Rosetta Stone 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

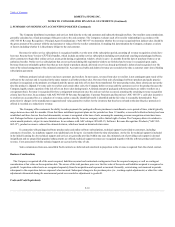

The Company distributes its products and services both directly to the end customer and indirectly through resellers. Our resellers earn commissions

generally calculated as a fixed percentage of the gross sale to the end customer. The Company evaluates each of its reseller relationships in accordance with

ASC 605-45 Revenue Recognition - Principal Agent Considerations (“ASC 605-45”) to determine whether the revenue recognized from indirect sales should be

the gross amount of the contract with the end customer or reduced for the reseller commission. In making this determination the Company evaluates a variety

of factors including whether it is the primary obligor to the end customer.

Revenue for online service subscriptions is recognized ratably over the term of the subscription period, assuming all revenue recognition criteria have

been met. Rosetta Stone Version 4 bundles, which include an online service subscription including conversational coaching and packaged software,

allow customers to begin their online services at any point during a registration window, which is up to six months from the date of purchase from us or an

authorized reseller. Online service subscriptions that are not activated during this registration window are forfeited and revenue is recognized upon expiry.

Revenue from non-refundable upfront fees that are not related to products already delivered or services already performed is deferred and recognized over the

term of the related arrangement or the estimated customer life. Accounts receivable and deferred revenue are recorded at the time a customer enters into a binding

subscription agreement.

Software products include sales to end user customers and resellers. In most cases, revenue from sales to resellers is not contingent upon resale of the

software to the end user and is recorded in the same manner as all other product sales. Revenue from sales of packaged software products and audio practice

products is recognized as the products are shipped and title passes and risks of loss have been transferred. For most product sales, these criteria are met at the

time the product is shipped. For some sales to resellers and certain other sales, the Company defers revenue until the customer receives the product because the

Company legally retains a portion of the risk of loss on these sales during transit. A limited amount of packaged software products are sold to resellers on a

consignment basis. Revenue is recognized for these consignment transactions once the end user sale has occurred, assuming the remaining revenue recognition

criteria have been met. In accordance with ASC 985-605-50 Revenue Recognition: Customer Payments and Incentives (“ASC 605-50”), cash sales incentives

to resellers are accounted for as a reduction of revenue, unless a specific identified benefit is identified and the fair value is reasonably determinable. Price

protection for changes in the manufacturer suggested retail value granted to resellers for the inventory that they have on hand at the date the price protection is

offered is recorded as a reduction to revenue.

The Company offers customers the ability to make payments for packaged software purchases in installments over a period of time, which typically

ranges between three and five months. Given that these installment payment plans are for periods less than 12 months, a successful collection history has been

established and these fees are fixed and determinable, revenue is recognized at the time of sale, assuming the remaining revenue recognition criteria have been

met. Packaged software is provided to customers who purchase directly from our company with a limited right of return. The Company allows its retailers to

return unsold products, subject to some limitations. In accordance with ASC subtopic 985-605-15, Software: Revenue Recognition: Products ("ASC 985-

605-15"), product revenue is reduced for estimated returns, which are based on historical return rates.

In connection with packaged software product sales and online software subscriptions, technical support is provided to customers, including

customers of resellers, via telephone support at no additional cost for up to six months from the time of purchase. As the fee for technical support is included

in the initial licensing fee, the technical support and services are generally provided within one year, the estimated cost of providing such support is deemed

insignificant and no unspecified upgrades/enhancements are offered, technical support revenues are recognized together with the software product and license

revenue. Costs associated with the technical support are accrued at the time of sale.

Sales commissions from non-cancellable SaaS contracts are deferred and amortized in proportion to the revenue recognized from the related contract.

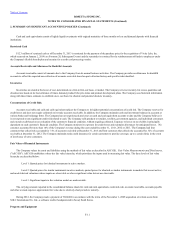

The Company recognized all of the assets acquired, liabilities assumed and contractual contingencies from the acquired company as well as contingent

consideration at fair value on the acquisition date. The excess of the total purchase price over the fair value of the assets and liabilities acquired is recognized as

goodwill. Acquisition-related costs are recognized separately from the acquisition and expensed as incurred. Generally, restructuring costs incurred in periods

subsequent to the acquisition date are expensed when incurred. Subsequent changes to the purchase price (i.e., working capital adjustments) or other fair value

adjustments determined during the measurement period are recorded as adjustments to goodwill.

F-10