expense calculation. The fair value of each option

grant is estimated on the date of grant using the Black Scholes option pricing model as follows:

37